Posted by Elena del Valle on February 18, 2009

Click on image to enlarge

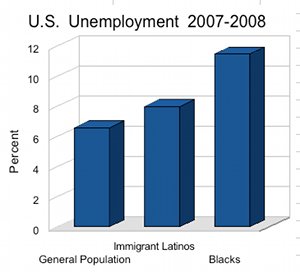

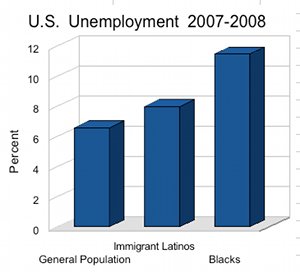

Although the economic recession is impacting everyone, it seems Latino immigrants, blacks and native-born Hispanics have been more severely affected than the rest of the population. While blacks are the only group with an unemployment rate in the double digits, 11.5 percent; in the fourth quarter of 2008, 9.5 percent of U.S.-born Hispanics were unemployed.

From the last quarter of 2007 to the last quarter of 2008, unemployment in general market increased 2 percentage points, from 4.6 percent to 6.6 percent. The unemployment rate for foreign born Latinos rose by 2.9 percentage points (from 5.1 percent to 8 percent) for the same period.

At the same time, the number of employed immigrant Latinos of working age dropped 2.8 percentage points from the last quarter of 2007 to the last quarter of 2008 (from 67.5 percent to 64.7 percent); compared to a 1.6 percentage point drop in the employment rate among the general working age population (from 63.2 percent to 61.6 percent).

These are the conclusions of Rakesh Kochhar, associate director for Research, Pew Hispanic Center in an article published last week, Unemployment Rises Sharply Among Latino Immigrants in 2008. He relied on data from the Current Population Survey, a monthly survey of 55,000 households conducted jointly by the Bureau of Labor Statistics and the Census Bureau.

The Pew Hispanic Center, a nonpartisan research organization, is dedicated to improving public understanding of the Hispanic population in the United States and to chronicle Latinos’ growing impact on the nation. It does not take positions on policy issues.

Reach Hispanics online today with

“Marketing to Hispanics Online” audio recording

Identifying and characterizing the booming Hispanic online market

Joel Bary, Alex Carvallo and Matias Perel

Find out about

• The 16 million Latino online users

• Latino online users by gender

• What they do online

• Their language preferences

• How to reach Hispanic urban youth online

• What affects their online behavior

• What influences their purchases

Click here for information about “Marketing to Hispanics Online”

Posted by Elena del Valle on February 16, 2009

Click on image to enlarge

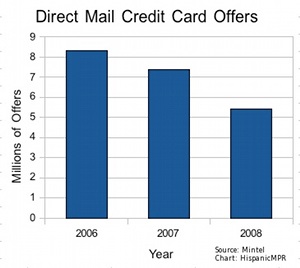

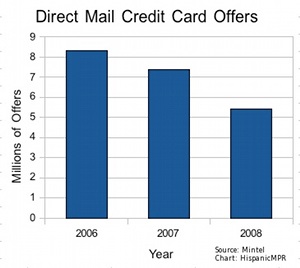

Does your mailbox look less full lately? One reason might be that the number of credit card offers has decreased significantly in the last year, especially for households with incomes below $100,000 a year. New data from Mintel Comperemedia, a leading market research company, indicates only 5.4 billion credit card direct mail offers were sent to Americans in 2008, the lowest annual total reported since 2000.

In 2008, most credit card issuers decreased their direct marketing mailings significantly, resulting in a new card mail volume decline of 26 percent compared with the previous year. Researchers estimate 2007 mail volume at 7.4 billion or 36 solicitations per household, and at 8.3 billion in 2006.

The decrease in offers may be the result of the weak economy as well as the hundreds of consumer complaints against credit card issuers. From poor performers to stellar credit holders, people across the country have been complaining for months about credit card company abuses including sudden rate hikes, changes in terms with little or no advance notification, as well as increasing late fees and minimum service charges.

According to the Consumer Federation of America, the average credit card debt per household is $7,430 and 35 percent of accounts are incurring late fees. There are those who argue that credit card companies are in trouble, having oversold their product. Unable to find a way to sell their debt to investors some credit card issuers are requesting federal rescue monies.

Mail offers sent for new credit cards dropped steadily throughout 2008. There was an 8 percent decline from Q1-Q2 and a 13 percent decline from Q2-Q3. The last quarter of 2008 had the most remarkable quarterly drop, 33 percent compared to the previous quarter.

“With reduced funds available for lending and increased loan losses, credit card issuers had no choice but to drastically cut direct marketing for new cards during 2008. Credit card issuers shifted direct marketing strategy to focus on higher earning, lower risk consumers. 2008 was an adjustment year for the credit card industry as issuers were confronted with economic conditions not seen in decades,” said Stephen Clifford, vice president of Financial Services at Mintel Comperemedia. “In 2009, I expect less volatile fluctuations in mail volume as the industry positions itself to ride out the recession and recover.”

Although a breakdown by ethnic group was unavailable, it is noteworthy that while estimated direct mail volume for credit card acquisition fell across the board last year, individuals with the highest incomes saw little change in their mailboxes. According to Mintel Comperemedia, households with an income in excess of $100,000 a year received only 1 percent fewer credit card offers in 2008 than in 2007. At the same time, households making $50,000 or less saw a 42 percent drop in new credit card mail volume.

Based on that data, perhaps we can conclude that Latinos with incomes above $100,000 continued receiving an almost unchanged number of credit card offers while those with incomes below $50,000 saw a significantly lower number reach their mailboxes.

“Best in Class Hispanic Strategies” audio recording

Presenters Carlos Santiago and Derene Allen

-

Find out what makes 25 percent of the top 500 Hispanic market advertisers out perform the remaining companies

-

Discover what questions to ask, steps to take to be a Best in Class company

Click here for more about “Best in Class Hispanic Strategies” audio recording

Posted by Elena del Valle on February 13, 2009

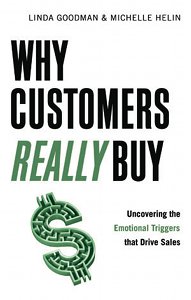

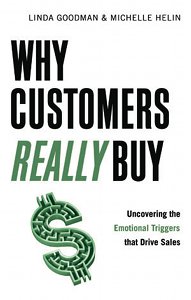

Why Customers Really Buy: Uncovering the Emotional Triggers that Drive Sales book cover

Photos: Career Press, EvinThayer

A newly published book written for sales and marketing professionals addresses issues relating to the emotional triggers the authors believe are behind shoppers purchasing behavior. In a jointly written book, Why Customers Really Buy: Uncovering the Emotional Triggers that Drive Sales (Career Press, $14.99), Linda Goodman and Michelle Helin, business consultants with decades of experience advising Fortune 500 companies, discuss specific and practical guidelines to illustrate how “insights can become useful for converting emotional considerations into actionable solutions.”

They believe that the same emotional motivation that drives consumers to loyally purchase brand products applies to the business to business environment. They explain that unlike other popular methodologies that focus on mapping emotional reactions against existing products or communications messages, Emotional Trigger Research is a proactive technique designed to uncover the core, unfiltered, and spontaneous triggers that drive actions.

They are convinced that these triggers reveal insights that can be useful in creating sales and marketing strategies that may transform companies. The process relies on a combination of questions, listening, and in-depth conversations, to identify the information companies seek.

The 256-page paperback includes local, national and international case studies and is divided into five parts: Discovering the Power of Emotion, Putting Emotional Triggers to Work – Sales, Putting Emotional Triggers to Work – Marketing, Putting Emotional Triggers to Work – Customer Relationships, and Integrating Emotional Logic.

Linda Goodman and Michelle Helin, coauthors, Why Customers Really Buy

Goodman and Helin are independent business consultants who have served as senior sales and marketing officers for Fortune 500 corporations within the hospitality, entertainment, and retail sectors. Past clients, in the United States and around the world, include AT&T Lucent Technology, Schlumberger LTD, GE Corporation, Compaq Computer, Omnicom Group Inc., Staples, Tribe Pictures, and Disney. Goodman’s business, LG Associates, is based in Avon, Connecticut. Helin’s company, Michelle Helin LLC, is based in Houston, Texas.

Click here to buy Why Customers Really Buy: Uncovering the Emotional Triggers That Drive Sales

Posted by Elena del Valle on February 11, 2009

Photo: brickartist.com

Although no one knows for sure who was the original Valentine, many believe it was a clergyman who was executed for secretly marrying couples in ancient Rome during a marriage ban imposed by Emperor Claudius II, who felt that marriage weakened his soldiers. In A.D. 496, Pope Gelasius I declared February 14 Valentine Day. Over time, the Christian holiday became a time to exchange love messages, and St. Valentine became the patron saint of lovers. In the 1840s, Esther Howland, a native of Massachusetts, is believed to be the first person to sell mass-produced valentine cards.

On the business side of Valentine there are many advantages to the holiday. In 2006, there were 1,170 locations employing 39,457 people producing chocolate and cocoa products in the United States. California with 128 was the number one chocolate producer followed by Pennsylvania with 116. That same year, there were 473 companies that produced nonchocolate confectionary products. These establishments employed 18,733 people.

Looking at the sales side of things in 2006, there were $13.9 billion shipments for firms producing chocolate and cocoa products and $7.2 billion shipments of nonchocolate confectionery products produced by 3,563 confectionery and nut stores in the United States. On average Americans consumed 24.5 pounds of candy per person in 2007.

On the florist side of things, there were 20,227 flower shops in the country in 2006 employing 98,373 people. At the same time, the wholesale value of domestically produced cut flowers in 2007 (for flower-producing operations with $100,000 or more in sales) was $416 million. California was the leading producer, accounting for three-quarters of the total ($320 million).

For a longer lasting memory jewelry may be the answer. There are 1,777 jewelry manufacturing establishments in the country. In 2006, there were 28,300 jewelry stores in the United States. In February 2008, these stores sold $2.6 billion in merchandise.

Who says marriage is going out of style? In 2007, there were 2.2 million marriages or about a little more than 6,000 weddings a day. Nevada alone performed 126,354 that year.

Those who aren’t getting married are looking for love. In 2002, there were 904 dating service establishments nationwide employing nearly 4,300 people and earning $489 million in revenue.

According to the U.S. Census Bureau, 57 percent of women and 60 percent of men in America are 18 or older and married (including those who are separated). On a more sobering note, most marriages in the United States only last eight years. The median number of years between a divorce and a second marriage is 3.5.

“Moving Beyond Traditional Media Measurement: measuring conversations and social media” audio recording

Presenter Katie Delahaye Paine, founder, KDPaine & Partners

Find out about

- Issues affecting online public relationships today

- Testing relationships as part of a survey

- Measuring ethnic group relationships

- Measuring foreign language communications in a similar ways to English

- Biggest challenges measuring conversations and social media

- Measuring online relationships with little or no money

Click here for information on “Moving Beyond Traditional Media Measurement”

Posted by Elena del Valle on February 6, 2009

The 130-page Who’s Buying Executive Summary of Household Spending Third Edition (New Strategist, $59.95) features concise data on buying across the country for 2005. The paperback book includes information on consumer spending patterns by age, race and ethnicity, household type, and region.

The source of the information is the Consumer Expenditure Survey of the Bureau of Labor Statistics, a national survey of household spending. There are indexed spending figures illustrating what households spend on many products and services, and whether the households expenditures in a segment are higher or lower than the average for all households in that segment and by how much. The indexed spending tables, based on the average figures, were produced by the publisher’s staff.

The book lists data for 2005 as follows: Spending by Age, Spending by Income, Spending by High-Income Consumer Units, Spending by Age and Income, Spending by Household Type, Spending by Household Type and Age, Spending by Region, Spending by Region and Income, Spending by Metropolitan Area, Spending by Race and Hispanic Origin, Spending by Education, Spending by Household Size, Spending by Homeowners and Renters, Spending by Number of Earners, and Spending by Occupation.

New Strategist is a New York publishing company. Other titles published by the company include Household Spending, Who’s Buying for Travel, Who’s Buying Apparel, Who’s Buying Health Care, Who’s Buying Household Furnishings, Services and Supplies, Who’s Buying for Pets, Who’s Buying by Race and Hispanic Origin, Who’s Buying at Restaurants and Carry-Outs, Who’s Buying Transportation, Who’s Buying Groceries, Who’s Buying Entertainment, Who’s Buying by Age and Who We are Hispanic.

Click here to buy Who’s Buying Executive Summary of Household Spending

Posted by Elena del Valle on February 4, 2009

5 Ways Hispanic Business Owners Can Boost Sales with Promotional Products

By Julius Rosen

CEO, Best Logo Products

Let’s face it. In today’s world, people are bombarded with advertising so it can be hard to market your business effectively. Promotional products offer a unique and affordable way for Hispanic business owners to get their name out to potential customers without being obvious.

Promotional products range from pens to totes to key chains, all with your company’s name and contact information imprinted on them. Here are 5 ways Hispanic business owners can boost sales with promotional products.

Click here to read the complete article

“Segmentation by Level of Acculturation” audio recording

Presenter Miguel Gomez Winebrenner

Discusses

- Assimilation versus acculturation

- Factors that affect Latino acculturation

- How to know if someone is acculturated

- Number of years necessary for acculturation

- Effects of immigration debate on acculturation

- Three main ways of segmenting Latinos

Click here for details about “Segmentation by Level of Acculturation”

Posted by Elena del Valle on February 2, 2009

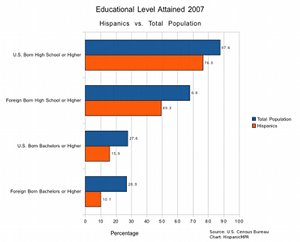

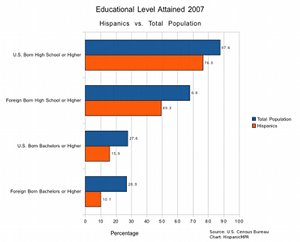

Educational Level Hispanic vs. U.S. Total Population 2007 – click on image

When it comes to advanced degrees foreign-born residents exceed native-born residents, according to a U.S. Census Bureau report released last week. In 2007, more foreign born people living in the United States had master’s degree or higher than native-born residents. Nationally, 11 percent of people born in another country who lived in the United States and 10 percent of U.S.-born residents had an advanced degree.

That same year, 84 percent of adults 25 and older said they had at least a high school diploma and 27 percent claimed to have a bachelor’s degree or higher. At the same time, across the whole country a smaller percentage of foreign-born than native-born adults had completed at least a high school education. Only 49 percent of foreign-born Latinos said they had graduated from high school while 49 percent of Asians indicated they had graduated from college or higher.

While 87.7 percent of U.S.-born residents said they had a high school diploma only 76.5 percent of U.S.-born Latinos graduated from high school; 68 percent of foreign-born residents had a high school diploma and 49 percent of foreign born Latinos had graduated from high school. Undergraduate degrees were less common. Some 27.6 percent of U.S.-born residents said they had a bachelor’s degree or higher and 15.9 percent of U.S.-born Latinos had a bachelor’s degree or higher. Just over one quarter of foreign-born residents (26.9 percent) claimed a bachelor’s degree or higher while 10 percent of foreign born Latinos had such degrees.

In the West, the percentage of foreign-born who had completed at least a bachelor’s degree or higher was less than the percentage of the native-born, 24 percent compared with 31 percent respectively. In the Northeast, both groups had 32 percent with bachelor’s degrees or more. The foreign-born in the South (26 percent) and Midwest (31 percent) were more likely than native-born residents to have at least a college degree (25 percent and 26 percent, respectively).

The report also indicates that: 84 percent of adults 25 and older had completed high school, while 27 percent had obtained at least a bachelor’s degree in 2007; a larger proportion of women (85 percent) than men (84 percent) had completed high school; a larger proportion of men had earned a bachelor’s degree (28 percent compared with 27 percent); the percentage of high school graduates was highest in the Midwest (87 percent), and the percentage of college graduates was highest in the Northeast (32 percent).

Also, men earned more than women at each level of educational attainment. The percentage of female-to-male earnings among year-round, full-time workers 25 and older was 77 percent; workers with a bachelor’s degree on average earned about $20,000 more a year ($46,805) than workers with a high school diploma ($26,894). Hispanic and black workers earned less at all levels than non-Hispanic whites and Asians.

The information in the report is from Educational Attainment in the United States: 2007, a report that describes the degree or level of school completed by adults 25 and older. This data stands out because it’s the first Census Bureau report on educational attainment to use data from the Current Population Survey and the American Community Survey. Researchers point out that combining the two data sets provides a state-by state comparison of educational attainment while providing an examination of historical trends.

Target Latinos effectively by anticipating changes in the market with

“Hispanic Projections with 2007-08 update” audio recording

Presenter Roger Selbert, Ph.D.

Find out

- About Latino buying power growth in the future

- How Latino market growth compares with other markets in the U.S.

- What drives the rise of Latino economic clout

- Who should target the Latino market

- What is the size of the Hispanic affluent market

- If the luxury Latino market is growing

Stay ahead of your competition with “Hispanic Projections”

Posted by Elena del Valle on January 30, 2009

Hispanic Heresy: What is the Impact of America’s Largest Population of Immigrants? book cover

Photos: Mead Publishing

In Hispanic Heresy: What is the Impact of America’s Largest Population of Immigrants? (Mead Publishing, $25), Angel L. Reyes, III, MBA, J.D., Bradley T. Ewing, Ph.D. and James C. Wetherbe, an attorney and two university professors respectively, address the impact of Latino immigration on the United States.

The 104-page newly published hardcover book is divided into seven chapters: Hispanic Forest Among American Trees; ¿Habla Ingles? Myth of a Bilingual America; Employment: Would You Become an Illegal Alien If You Could Increase Your Income 7 to 1?; Education: The Critical Equalizer; Politics and Justice for Hispanics in America; The Economic Impact of Hispanic Consumers; and Hispanic Immigration: Profile Tributes to Hispanics.

The three men set out to provide an overview of the immigration of Latinos to the United States. They address employment, educational challenges, politics, judicial system, and economic impact. The book ends with a profile and tribute to a small group of Hispanic immigrants they deemed noteworthy.

They wrote Hispanic Heresy to dispel the misunderstanding about the impact of Hispanics on American socio-economics. The authors point out that the significant growth of the Hispanic population in the United States is the result of immigration and a high birthrate among Latinos.

They believe that this demographic shift in the country can be interpreted as a problem or as an opportunity. Illegal immigration can strain the educational, social welfare, employment and medical care systems if income taxes go uncollected, they say. On the other hand, historically immigrants have been willing to take on entry level jobs and work their way up to achieve the American dream.

The authors, who have differing political perspectives, debated the issues while writing the book in order to express bi-partisan views and achieve compromise. In the end, they concluded that Hispanic immigration is beneficial for the country and “an opportunity that America must deftly handle if it is to continue to lead the world and truly be the land of opportunity.”

Angel L. Reyes, III, MBA, J.D., founder, Heygood, Orr, Reyes, Pearson & Bartolomei

Reyes, III is the founder and managing partner of Heygood, Orr, Reyes, Pearson & Bartolomei, a Dallas law firm. A graduate of the University of Michigan Law School, he started his legal career on Wall Street before moving to Texas. He also received an MBA (Master’s in Business Administration) degree from Texas Tech University. He has appeared on Lou Dobbs Tonight on CNN, CBS-KTVT and on Court TV’s national satellite radio channel.

Bradley T. Ewing, Ph.D., professor, Texas Tech University

Ewing is the Jerry S. Rawls Professor in Operations Management at Texas Tech University. He is a founding partner of the Ph.D. Resource Group, L.L.C., and serves as a consultant and expert witness for law firms and businesses on intellectual property, business valuation, employment and economic losses issues. He is the editor of the Journal of Business Valuation and Economic Loss Analysis. Ewing, who received his doctoral degree from Purdue University, is the author of two economics books and 100 academic articles. He is co-director of the Center for Professional Development/Management and Executive Education at Rawls College of Business.

James C. Wetherbe, professor, Texas Tech University

Wetherbe is the Stevenson Chaired Professor in the Rawls College of Business at Texas Tech University. Author of 26 books, he likes to explain complex topics in “straightforward, practical terms that can be understood and applied by executives and general management.” He has developed and conducted executive education programs for thousands of people.

Click here to buy a copy of Hispanic Heresy

Posted by Elena del Valle on January 28, 2009

At the beginning of 2008, there were 112.8 million households including 12.1 million Latino homes, in the United States. At the same time that the Latino population has grown, television penetration in Hispanic households has increased from 8.7 million in 1991 to almost 10.8 percent in 2008.

Since much of the overall growth of the country, especially in youth markets, is from Latinos much of the overall growth in television audience, it follows, is in the Latino market segments. According to the Hispanic Marketers’ Guide to Cable 2008 Edition, Hispanic households grew 35.7 percent between 2004 (10.5 million) and 2008 (12.1 million), accounting for almost all the population growth during that time period.

When it comes to language of the viewer, opinions vary. The Guide, relying on Nielsen data (some researchers have objected to Nielsen numbers in the past as reflecting an insufficient number U.S.-born Latinos), indicates 43 percent of television watching Latinos are Spanish dominant (their main language is Spanish); 34 percent are English dominant (their main language is English); and 23 percent are bilingual.

Nearly 60 percent of adult Latinos are Spanish dominant, according to the data in the 192-page book published by Cabletelevision Advertising Bureau. It lists 11 ad-supported networks offering content for Latinos: CNN en Español, Discovery en Español, Discovery Familia, ESPN Deportes, Fox Sports en Español, Galavision, GolTV, MTV Tr3s, Mun2, Si TV, and Sorpresa.

“Moving Beyond Traditional Media Measurement: measuring conversations and social media” audio recording

Presenter Katie Delahaye Paine, founder, KDPaine & Partners

Find out about

- Issues affecting online public relationships today

- Testing relationships as part of a survey

- Measuring ethnic group relationships

- Measuring foreign language communications in a similar ways to English

- Biggest challenges measuring conversations and social media

- Measuring online relationships with little or no money

Click here for information on “Moving Beyond Traditional Media Measurement”

According to a 2006 Encuesta study, 57 percent of foreign-born Hispanics watch TV in English and 73 percent of U.S.-born Hispanics watch some Spanish language programs. Only 12 percent of the TV viewers they surveyed said they watched television in English only and 31 percent said they watch television in Spanish only. Sixty-eight percent of respondents said their preferred programs covered news and political issues while 43 percent said they like to watch telenovelas (Spanish language programs similar to soap operas) in English (5.9 hours) and Spanish (7.2 hours).

The study, part of the Americanos Poll series, explored the television viewing habits of Hispanics, including time spent watching specific program formats. Participants also shared opinions on 13 English- and Spanish-language television networks and on programming in each language.

At the same time, recent statistics indicate America’s most popular shows for viewers aged 18 to 34, considered by many among the most elusive and desired demographic for advertisers, are Fuego en la Sangre (Fire in the Blood) and Cuidado Con el Angel (Don’t Mess with the Angel), broadcast by Univision, one of the most viewed networks in the United States and possibly the most viewed Spanish-language television network in the country.

More than ever marketing and advertising executives are paying attention to the booming Latino demographic in light of increasing evidence of that market segment’s growth, especially among the country’s youth. Data recently released by Univision indicates that its ratings on Wednesday and Friday nights are higher than those of the big four English-language networks, CBS, ABC, NBC and Fox.

In terms of programing and contrary to the Encuesta survey findings, the majority of the successful with the audience Spanish-language television programs are soap operas imported from Latin America. Examples include Sin Tetas No Hay Paraíso (Without Breasts There Is No Paradise) and Las Tontas No Van al Cielo (Dumb Girls Don’t Go to Heaven), imported from Mexico and Colombia.

Miami-based Encuesta, Inc. is a U.S. Hispanic marketing research and public opinion polling firm that provides customized research, objective analysis, and insights to reach the Hispanic community. Founded in 1980, the Cabletelevision Advertising Bureau is a cable television advertising advocacy group dedicated to providing advertisers media insights.

Hispanic Marketing and Public Relations Understanding and Targeting America’s Largest Minority book

“A must resource for practitioners/professionals expecting to reach US Hispanics; also valuable for college programs in marketing, public relations and communications. Highly recommended.”

Choice magazine

Click here for information on the Hispanic Marketing & Public Relations book

Posted by Elena del Valle on January 26, 2009

Shira Simmonds, president and co-founder, Ping Mobile

Photos: Ping Mobile, impreMedia

Ping Mobile and impreMedia recently announced a partnership designed to offer mobile advertising and marketing to advertisers via Ping Mobile’s PingRewards platform. According to an impreMedia press release, the company aspires to be the leading U.S. mobile coupon site in Spanish. It is offering Hispanics a series of sweepstakes through print publications and online portals.

The company will offer Spanish speakers discounts through a portal, impreRewards, which is free for users. Its executives hope Latinos will be particularly receptive to marketing offers due to the current economic climate. The idea is to motivate consumers to accept the offers and information directly to their mobile phones by inviting them to carry the coupon content and redemption information on-the-go or in a viral format.

“This partnership represents a tremendous opportunity for advertisers interested in reaching the Hispanic consumer and we are excited to partner with impreMedia, given their unparalleled Hispanic audience in both online and print. Because of the current economic climate, consumers are turning to mobile couponing and it’s these consumers who will benefit from the impreRewards portal,” said Shira Simmonds, president and co-founder of Ping Mobile.

“Best in Class Hispanic Strategies” audio recording

Presenters Carlos Santiago and Derene Allen

-

Find out what makes 25 percent of the top 500 Hispanic market advertisers out perform the remaining companies

-

Discover what questions to ask, steps to take to be a Best in Class company

Click here for more about “Best in Class Hispanic Strategies” audio recording

ImpreMedia plans to provide users access through a keyword and short code to text in to receive individual coupons and encourage platform sign-up. Through their mobile phones, users should be able to text in a short code to receive their coupon and be able to double opt-in into the platform.

ImpreMedia is targeting Spanish Preferred Hispanics 18 to 44 with a household income over $40,000 via its 14 print publications in 17 Hispanic markets and 11 states: Arizona, California, Connecticut, Florida, Illinois, Massachusetts, New Jersey, New Mexico, New York, Pennsylvania and Texas.They plan to measure results and track coupon redemption by looking the exposure of print and online advertising along with opt-in and double opt-in metrics.

They expect to offer advertisers low cost introductory packages up to a specific message count (until messages are served) with the ability to control their message through the promotional period. They are also planning to offer tie-in to SMS offers (text keyword and code) to other ongoing promotional materials that the advertiser has, such as print receipts, online banners, TV or radio spots.

Arturo Duran, chief executive officer, impreMedia Digital

“Given the heavy mobile usage among Hispanic consumers, impreRewards is the perfect solution for any advertiser looking to target the Hispanic market,” said Arturo Duran, chief executive officer of impreMedia Digital. “The solid technology behind Ping’s platform and the ease of use from both the advertisers’ and consumers’ viewpoint, will allow our users to feel comfortable using this exciting, new and innovative marketing tool in their preferred language. Using impreRewards brands nationwide will be able to drive traffic directly to the point of sale within minutes.”

ImpreRewards, built on the same platform and relying on identical back-end technology as PingRewards, promises advertisers full control over campaign details including the content and timetable of each promotion.

ImpreRewards allows users to opt-out anytime by replying with the keyword “Stop.” The company promises that it will keep all consumer information secure. Ping Mobile boasts a coupon campaigns redemption rate of 56 percent on average. Executives at Ping believe high conversion rates are due to the method of SMS distribution they use designed to facilitate that the right messages be being sent to the right consumers. Current advertisers include Footlocker, ESPN Shop, 1-800 Flowers.com, Ice.com, Mikasa, Diamonds International, and World of Watches.

“WorldofWatches.com is thrilled to be a part of this exciting new venture between impreMedia and Ping Mobile. We anticipate the success of mobile couponing to be of great value to us and look forward to offering customers amazing offers on over 3,500 name brand watches, straight to their mobile phones,” said Izac Ben-Shmuel, chief executive officer of the SWI Group.

ImpreMedia is a leading publisher of Spanish language newspapers in the country. The company owns publications in 17 cities and has 26 online and print properties targeting the United States Hispanic population.

Ping Mobile is a full-service mobile agency, that offers a range of mobile marketing, offers, promotions and content services, with a specialization in mobile offers and promotions. The company focuses on consumers, consultancy, reporting, data analysis and client services packages. Ping Mobile is headquartered in Englewood Cliffs, New Jersey and has offices in Los Angeles, California and Tel Aviv, Israel. Ping is comprised of three wholly owned and fully-integrated units: Israel-based Ping Mobile Ltd. (formerly Regisoft Ltd.); Pop Solutions LLC, a Los Angeles-based mobile marketing company; and Ping Mobile, a New Jersey-based mobile marketing company.

“Beyond the 30 Second Spot” audio recording

Listen to a 105-minute discussion

Panelists Ivan Cevallos, Hunter Heller, Kitty Kolding and Cynthia Nelson

Our panel of national experts discuss

• Challenges of measuring the impact of the 30-second ad spot

• Innovative tools are useful to reach Latinos

• Changes in marketing to Hispanics

• On which market segment are the changes most relevant

• Effects of technology and time shift on consumer behavior

• Role of multi-screens

• Getting started

• Tips for marketing professionals

Click here for information on Beyond the 30 Second Spot