Posted by Elena del Valle on June 9, 2008

Maria Lopez De Leon, executive director, National Association of Latino Arts and Culture

Artist Laura Varela

Photos: National Association of Latino Arts and Culture, Laura Varela

A podcast interview with Maria Lopez De Leon, executive director, National Association of Latino Arts and Culture (NALAC), and Laura Varela, a San Antonio-based documentary film maker and media artist, is available in the Podcast Section of Hispanic Marketing & Public Relations, HispanicMPR.com. During the podcast, Maria and Laura discuss Latinos and the arts as well as NALAC and Laura’s work with Elena del Valle, host of the HispanicMPR.com podcast.

Maria has been with NALAC for over nine years and served as executive director for six years. She has been involved in all aspects of development and implementation of the organization’s programs and strategic planning.

Under her leadership, NALAC launched the NALAC Fund for the Arts, a grant program for Latino artists and organizations; completed production of a documentary series on Latino art and culture for the Public Broadcasting System; directed the convening of three national arts and cultural conferences and has lead the continued development of the annual Leadership Institute. She has also launched efforts to purchase a historic site to serve as NALAC’s national offices.

Maria has served as a panelist for the National Endowment for the Arts, City of San Antonio Office of Cultural Affairs, Houston Arts Alliance, City of El Paso Museums and Cultural Affairs and the Hispanic Heritage Arts and Entertainment Award. She was selected to participate in the Wallace Foundation “Leadership in Excellence and Arts Participation” (LEAP) program in 2005, and completed a peer mentorship program at the Mexican Fine Arts Center Museum. She has completed training in Technology of Participation group facilitation methods. In 2005, Maria received the Community and Culture award from San Antonio Cultural Arts, and in 2006 she was recognized with an award from Southwest Workers Network for her work and support of community in the struggle to achieve justice.

“Emotional Branding: How to capture the heart and mind of the Hispanic consumer” audio recording

“Emotional Branding” was recorded January 2007 during the Strategic Research Institute 13th Annual Blockbuster Marketing to U.S. Hispanic and Latin America conference in Miami, Florida.

Click here for your free copy of Emotional Branding

Laura is a San Antonio-based media artist, activist and educator originally from the U.S./Mexico border town of El Paso, Texas. Her projects are community-based and focus on issues of social justice and cultural preservation. She is a recipient of the Humanities Texas Media Arts grant for her current project As Long as I Remember: American Veteranos, which examines the legacy of the Vietnam War in the Chicano community from the point of view of artists.

This project was also selected for funding by Latino Public Broadcasting (part of the CPB Minority Consortia) and is in post-production with an intended PBS broadcast in 2008. Laura is developing raúlrsalinas and the Poetry of Liberation, a feature documentary about the life and times of Xicano poet and activist raúl r salinas. This program is also funded by Humanities Texas and Independent Television Service and the NALAC fund for the arts.

In San Antonio, her installation work has been exhibited by the Blue Star Art Space, The Esperanza Peace and Justice Center, Gallista Gallery, and the UTSA Downtown Art Gallery. She is an alumnus of the 2006 CPB/PBS Producers Academy, the 2006 NALAC Leadership Institute, and the 2003 NALIP/UCLA Latino Producers Academy. Her youth work in San Antonio includes organizations like the Esperanza Peace and Justice Center and the Guadalupe Cultural Arts Center, and KLRN. Artist residencies include Swarthmore College, Pennsylvanie, Art for Change, New York, New York. She recently returned from Hochschule Niederrhein, Monchengladbach, Germany.

To listen to the interview, scroll down until you see “Podcast” on the right hand side, then select “HMPR Maria Lopez De Leon, Laura Varela,” click on the play button below or download the MP3 file to your iPod or MP3 player to listen on the go, in your car or at home. To download it, click on the arrow of the recording you wish to copy and save to disk. The podcast will remain listed in the June 2008 section of the podcast archive.

“Moving Beyond Traditional Media Measurement: measuring conversations and social media” audio recording

Presenter Katie Delahaye Paine, founder, KDPaine & Partners

Find out about

- Issues affecting online public relationships today

- Testing relationships as part of a survey

- Measuring ethnic group relationships

- Measuring foreign language communications in a similar ways to English

- Biggest challenges measuring conversations and social media

- Measuring online relationships with little or no money

Click here for information on “Moving Beyond Traditional Media Measurement”

Posted by Elena del Valle on June 5, 2008

LegalMatch website – click on image to enlarge

Photos: LegalMatch

LegalMatch has begun translating a few of the 4,000 pages on its legal matching website into Spanish with the goal of targeting Spanish speaking Latinos searching for legal advice, especially for immigration issues. So far the company has translated its homepage, intake processes for each category of law and some pages of its law library. Plans are in place to translate the remaining pages in the coming months.

“Finding the right lawyer in the United States is difficult enough if you speak English and know something about the law,” said Anna Ostrovsky, general counsel and co-founder of LegalMatch. “If you are not familiar with the United States legal system, and don’t speak English, it’s even harder. We created LegalMatch to empower consumers seeking the right attorney for their legal needs. Making LegalMatch available in Spanish was a logical next move for us.”

Five percent of the thousands of attorney members responded to a recent survey about their interest in Spanish language cases. Seventy-five percent of those who responded said they would be interested in receiving Spanish language cases; 44 percent said they spoke Spanish; and an 43 percent said they had Spanish-speaking staff members.

Anna Ostrovsky, general counsel and co-founder, and Laurie Ziffrin, CEO, LegalMatch

“We are very excited about the launch of our service in Spanish,” said Laurie Ziffrin, chief executive officer, LegalMatch. “Spanish is the primary language for about 15 percent of all U.S. residents. LegalMatch is proud to make its lawyer finding service available to this historically underserved group.”

Make your ads resonate with Hispanics

Listen to C&R’s Research Director Liria Barbosa in

“Hispanics’ Perspective on Advertising” audio recording

Liria Barbosa gives a presentation and participates in an extended Q&A discussion about

• Type of ads Latinos prefer

• Latino top media choices

• Percent of Latinos who tried products because of ads

• Percent of Latinos who purchased products because of ads

• What makes an ad “Hispanic”

• If ad language is important for bicultural Latinos

• What to keep in mind when targeting bicultural Latinos with ads

Click here for information on Hispanic Perspectives on Advertising

“Our Spanish site launch is our first major outreach aimed specifically at the Hispanic community. Before the launch, we likely had many Hispanics using the site in English, but we do not track ethnicity as part of our intake,” said a company representative. “So, we had no way of knowing the race or ethnicity of any of our clients. Once a few months pass after the launch, we will be better able to answer this question, as we will know what percent of clients choose to use the Spanish intake as opposed to English.”

LegalMatch, based in San Francisco, California with offices in Los Angeles, and Austin, Texas, was established in 1999 as a website targeting small business owners and individuals seeking legal counsel. According to the company website, it operated in the 50 states. The company is owned by dozens of shareholders and has 80 employees.

Posted by Elena del Valle on June 4, 2008

2008 Latino Lifestyle Study cover

Photo: The Intelligence Group

Many researchers believe the U.S. Latino population will triple in size and account for most of the nation’s growth from 2005 through 2050. Much of that increase is attributed to young Latinos who are struggling with their self identity, aspirations, hopes and dreams. How can marketers understand Latino youth when these young people are still searching for their role in American society? Will future Latinos be integrated into the mainstream as many generations of immigrants have done before them or will they cling to their cultural heritage as their parents have in the past decades? No one knows for sure.

In an effort to reach marketers targeting this fast growing ethnic group, The Intelligence Group recently released the third annual edition of its subscription based study of Latino youth. The 2008 Latino Lifestyle Study was designed as a forecasting tool for marketers looking to understand the 14 to 34 year old Latino consumer.

The Latino Intelligence Report is 150 pages in length and is available in a hard copy as well as CD. To help their researchers find the pulse of the booming market segment, The Intelligence Group tapped Christy Haubegger. The report is divided into six distinct sections: Themes & Trends, Language & Identify, Attitudes & Behavior, Entertainment, Tech & Web, and Marketing & Retail. The cost for the report is $25,000 per subscription which includes a copy of the report and one customized presentation of the report findings.

Target Latinos effectively by anticipating changes in the market with

“Hispanic Projections with 2007-08 update” audio recording

Presenter Roger Selbert, Ph.D.

Find out

- About Latino buying power growth in the future

- How Latino market growth compares with other markets in the U.S.

- What drives the rise of Latino economic clout

- Who should target the Latino market

- What is the size of the Hispanic affluent market

- If the luxury Latino market is growing

Stay ahead of your competition with “Hispanic Projections”

“Unlike their ancestors, young Latinos embrace technology, are predominantly bi-lingual, and are the leaders of both their families and their larger communities,” said Jane Buckingham, president of The Intelligence Group. “It is more important than ever for marketers to find ways to communicate with this growing demographic.”

The study is based on a telephone survey of 1,000 Latino youth in eight Hispanic markets, 1,028 online interviews conducted among 14 to 24 year old Hispanics. Telephone interview participants were recruited for age and gender balance, and interviews were conducted in the language of the participant’s choice by bilingual interviewers.

The researchers conducted online interviews nationwide, with quotas established by market and region to reflect the national Latino population. Online interviews were conducted, with respondents who self-identified as Hispanics, between November 30 and December 20, 2007.

Hispanic Marketing and Public Relations Understanding and Targeting America’s Largest Minority book

“A must resource for practitioners/professionals expecting to reach US Hispanics; also valuable for college programs in marketing, public relations and communications. Highly recommended.”

Choice magazine

Click here for information on the Hispanic Marketing & Public Relations books

Researchers also conducted focus groups and individual, in-person interviews with Latinos between 14 and 24 years of age in New York, Los Angeles, Miami, and Houston. They segmented the focus groups by age, gender and language. The Latino Intelligence Report includes attitudinal and behavioral comparisons to general market findings from The Cassandra Report, the company’s general market study that tracks attitudes and trends among young people. The Cassandra Report sample was generated from an online sample of 600 respondents ages 14 to 24.

Christy Haubegger, founder, Latina magazine

“Today’s young Latinos have one foot in each culture and feel very influential in both,” said Haubegger, who founded Latina magazine and Creative Artists Agency. “Marketers will have success if they embrace these notions and create campaigns geared toward culture, not language.”

According to promotional materials, the annual Latino youth study is made up of online surveys, focus groups, and in-person interviews. This year’s report identifies 10 themes the researchers believe will be useful to marketers: Bi-Dentity, The 40 Percent Perception, The American (Latino) Dream, Experience Economy, Flipping The Script, Social Connectors, Latinas Rising, Key Influencers, Mix Mash, Cautious Optimism; and identifies their favorite marketers in the segment. The report also provides an overview of the attitudes, behaviors and preferences the researchers identified among the young Latinos who participated in the study.

Some of the report findings shared by the publishers (the full report was not made available to Hispanic Marketing & Public Relations) include: The 40 Percent Perception, the belief by those surveyed that Latinos represent 40 percent of the United States overall market; Latinas Rising, the sense of empowerment young Latinas expressed in the study; Cautious Optimism, the researchers’ impression that the youth surveyed were optimistic and socially oriented; and Social Networking, the study subjects strong online presence which was identical to non Hispanics in the same age group.

The Intelligence Group is a market research, trend forecasting, and marketing consulting group focusing on Gen X, Gen Y, moms, teens, and tweens. The company, a division of Creative Artists Agency, also publishes the Cassandra Report, a lifestyle study of 14-34-year-old mainstream consumers and trend setters. Creative Artists Agency is a talent and sports agency that represents individuals working in film, television, music, theater, sports and video games, and provides marketing services to corporate clients.

Make your ads resonate with Hispanics

Listen to C&R’s Research Director Liria Barbosa in

“Hispanics’ Perspective on Advertising” audio recording

Liria Barbosa gives a presentation and participates in an extended Q&A discussion about

• Type of ads Latinos prefer

• Latino top media choices

• Percent of Latinos who tried products because of ads

• Percent of Latinos who purchased products because of ads

• What makes an ad “Hispanic”

• If ad language is important for bicultural Latinos

• What to keep in mind when targeting bicultural Latinos with ads

Click here for information on Hispanic Perspectives on Advertising

Posted by Elena del Valle on June 3, 2008

Kurt Pflucker, president, LAETV

Photo: LAETV

Relying on the belief that Spanish dominant Latinos living in the United States are eager to remain linked in some way with their countries of origin, Latinamerican Ethnic TV (LAETV) promotes Latin American networks in the United States; and offers United States companies ad space in 14 Latin American television networks.

The company recently added five networks to its existing inventory. The new networks are AYM Sports, MI CINE México, Televisa Michoacán, 22 México, and Once México. Ad rates start at $50 for 30 seconds in the segment between 4 pm and 7 pm and $80 for 30 seconds on prime time.

According to promotional materials, the company is the largest Latin American television network sales rep firm in the United States, covering 50 percent of available U.S. Hispanic network options. Ecuavisa can be seen in Chicago, Connecticut, Illinois, New Jersey, New York, and Washington DC. While in TV Colombia is available in Arizona, Connecticut, Florida, Indiana, Maryland, Massachusetts, Tennessee, Texas, Oklahoma, Rhode Island, Pennsylvania and Los Angeles, California.

“Without a doubt, we are the most qualified option for those advertisers seeking to establish brand recognition and to increase their products’ demand. We have definitely become the best connection between the media and the Hispanic communities originating from Mexico, Central and South America,” said Kurt Pflucker, president of LAETV.

“Moving Beyond Traditional Media Measurement: measuring conversations and social media” audio recording

Presenter Katie Delahaye Paine, founder, KDPaine & Partners

Find out about

- Issues affecting online public relationships today

- Testing relationships as part of a survey

- Measuring ethnic group relationships

- Measuring foreign language communications in a similar ways to English

- Biggest challenges measuring conversations and social media

- Measuring online relationships with little or no money

Click here for information on “Moving Beyond Traditional Media Measurement”

LAETV offers to connect United States Latinos in touch with their roots while selling the concept to advertisers as a means to establish emotional ties to the Hispanic community and reinforce brand loyalty. LAETV represents entertainment, general information, sports and news networks, with direct broadcasts from Latin American countries. In addition to the five networks that were recently added LAETV has agreements with nine others: CANAL SUR, SUR Perú, TV Venezuela, SUR México, TV Colombia, Telefe, Ecuavisa, TV Chile, and CentroaméricaTV.

“We know very well each of the idiosyncrasies of the different groups that comprise the Hispanic community. We know what they watch, what attracts them and what they buy. Thanks to our varied and extensive portfolio, we offer our clients the possibility of a real closeness with these groups,” said Pflucker. “Although our signals are not yet measured by Nielsen, our clients continue to buy our networks because of the reaction of their audiences to the brand and during direct response campaigns that have proven to be successful.”

Latinamerican Ethnic TV (LAETV) was established in Miami in 2002. The company, which also has offices in New York and Los Angeles and 40 employees in the United States, is wholly owned by Jose Luis Valderrama and Pflucker. LAETV clients include, LAN Airlines, Spirit Airlines, Toyota, Lexus, Americatel and Western Union.

“Beyond the 30 Second Spot” audio recording

Listen to a 105-minute discussion

Panelists Ivan Cevallos, Hunter Heller, Kitty Kolding and Cynthia Nelson

Our panel of national experts discuss

• Challenges of measuring the impact of the 30-second ad spot

• Innovative tools are useful to reach Latinos

• Changes in marketing to Hispanics

• On which market segment are the changes most relevant

• Effects of technology and time shift on consumer behavior

• Role of multi-screens

• Getting started

• Tips for marketing professionals

Click here for information on Beyond the 30 Second Spot

Posted by Elena del Valle on May 29, 2008

Susanna Whitmore and David Morse

Photos: New American Dimensions

According to a 2008 segmentation study, acculturation is the most significant factor when segmenting the U.S. Hispanic market. At the same time, the lead researchers involved in the study, David Morse and Susanna Whitmore of New American Dimensions, believe there are important differences between the various groups marking it important for marketers to have a clear understanding of Latino market segments before approaching them.

In the Acculturation & Beyond New American Dimensions Hispanic Segmentation Study report they counsel marketers to be cautious of stereotypes. As an example, they point out that consumers that would be considered unacculturated by some standards may exhibit behaviors more common among acculturated Latinos. On the other hand, many Latinos born in the United States are eager for a strong cultural connection with their country of origin and roots.

They also point out that although language is often linked to acculturation, some less acculturated Latinos prefer to receive information in English and some highly acculturated individuals favor Spanish language communications.The study was conducted between January 21 and February 10, 2008 via phone with 1,000 Hispanics across the country.

“Segmentation by Level of Acculturation” audio recording

Presenter Miguel Gomez Winebrenner

Discusses

- Assimilation versus acculturation

- Factors that affect Latino acculturation

- How to know if someone is acculturated

- Number of years necessary for acculturation

- Effects of immigration debate on acculturation

- Three main ways of segmenting Latinos

Click here for details about “Segmentation by Level of Acculturation”

New American representatives selected the names at random from surname lists in zip codes where Hispanics comprised at least 1 percent of the population. Survey participants self-identified as Hispanics between 18 and 64 years of age and the group was divided almost equally between men and women. Although respondents could chose to be interviewed in Spanish or English, slightly more than 60 percent chose Spanish.

Researchers sought a representative sample by including a proportionate number of Latinos from major U.S. Hispanic markets and from varied age groups similar to those reflected in the January 2008 United States Census Hispanic Current Population Survey. About 18 percent of respondents were aged 18 to 24; 30 percent were between 25 and 34; 35 percent were between 35 and 49, and 17 percent were between 50 and 64 years of age.

The 85-page report available on the company website is divided as follows: Attitudes About Heritage; Culture & Life in U.S.; Beliefs About Family, Religion, Conformity & Other Aspects OF Role in Society; Shopping Habits and Brand & Store Selection Criteria, Leisure Activities, Language Proficiency and Media Preferences, Opinions On Immigration, Segmentation Results, Getting to Know Them, Accidental Explorers, and Conclusions.

New American Dimensions is a California marketing research and consulting firm dedicated to identifying “how ethnic consumers think, feel, and make decisions about purchasing, brands, communications, and marketing.”

Target Latinos effectively by anticipating changes in the market with

“Hispanic Projections with 2007-08 update” audio recording

Presenter Roger Selbert, Ph.D.

Find out

- About Latino buying power growth in the future

- How Latino market growth compares with other markets in the U.S.

- What drives the rise of Latino economic clout

- Who should target the Latino market

- What is the size of the Hispanic affluent market

- If the luxury Latino market is growing

Stay ahead of your competition with “Hispanic Projections”

Posted by Elena del Valle on May 28, 2008

Alex Reider, a 2008 intern at Revolucion in New York

Photos: Revolucion

This year, four United States based advertising companies specializing in the Latino market are participating in a student internship program offered by the Miami Ad School. Although 240 of the school’s students participate in the internship programs every year, only a handful of agencies offer Hispanic market and Spanish language oriented opportunities. Miami Ad School student interns receive a scholarship and academic credit. The agencies sponsor the student’s tuition and housing costs for the quarter.

“In Miami, we teach our classes in English but about half of our students and teachers speak Spanish and/or Portuguese as well as other languages,” said a Miami Ad School representative. “We have students from all over the world. It is a very multi-cultural environment. Our Quarter Away and internship programs offer our students the opportunity to enter the work force with a global perspective on advertising.”

Currently, Revolucion NYC, Vidal Partnership NYC, Lapiz Chicago, Jeffrey Group Miami, (and Ogily & Mather Sao Paulo) are participating. Most of these agencies accept Spanish speaking and non-Spanish speaking interns. Latinworks Austin and Dieste Dallas have also participated in past years. In 2008, 20 students are expected to participate in Hispanic oriented internships.

“Beyond the 30 Second Spot” audio recording

Listen to a 105-minute discussion

Panelists Ivan Cevallos, Hunter Heller, Kitty Kolding and Cynthia Nelson

Our panel of national experts discuss

• Challenges of measuring the impact of the 30-second ad spot

• Innovative tools are useful to reach Latinos

• Changes in marketing to Hispanics

• On which market segment are the changes most relevant

• Effects of technology and time shift on consumer behavior

• Role of multi-screens

• Getting started

• Tips for marketing professionals

Click here for information on Beyond the 30 Second Spot

This year, Revolucion Hispanic Communications welcomed two interns for a ten-week internship. Mexico City native Alex Reider studies copywriting and Vanessa Velez of Puerto Rico likes art direction. The students will work full-time at the Manhattan agency through June and report directly to Roberto Alcazar, the agency’s executive creative director.“We are proud to join the esteemed roster of agencies on Miami Ad School’s internship list,” said Alcazar. “Our agency is always looking for opportunities to share our expertise with the next generation of creatives and fresh ideas from the newest talent entering the industry.”

Roberto Alcazar, executive creative director, Revolucion

“To give Miami Ad School students the best education in the business, we expose them to the best minds in the business,” said Pippa Seichrist, president and founder of Miami Ad School. “That’s why we partner with the most innovative agencies around the world. We’re excited about having our students intern at Revolucion. They’ll have remarkable opportunities working in the Latin market, the fastest-growing market segment.”

The Miami Ad School, founded in 1993, has six full time schools that graduate 400 students per year from its two year program. The school also has a full time Spanish speaking school in Madrid and, a full time Portuguese speaking school in Sao Paulo. The Miami Ad School began working with Hispanic agencies in Miami such as La Comunidad and Alma DDB 15 years ago. Miami Ad School’s Quarter Away and internship program has been offered for 10 years. Revolucion is a New York City based Hispanic brand-communications agency.

Posted by Elena del Valle on May 21, 2008

Don’t Be Afraid screen image

Photos, video: Comcast

In April, the police departments of the Montgomery and Prince George’s counties in Maryland, with the help of Comcast, launched a public service campaign targeting foreign language speakers in the two counties. Don’t Be Afraid, a bi-county campaign assuring speakers of other languages that emergency services will help those who seek assistance will run through August 2008. It includes two public service announcements (PSAs) and two five-minute interview segments with each county’s chief of police at a value of more than $400,000 in air-time. Scroll down to watch the public service announcement video.

Chief J. Thomas Manger of the Montgomery County Policy Department, and Chief Melvin C. High of the Prince George Police Department recorded five-minute Comcast Newsmakers interview segments explaining the campaign’s role in ensuring the safety of the counties’ non-English or limited English speaking residents. Each chief’s interview aired on CNN Headline News in his respective county for two weeks from mid to late April.

The PSAs produced for the campaign display the “911” emergency number and the word “Help” on-screen. The word “Help” appears translated into the most commonly-spoken languages in the counties: Spanish, French, Korean, Mandarin, Vietnamese and Russian. Taped in English and Spanish, the PSAs will run cross-channel on Comcast Cable in both counties through the end of August 2008.

Sanford Ames, Jr., area vice president, Comcast

“It is Comcast’s goal to make all members of our community feel valued and safe,” said Sanford Ames, Jr., area vice president, Comcast. “We’re proud to partner with the Montgomery and Prince George’s counties police departments to publicize the availability of 911-call translation services and to eliminate the ethnic community’s fear of reporting crime.”

Discover how to reach Latinos in language today with

“Hispanic Market Translation Issues” audio recording

Presenter Martha E. Galindo

Translation company owner Martha E. Galindo explains

- Why it’s important to reach your clients in language

- Ins and outs of translations issues

- How to select a translator

- What to expect

- How to save on translation costs

- Much more

Click here for information on “Hispanic Market Translation Issues”

“We are very grateful to Comcast for its commitment in helping us get this critically important message out to the community,” said Manger. “Montgomery County has a culturally diverse population and we want to make sure that our community members who don’t speak English as a first language know, that through our translation services, when they need our help they can call 911 and be understood.”

Don’t Be Afraid is the fourth in a series of public safety campaigns in which Comcast has invested its resources. Previous campaigns included Drive, Think, Live, a program the company sponsored in Montgomery County promoting driver safety among young people; as well as Pedestrian Safety, a District of Columbia metro area campaign promoting the use of crosswalks and safe driving tactics in heavily populated areas. Crossing Guards, the third in the series, highlighted school crossing guards and the work they do to keep children safe.

Posted by Elena del Valle on May 14, 2008

McDonald’s new Spanish language website – click on image to enlarge

Photo: McDonald’s

As part of its promotional efforts to introduce a new chicken product, McDonald’s recently launched two websites, WhatCameFirst.com and QuienFuePrimero.com, operated by a third party. The Southern Style Chicken Biscuit and Sandwich was introduced nationwide May 6, 2008. The sandwich, available as a breakfast item and during the day, features lightly breaded all white chicken and is served with two pickles on a biscuit (in the morning) or a bun. As for the debate, the day we visited the website the egg was winning 4,989 to 4,789.

The primary audience for these efforts are multicultural adults between the ages of 18 and 49. The new pages will be promoted through media relations, word of mouth, street team initiatives across the country, and special events for May 14, National Dance Like a Chicken Day. The Game Agency developed the Spanish-language pages.

The idea is for consumers to log on to participate in an online exchange about the age-old chicken versus egg debate through a customized Dance-Off. Website visitors can upload a photo to a character of their choice to create a customized animated figure to pit the chicken and the egg against each other; share dance sequences, challenge friends and family to participate with equally customized animated characters; and view humorous “man-on-the-street” video interviews from people across the country who share their opinions on the eternal question of “What came first, the chicken or the egg?”

McDonald’s USA, LLC, is a fast food provider in the United States. More than 80 percent of McDonald’s 13,700 U.S. restaurants are independently owned and operated by local franchisees. One third of McDonald’s employees in the United States are Latino and 11 percent of the company’s board members are Hispanic.

“Best in Class Hispanic Strategies” audio recording

Presenters Carlos Santiago and Derene Allen

-

Find out what makes 25 percent of the top 500 Hispanic market advertisers out perform the remaining companies

-

Discover what questions to ask, steps to take to be a Best in Class company

Click here for more about “Best in Class Hispanic Strategies” audio recording

Posted by Elena del Valle on May 7, 2008

Hispanic Heritage CD cover

Photos: Encyclopaedia Britannica

Although 98 percent of Encyclopaedia Britannica products are in English, in 2004 the company began offering a limited selection of CD-ROM products for United States Latinos. The products, available online and through special promotions, are Hispanic Heritage in English; Britannica Junior Visual Dictionary in English, French and Spanish; Enciclopedia Compacta Britannica in Spanish; and Merriam-Webster’s Spanish English Dictionary.

Steve Gilberg, director of Promotions and Licensing, Encyclopaedia Britannica

“We offer highly-relevant CD-ROM premiums for Hispanic marketing campaigns. They’re affordable, flat and postal-friendly,” said Steve Gilberg, director of Promotions and Licensing, Encyclopaedia Britannica.

Hispanic Heritage, for example, outlines people, history, places, events, and traditions the company’s editors believe shape Hispanic culture in South, Central, and North America. The CD includes biographies of notable figures including Simón Bolívar, Fidel Castro, Roberto Clemente, Oscar de la Renta, Plácido Domingo, José Ferrer, Vicente Fox, Alberto Gonzales, Che Guevara, Frida Kahlo, Jennifer Lopez, Eva Perón, Juan Ponce de León, Saint Martín de Porres, Carlos Santana, and Sammy Sosa.

Find out what multicultural kids across America think

Listen to Michele Valdovinos, SVP, Phoenix Multicultural in

“Marketing to Multicultural Kids” audio recording

Michele Valdovinos gives a presentation and participates in an extended Q&A discussion about multicultural children based on a Phoenix Multicultural and Nickelodeon study of 1,300 multicultural children in 16 United States markets.

Find out about

• The Phoenix Multicultural Kids Study

• Relationship between children and their context

• Issues relating to family, technology and media, diversity, buying power, relationships in household, self perception, values, acculturation, cultural heritage, frequency of media activity, income and spending, brand preferences, the American Dream

• How many billions of dollars buying power multicultural kids children have

• Children’s spending attitudes, habits by ethnicity

• How much money a year Hispanic kids have available to spend

• Types of products Hispanic kids buy

Click here for information on “Marketing to Multicultural Kids”

There is information about individual countries and World Heritage sites like Cuzco in the Peruvian Andes, Quito, and Mexico City; as well as the history and culture of Hispanics and their impact on the world; the Aztec and Mayan civilizations; the Panama Canal; the Spanish-American War; the Bay of Pigs invasion; Latin American literature, and Latin music.

Britannica Junior Visual Dictionary cover

There are also speeches, writings, and historical documents such as a letter from the Spanish conquistador Hernan Cortes describing Mexico City to Emperor Charles V, king of Spain; the Nobel Prize lecture of writer Octavio Paz. There are multimedia items on Mayan ruins, the voyages of Christopher Columbus, and Argentine gauchos at work.

The retail price for each of these CDs is $19.95 (Jr. Visual Dictionary is $29.95). Promotional pricing depends on quantity ordered and the exact type of packaging. Annual sales average about 10,000 each of the Hispanic Heritage (English-language) and Enciclopedia Compacta Britannica (Spanish-language) CDs. The products are available at the Britannica eStore.

Enciclopedia Compacta Britannica cover

Some of the software is also sold in school fund-raising catalogs like Scholastic and Reader’s Digest/QSP. They can also be found as part of promotional give-aways, or premiums, to support the ethnic marketing or Back-to-School marketing campaigns of third parties like Kellogg and General Mills who distribute them as a premium in in-pack, near-pack, and mail-in formats.

Encyclopaedia Britannica also owns Merriam-Webster, Inc., the dictionary publisher. Those products, including a handful in Spanish, are also available for online purchase. Although Encyclopaedia Britannica representatives don’t know who exactly is buying them, according to Gilberg, they sell “pretty well.” Encyclopædia Britannica, Inc., headquartered in Chicago, Illinois, is a leading provider of learning and knowledge products.

Click here to buy Encyclopedia Britannica Hispanic Heritage

and

Enciclopedia Compacta Britannica

Posted by Elena del Valle on May 6, 2008

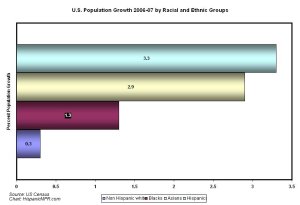

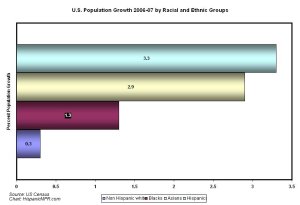

America’s population growth by racial and ethnic groups – click on image to enlarge

According to the latest Census Bureau updates, more than one third of Americans is from racial and ethnic minorities. Hispanics continue to grow faster than any other group, exceeding 15 percent of the overall population for the first time last year. At the same time, children of racial and ethnic minorities continue to exhibit significant growth. Hawaii was the only state where the share of non Hispanic white children rose.

High fertility and immigration are prompting the growth of Asian American and Hispanic populations. This is most evident in youth markets. In two of the fastest growing states, Florida and Nevada, the majority of children are from ethnic minority groups. Among children five and younger, ethnic and racial minority children are already the majority across the country.

Target Latinos effectively by anticipating changes in the market with

“Hispanic Projections with 2007-08 update” audio recording

Presenter Roger Selbert, Ph.D.

Find out

- About Latino buying power growth in the future

- How Latino market growth compares with other markets in the U.S.

- What drives the rise of Latino economic clout

- Who should target the Latino market

- What is the size of the Hispanic affluent market

- If the luxury Latino market is growing

Stay ahead of your competion with “Hispanic Projections”

An example of the growth patterns sweeping the country is Florida. The Sunshine State had been the top state in non Hispanic white population increases in the past 30 years. In 2005, its non Hispanic white population mushroomed by 123,000; in 2006 the same segment grew by 67,000. In 2007, there were only 4,000 new non Hispanic whites in the state.

At the national level, between 2006 and 2007 the Hispanic population grew 3.3 percent; while the Asian population grew by 2.9 percent; the black population grew 1.3 percent; and growth among non Hispanic whites was only 0.3 percent. At the same time, minorities concentrated in certain parts of the country. Almost one third of America’s minorities live in California and Texas. Texas gained the greatest number of Hispanic residents between 2006 and 2007.

Listen to Cesar Melgoza discuss

“Changing Latino Landscape” audio recording

Presenter Cesar Melgoza, managing director, Latin Force Group

Find out about

• How demographic, social, political and economic factors affect Latinos

• Number of Hispanics in U.S.

• Hispanics as a percent of the mainstream population

• Number of Puerto Ricans in Puerto Rico

• Hispanics, including Puerto Rico, as a percent of U.S. mainstream

• Number of Asians and African Americans

• Estimated size of Hispanic market by 2012

• Percentage growth of new Hispanics per year

• Number of counties where Latinos are majority

• Areas of significant Latino growth

• Area of U.S. with a 950 percent Latino growth

• Role of acculturation

• Hispanicity segmentation

Click here for information on the Changing Latino Landscape