Posted by Elena del Valle on March 30, 2009

A CBP Border Patrol agent scans the area with binoculars

Photo: James Tourtellotte

Crouching in the bushes, silently hiding from men in uniforms with search lights a group of 20 people listen to a loud warning in Spanish with a thick American accent. Someone runs but he is caught, dropped to the ground and interrogated before being “deported.” The remaining “immigrants” wait a few minutes before crawling under the fence into the darkness and freedom.

Although it is meant to simulate hundreds or thousands of real scenes that take place across the 2,000 mile border that divides the two countries, the activity really takes place 500 miles south of the United States-Mexico border in the village of El Alberto. The people participating in the night time event are really curious travelers to Mexico wanting a glimpse of what undocumented immigrants from Mexico experience when attempting to cross north of the United States-Mexico border in search of a better life.

A group from the small Hnahnu Indian community of El Alberto in the Mezquital valley makes this activity available to tourists for a fee. The Hnahnu representatives that play smugglers, border patrol agents, deportees and other performers are volunteers. This part of Mexico is, according to a recent article in Guardian.co.uk, is known for its poverty, water contamination, and many immigrants to the United States. Increased border security and the worsening recession have made it increasingly difficult to find jobs for new arrivals to the United States so leaders of El Alberto have found a way to generate revenue and provide tourist entertainment.

The “show” is led by a representative of El Alberto in the role of a coyote or smuggler before the tourists head down to the river bank while border patrol car siren wails in the background. If the visitors are in good physical shape they may continue another six hours moving from one side of the river to the other constantly. Others may complete the experience in one hour. Apparently, even the simplest version includes a walk along a high wall (30 feet) without exit in sight.

Listen to Cesar Melgoza discuss

“Changing Latino Landscape” audio recording

Presenter Cesar Melgoza, managing director, Latin Force Group

Find out about

• How demographic, social, political and economic factors affect Latinos

• Number of Hispanics in U.S.

• Hispanics as a percent of the mainstream population

• Number of Puerto Ricans in Puerto Rico

• Hispanics, including Puerto Rico, as a percent of U.S. mainstream

• Number of Asians and African Americans

• Estimated size of Hispanic market by 2012

• Percentage growth of new Hispanics per year

• Number of counties where Latinos are majority

• Areas of significant Latino growth

• Area of U.S. with a 950 percent Latino growth

• Role of acculturation

• Hispanicity segmentation

Click here for information on the Changing Latino Landscape

Posted by Elena del Valle on March 25, 2009

Roselyn Sanchez at the Absolut Vodka Mango event

Photos: 217design.com, Liz Brown

Absolut Vodka is targeting fans of the potato based beverage and Latinos with a new mango flavored vodka, its tenth flavor. Made from all-natural ingredients without added sugar or added preservatives it is described in promotional materials as “Aromatic and juicy with a pronounced and genuine character of ripened mango, the taste is fruity and full-bodied.”

Puerto Rican actress Roselyn Sanchez was tapped as a celebrity host for the new flavor launch event in New York City earlier this month. She appeared on the opening day of the three day event and the third day of the event was dedicated to the Hispanic market. According to a company spokesperson, her status as a bilingual actress closely tied to her roots and who recently married a non Hispanic made her particularly attractive to the brand.

“Absolut Mango has done exceptionally well in both the South American market and at Global Travel Retail, and we are eager to replicate that success in the U.S. market, as we offer bartenders and consumers the true taste of mango in their cocktails,” said Ian Crystal, brand director of Absolut Vodka. “Absolut revolutionized the flavored vodka market in the mid-1980s and we continue to set the standard with exciting new flavors that have strong global appeal.”

Absolut Mango

With this product, Absolut is targeting young professionals 21 to 40 years old, especially Latinos. It recently launched a three week Hispanic oriented radio ad campaign in New York City, Los Angeles and Miami.

“Roselyn Sánchez is a successful actress from Puerto Rico passionate about her roots, but also very bi-cultural who is respected by both Hispanics and the general market. She was the perfect fit for the launch of our first tropical flavor because her personality and background embodied the exoticness of the mango,” said Sarah Bessette, public relations manager, Spirits, Pernod Ricard USA.

Sanchez plays Elena Delgado on Without A Trace, a television program. She has also appeared in several films. Prior to her career as an actress she studied marketing for three years at the University of Puerto Rico in the hopes of taking over the family business. She gave up her studies and joined a comedy show on the island. Eventually, she moved to New York City where she studied dancing, singing and acting and pursued a career in entertainment.

The design of the bottle for the new drink has more transparent glass than previous flavors and the decoration consists of mango fruit contours gathered in groups around the bottle. Shades of green, red and yellow combined were meant to reflect the characteristics of the fruit and stand out on back bars.

Pernod Ricard USA, the parent company of Absolut Vodka, is a spirits and wine company in the U.S., and the largest subsidiary of Paris, France-based Pernod Ricard SA. In July, 2008, Pernod Ricard completed the acquisition of Absolut Vodka brand from the V&S Group, and Pernod Ricard USA is now the second-leading company in the U.S. by sales.

Other Pernod Ricard USA brands include Glenlivet Single Malt Scotch Whisky, Chivas Regal Scotch Whisky, Jameson Irish Whiskey, Wild Turkey Bourbon, Seagram’s Extra Dry Gin, Beefeater Gin, Plymouth Gin, Martell Cognac, Perrier Jouët Champagne, and G.H. Mumm Champagne.

Target Latinos effectively by understanding how they shop

“Hispanic Holiday Shopping Patterns” audio recording

Manuel Delgado, CEO Agua Marketing, gives a presentation and participates in an extended Q&A discussion about

- Hispanic shopping patterns national survey

- Why Latino consumers may be more desirable than general market shoppers

- Hispanics holiday shopping patterns and behaviors

Click here for information on “Hispanic Holiday Shopping Patterns” audio recording

Posted by Elena del Valle on March 23, 2009

Latinos like to buy local produce

Photo: Simon and Baker

In the last few years organic foods and local products have become increasingly popular. Sales of organic foods are booming. They doubled, from $2.6 billion to about $5.2 billion, in the past four years. A quarter of those who prefer organic foods prefer to buy them from farmers’ markets and other local sources. Some people believe the recession may increase farmers’ markets sales because shoppers are interested in inexpensive alternatives to organic foods.

Although most Americans are mildly supportive of local shopping, Latinos strongly favor local purchases, especially of produce. In general, shoppers think the idea of purchasing goods and services from the mom and pop store near their home is quaint but when it comes to actually patronizing the store their enthusiasm wanes, according to Mintel. The market research company conducted a survey to identify shopper attitudes about buying local products and services and recently released a summary of the results.

“We found that although the ‘buy local’ mantra has gotten strong media coverage and government support, most Americans haven’t yet incorporated it into their lifestyles,” said Krista Faron, senior analyst at Mintel. “Nonetheless, local products offer unique benefits and are more accessible than ever before, so we think the local movement has relevance with today’s consumer.”

Only 17 percent of adults nationwide, according to Mintel’s consumer survey, buy local as often as possible. Those who do are willing to pay a premium and select local goods and services over non local ones even when the local items are less competitive in quality. Mintel researchers believe adults 25-34 year old and families with children as the most zealous local shoppers.

The researchers think parents believe that local food items are fresher and healthier than packaged products. At the same time, parents want to belong to strong communities that provide a good environment for their children, and feel that making local purchases helps to strengthen their community.

What people are most likely to buy near where they live is food. Fruits and vegetables are by far the most common items. Almost one third of the survey respondents (31 percent) said they purchase these items once a week or more often. Other common local purchases selected by 25 percent of shoppers are baked goods, meats or cheese/dairy products.

Local buying may be influenced by other factors. For example, almost one third (30 percent) of respondents to the Mintel survey thought the idea of buying local had appeal but didn’t know where to find what they sought; and 27 percent of shoppers who participated in the survey indicated they were indifferent about the source of their foods and services.

“Local is becoming a desirable product claim, as people try to save money, support their communities and preserve the environment. We found that over half of local shoppers are trying to help their local economy, but they also buy local products for convenience, better taste and the environment. Companies should use these motivations to craft marketing messages that appeal to locally conscious consumers,” said Faron.

Hispanics like local produce. Those that responded to the survey indicated they were likely to buy produce at least once a week. In August 2006, Mintel’s Hispanic Meals at Home U.S. Revealed that individuals who identify themselves as Hispanic were more likely than those who think of themselves as Americans to mostly cook from scratch.

Young Hispanics, in particular, prefer to buy local. Latinos and blacks aged 18-34 who participated in the Mintel research said they are more likely to purchase locally sourced meals in a restaurant or food service at a farmers’ market.

Target Latinos effectively by understanding how they shop

“Hispanic Holiday Shopping Patterns” audio recording

Manuel Delgado, CEO Agua Marketing, gives a presentation and participates in an extended Q&A discussion about

- Hispanic shopping patterns national survey

- Why Latino consumers may be more desirable than general market shoppers

- Hispanics holiday shopping patterns and behaviors

Click here for information on “Hispanic Holiday Shopping Patterns” audio recording

Posted by Elena del Valle on March 9, 2009

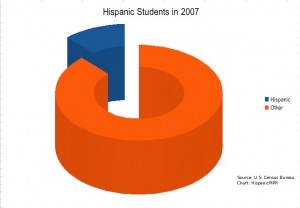

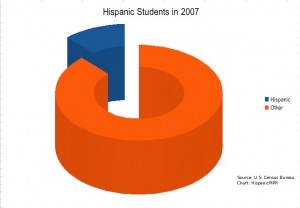

Hispanic Students in 2007 - click to enlarge

In 2007, Hispanic students represented one fifth (12 percent) of kindergarten through high school students as well as full-time undergraduate and graduate college students. The number of college students represents an increase of 2 percent from 10 percent in 2006, according to U.S. Census Bureau tables released last week. These numbers are not surprising since Hispanics, even by conservative estimates, comprise 15 percent of the nation’s population.

The increase in Latino students is considered part of a trend of an increasing wave of emerging market or minority students across schools and universities nationwide. In 2007, there were twice as many minority (Hispanics, blacks, Asian-Americans) students in grades K-12 than 30 years earlier. Pre-college minority students in that part of the country exceeded mainstream students. By 2023, minority children are projected to be the largest percentage of children in the United States population.

Immigration and high birth rates among Latinos combined with shrinking birthrates among non Hispanic whites are resulting in changes in the school systems, especially in western states such as Arizona, California, and Nevada where 37 percent of students is Hispanic.

Nationwide, more than 23 percent of kindergarten students is Hispanic. At the same time, in 2007, more of those young students were U.S.-born than foreign-born. Fifty-four percent of students in New Mexico is Latino, 47 percent of students in California is Latino, 44 percent in Texas, and 40 percent in Arizona according to the latest data available.

“Marketing to Multicultural Kids” audio recording

Michele Valdovinos gives a presentation and participates in an extended Q&A discussion about multicultural children based on a Phoenix Multicultural and Nickelodeon study of 1,300 multicultural children in 16 United States markets.

Find out about

• The Phoenix Multicultural Kids Study

• Relationship between children and their context

• Issues relating to family, technology and media, diversity, buying power, relationships in household, self perception, values, acculturation, cultural heritage, frequency of media activity, income and spending, brand preferences, the American Dream

• How many billions of dollars buying power multicultural kids children have

• Children’s spending attitudes, habits by ethnicity

• How much money a year Hispanic kids have available to spend

• Types of products Hispanic kids buy

Click here for information on “Marketing to Multicultural Kids” audio recording

Posted by Elena del Valle on March 4, 2009

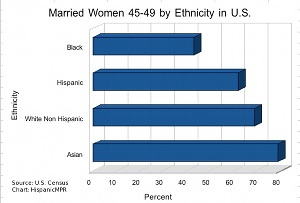

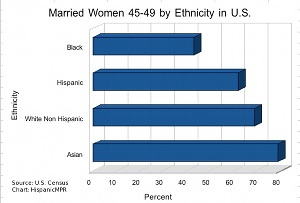

Married Women 45-49 by Ethnicity in U.S. 2008 – click on image to enlarge

Although mainstream families are showing a decline in fertility rates and as Baby Boomers age there tend to be fewer families with children 18 and under living at home, the situation is different among Latino families. In the general population the percentage of families with one or more children living at home decreased to 46 percent in 2008, from 52 percent in 1950 and 57 percent in the early 1960s, according to new data from the U.S. Census Bureau. On the other hand, 25 percent of babies and children five and under are Latino.

“Decreases in the percentage of families with their own child under 18 at home reflect the aging of the population and changing fertility patterns,” said Rose Kreider, family demographer at the U.S. Census Bureau. “In 2008, not only were Baby Boomers old enough that most of their children were 18 and over, but they were having fewer kids than their parents, as well.”

In 2008, 66.9 million opposite-sex couples lived together. Of those 60.1million were married, and 6.8 million were unmarried. At the same time, the percentage of adults ages 45 to 49 who were married varied by race and ethnicity. Among women 45 to 49, 79 percent of Asians, 69 percent of white non-Hispanics, 62 percent of Hispanics and 43 percent of blacks were married.

The census data suggests there are 25,173,000 married couples living with children or one million less than the previous year. That is the lowest number since 1999. Just over half of men and women over 18 are married and living with their spouse. People making $100,000 or more are more likely to live with their spouse, 82 percent of men and 65 percent of women.

The percentage of children living with two parents varied by race and ethnicity. Eighty-five percent of Asian children lived with two parents, while 78 percent of white non-Hispanic children, 70 percent of Hispanic children and 38 percent of black children cohabited with both parents.

Some 9 percent of all children (6.6 million) lived in a household where there was a grandparent; although for 23 percent of children living with a grandparent there was no parent in the household. In 2008, 6 percent of white non-Hispanic children lived in a household with a grandparent present, compared with 10 percent of Hispanic children, and 14 percent of both Asian and black children.

The findings come from America’s Families and Living Arrangements: 2008, a collection of 2008 Current Population Survey (CPS) statistics on family and nonfamily households, characteristics of single-parent families, living arrangements of children and data on married and unmarried couples released last week. The CPS has been conducted annually since 1940. This survey was conducted in February, March and April for a nationwide sample of 100,000 addresses.

Discover from a new mom market expert how to reach Latino moms by listening to

“Marketing to New Hispanic Moms – a case study” audio recording

Presenter Cynthia Nelson, COO, Todobebe

Find out about

• New Latina mom market

• Baby demographics including market size, profile

• New moms’ language preferences

• Latino baby market trends

• Factors influencing Hispanic baby market

• Location of new Hispanic moms’ market

• Issues affecting new Latino moms

• Todobebe strategies

Click for information on “Marketing to New Hispanic Moms – a case study”

Posted by Elena del Valle on February 25, 2009

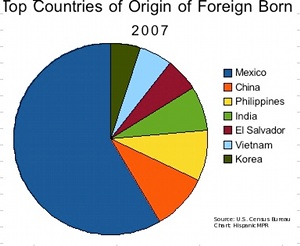

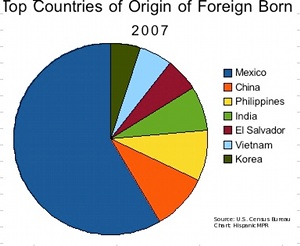

Top Countries of Origin of Foreign-Born 2007 – click on image to enlarge

There were 38.1 million foreign born people living in the United States in 2007, according to the United States Census Bureau. The agency’s new analysis of data about the U.S. foreign-born population from the 2007 American Community Survey (ACS) released last week, indicates a higher percentage of people born in India have a bachelor’s degree or higher (74 percent) than people born in any other foreign country.

Egypt and Nigeria had rates above 60 percent. Somalis and Kenyans living in the United States are the most likely to be newcomers, and Somalis are among the youngest and poorest.

Mexico is the country with the highest birth list with more than 11.7 million people. The next highest countries by birth are China (1.9 million), the Philippines (1.7 million), India (1.5 million), El Salvador and Vietnam (both at 1.1 million), Korea (1 million) as well as Cuba, Canada and the Dominican Republic.

These figures come from new detailed characteristic profiles on people who were not U.S. citizens at birth available by country of birth and their location of residence at the time of the survey.

“These new ‘selected population profiles’ highlight the diversity among the many different foreign-born groups in the United States,” said Elizabeth Grieco, chief of the Census Bureau’s Immigration Statistics Staff. “This diversity is due in part to the way the various communities were established, whether it be through labor migration, family reunification or refugee flows.”

Hispanic Marketing and Public Relations Understanding and Targeting America’s Largest Minority book

“A must resource for practitioners/professionals expecting to reach US Hispanics; also valuable for college programs in marketing, public relations and communications. Highly recommended.”

Choice magazine

Click here for information on the Hispanic Marketing & Public Relations book

In terms of education, Chinese born residents stand out. About 80 percent of the nation’s population born in China are high school graduates. In the New York metropolitan area, about two-thirds of those born in China are high school graduates, while in the metro area of San Jose, California, 93 percent were high school grads.

When it comes to earning capability among the foreign-born, people born in Somalia and the Dominican Republic had some of the lowest median household incomes; while those born in India, Australia, South Africa and the Philippines have the highest median household incomes. The median household income for U.S. residents born in India is $91,195. Median household income is $50,740 for the total population, $46,881 for the foreign-born population and $51,249 for the native population.

In terms of English language ability, 52 percent of the foreign-born population, 2 percent of the native population and 9 percent of the total U.S. population speak English less than “very well” while 97 percent of the foreign-born population from Mexico and the Dominican Republic age 5 and over speak a language other than English at home. Those born in Nicaragua, El Salvador, Armenia, Honduras, Bosnia and Herzegovina, and Ecuador also have high rates of speaking a language other than English.

People from Mexico, Guatemala, Honduras and El Salvador age 5 and over are most likely to speak English less than “very well.” More than 70 percent of the foreign-born population from these countries identified themselves in that category.

Foreign born respondents were more likely to suffer from poverty than U.S.-born respondents of the survey. Overall, about 13 percent of natives and the total U.S. population are living in poverty, while about 16 percent of the foreign-born are poor. About 51 percent of residents born in Somalia live in poverty. About a quarter of the population born in Iraq, the Dominican Republic, Jordan and Mexico are also living in poverty.

The 2007 ACS estimates are based on a nationwide sample of about 250,000 addresses per month as well as 20,000 group quarters across the United States that were sampled, comprising approximately 200,000 residents. Geographic areas for which one-year data are available are based on total populations of 65,000 or more.

Federal officials rely in part on the data collected by the ACS to determine where to distribute more than $300 billion to state and local governments each year. Responses to the survey are confidential and protected by law.

“Best in Class Hispanic Strategies” audio recording

Presenters Carlos Santiago and Derene Allen

-

Find out what makes 25 percent of the top 500 Hispanic market advertisers out perform the remaining companies

-

Discover what questions to ask, steps to take to be a Best in Class company

Click here for more about “Best in Class Hispanic Strategies” audio recording

Posted by Elena del Valle on February 23, 2009

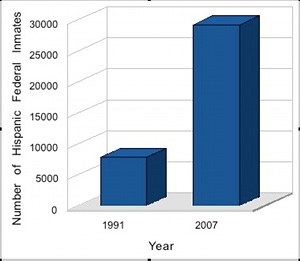

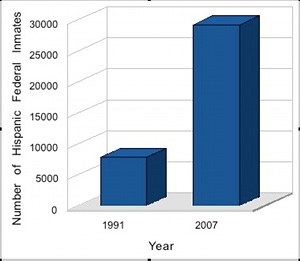

Number of Hispanic Federal Inmates – click on image to enlarge

An increase in illegal immigration over the years and the federal government’s recent enhanced surveillance of our borders have resulted in a significant increase in Latino inmates in federal prisons. Although Latinos only represent a fraction of the national population, they are overrepresented in federal prisons.

In 2007, 40 percent of prisoners convicted of federal crimes were Latinos. One third of federal prison inmates are Latino, making that ethnic group the largest in the federal prison system, according to a recent study. Between 1991 and 2007 the number of inmates at federal prisons doubled and the number of Latino inmates quadrupled increasing from 7,924 to 29,281.

It’s noteworthy that 72 percent of Latinos in federal prisons are not U.S. citizens and most were jailed as a result of sentences in courts from one of the states bordering Mexico. It’s not surprising then that almost half, 48 percent, of Latino federal inmates were convicted of immigration related violations. The second most common cause of incarceration was drug convictions, according to a Pew Hispanic Center study released last week.

The Pew Hispanic Center, a nonpartisan research organization, is dedicated to improving public understanding of the Hispanic population in the United States and to chronicle Latinos’ growing impact on the nation. It does not take positions on policy issues.

“Marketing to Multicultural Kids” audio recording

Michele Valdovinos gives a presentation and participates in an extended Q&A discussion about multicultural children based on a Phoenix Multicultural and Nickelodeon study of 1,300 multicultural children in 16 United States markets.

Find out about

• The Phoenix Multicultural Kids Study

• Relationship between children and their context

• Issues relating to family, technology and media, diversity, buying power, relationships in household, self perception, values, acculturation, cultural heritage, frequency of media activity, income and spending, brand preferences, the American Dream

• How many billions of dollars buying power multicultural kids children have

• Children’s spending attitudes, habits by ethnicity

• How much money a year Hispanic kids have available to spend

• Types of products Hispanic kids buy

Click here for information on “Marketing to Multicultural Kids” audio recording

Posted by Elena del Valle on February 18, 2009

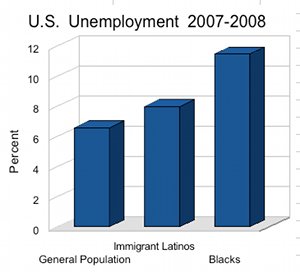

Click on image to enlarge

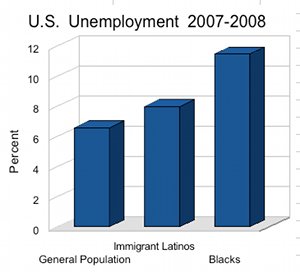

Although the economic recession is impacting everyone, it seems Latino immigrants, blacks and native-born Hispanics have been more severely affected than the rest of the population. While blacks are the only group with an unemployment rate in the double digits, 11.5 percent; in the fourth quarter of 2008, 9.5 percent of U.S.-born Hispanics were unemployed.

From the last quarter of 2007 to the last quarter of 2008, unemployment in general market increased 2 percentage points, from 4.6 percent to 6.6 percent. The unemployment rate for foreign born Latinos rose by 2.9 percentage points (from 5.1 percent to 8 percent) for the same period.

At the same time, the number of employed immigrant Latinos of working age dropped 2.8 percentage points from the last quarter of 2007 to the last quarter of 2008 (from 67.5 percent to 64.7 percent); compared to a 1.6 percentage point drop in the employment rate among the general working age population (from 63.2 percent to 61.6 percent).

These are the conclusions of Rakesh Kochhar, associate director for Research, Pew Hispanic Center in an article published last week, Unemployment Rises Sharply Among Latino Immigrants in 2008. He relied on data from the Current Population Survey, a monthly survey of 55,000 households conducted jointly by the Bureau of Labor Statistics and the Census Bureau.

The Pew Hispanic Center, a nonpartisan research organization, is dedicated to improving public understanding of the Hispanic population in the United States and to chronicle Latinos’ growing impact on the nation. It does not take positions on policy issues.

Reach Hispanics online today with

“Marketing to Hispanics Online” audio recording

Identifying and characterizing the booming Hispanic online market

Joel Bary, Alex Carvallo and Matias Perel

Find out about

• The 16 million Latino online users

• Latino online users by gender

• What they do online

• Their language preferences

• How to reach Hispanic urban youth online

• What affects their online behavior

• What influences their purchases

Click here for information about “Marketing to Hispanics Online”

Posted by Elena del Valle on February 16, 2009

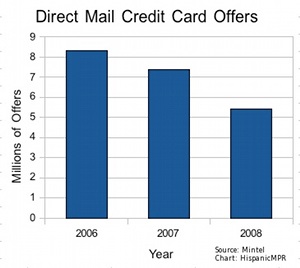

Click on image to enlarge

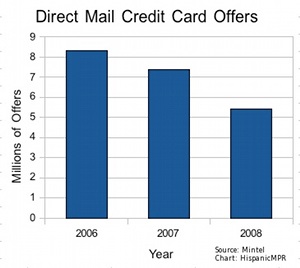

Does your mailbox look less full lately? One reason might be that the number of credit card offers has decreased significantly in the last year, especially for households with incomes below $100,000 a year. New data from Mintel Comperemedia, a leading market research company, indicates only 5.4 billion credit card direct mail offers were sent to Americans in 2008, the lowest annual total reported since 2000.

In 2008, most credit card issuers decreased their direct marketing mailings significantly, resulting in a new card mail volume decline of 26 percent compared with the previous year. Researchers estimate 2007 mail volume at 7.4 billion or 36 solicitations per household, and at 8.3 billion in 2006.

The decrease in offers may be the result of the weak economy as well as the hundreds of consumer complaints against credit card issuers. From poor performers to stellar credit holders, people across the country have been complaining for months about credit card company abuses including sudden rate hikes, changes in terms with little or no advance notification, as well as increasing late fees and minimum service charges.

According to the Consumer Federation of America, the average credit card debt per household is $7,430 and 35 percent of accounts are incurring late fees. There are those who argue that credit card companies are in trouble, having oversold their product. Unable to find a way to sell their debt to investors some credit card issuers are requesting federal rescue monies.

Mail offers sent for new credit cards dropped steadily throughout 2008. There was an 8 percent decline from Q1-Q2 and a 13 percent decline from Q2-Q3. The last quarter of 2008 had the most remarkable quarterly drop, 33 percent compared to the previous quarter.

“With reduced funds available for lending and increased loan losses, credit card issuers had no choice but to drastically cut direct marketing for new cards during 2008. Credit card issuers shifted direct marketing strategy to focus on higher earning, lower risk consumers. 2008 was an adjustment year for the credit card industry as issuers were confronted with economic conditions not seen in decades,” said Stephen Clifford, vice president of Financial Services at Mintel Comperemedia. “In 2009, I expect less volatile fluctuations in mail volume as the industry positions itself to ride out the recession and recover.”

Although a breakdown by ethnic group was unavailable, it is noteworthy that while estimated direct mail volume for credit card acquisition fell across the board last year, individuals with the highest incomes saw little change in their mailboxes. According to Mintel Comperemedia, households with an income in excess of $100,000 a year received only 1 percent fewer credit card offers in 2008 than in 2007. At the same time, households making $50,000 or less saw a 42 percent drop in new credit card mail volume.

Based on that data, perhaps we can conclude that Latinos with incomes above $100,000 continued receiving an almost unchanged number of credit card offers while those with incomes below $50,000 saw a significantly lower number reach their mailboxes.

“Best in Class Hispanic Strategies” audio recording

Presenters Carlos Santiago and Derene Allen

-

Find out what makes 25 percent of the top 500 Hispanic market advertisers out perform the remaining companies

-

Discover what questions to ask, steps to take to be a Best in Class company

Click here for more about “Best in Class Hispanic Strategies” audio recording

Posted by Elena del Valle on February 13, 2009

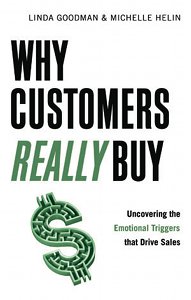

Why Customers Really Buy: Uncovering the Emotional Triggers that Drive Sales book cover

Photos: Career Press, EvinThayer

A newly published book written for sales and marketing professionals addresses issues relating to the emotional triggers the authors believe are behind shoppers purchasing behavior. In a jointly written book, Why Customers Really Buy: Uncovering the Emotional Triggers that Drive Sales (Career Press, $14.99), Linda Goodman and Michelle Helin, business consultants with decades of experience advising Fortune 500 companies, discuss specific and practical guidelines to illustrate how “insights can become useful for converting emotional considerations into actionable solutions.”

They believe that the same emotional motivation that drives consumers to loyally purchase brand products applies to the business to business environment. They explain that unlike other popular methodologies that focus on mapping emotional reactions against existing products or communications messages, Emotional Trigger Research is a proactive technique designed to uncover the core, unfiltered, and spontaneous triggers that drive actions.

They are convinced that these triggers reveal insights that can be useful in creating sales and marketing strategies that may transform companies. The process relies on a combination of questions, listening, and in-depth conversations, to identify the information companies seek.

The 256-page paperback includes local, national and international case studies and is divided into five parts: Discovering the Power of Emotion, Putting Emotional Triggers to Work – Sales, Putting Emotional Triggers to Work – Marketing, Putting Emotional Triggers to Work – Customer Relationships, and Integrating Emotional Logic.

Linda Goodman and Michelle Helin, coauthors, Why Customers Really Buy

Goodman and Helin are independent business consultants who have served as senior sales and marketing officers for Fortune 500 corporations within the hospitality, entertainment, and retail sectors. Past clients, in the United States and around the world, include AT&T Lucent Technology, Schlumberger LTD, GE Corporation, Compaq Computer, Omnicom Group Inc., Staples, Tribe Pictures, and Disney. Goodman’s business, LG Associates, is based in Avon, Connecticut. Helin’s company, Michelle Helin LLC, is based in Houston, Texas.

Click here to buy Why Customers Really Buy: Uncovering the Emotional Triggers That Drive Sales