Posted by Elena del Valle on March 7, 2012

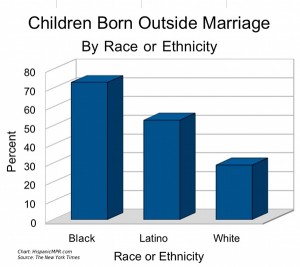

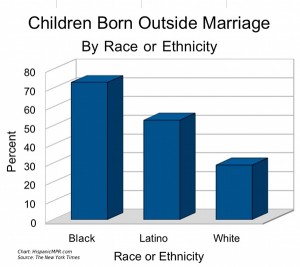

Children Outside Marriage Trends – click to enlarge

Sellers of products and services to married couples having children likely have noticed their target audience has changed significantly in the past few decades. In 2009, in the United States, although 59 percent of women married before having children when it came to younger women more than half had children out of wedlock. Also, two thirds of children were born to women under 30 years old, according to new federal data on births and marriages and Childbearing Outside of Marriage: Estimates and Trends in the United States, a research brief from Child Trends.

In the United States, although 52 percent of the out of wedlock births are to parents living together such unions are less stable than marriages; and children born to unwed mothers are more likely to be poor, fail in school and suffer from behavioral problems, according to Child Trends, a nonprofit, nonpartisan research center that studies children.

From a big picture perspective 92 percent of college educated women are married when they have a child while 62 percent of women with some post-secondary studies, and 43 percent of women with high school diploma or less are married when they give birth. At the same time 73 percent of black children are born to unwed mothers, while 53 percent of Latino children and 29 percent of whites are born outside marriage.

Being born to a single or unmarried mother went from being the exception 30 years ago to being common today. In 1980, the likelihood that a child would be born to unmarried parents was 18 percent; now it is 41 percent.

“It is hard to say what will happen. However, preliminary data from 2010 show a slight decline in the percentage of births occurring outside of marriage. It is possible that we have reached a plateau, or perhaps levels will continue to decline. We won’t know for several more years. Nonetheless, levels of nonmarital childbearing remain high and I don’t really expect that we will see a huge surge in marriage anytime soon. Given that many of these births occur to two parent families, to cohabiting parents, I think we should work to promote stability in cohabiting unions, as well as marriage. Additionally, we should make sure that children have access to resources from both parents,” said Elizabeth Wildsmith, research scientist, Child Trends, by email when asked about trends for the next two years.

Women college graduates resist the unwed mother trend. Increasingly, they are the most likely to marry before bearing children, according to a recent The New York Times article (see Half of Births under age 30 are by unwed).

Posted by Elena del Valle on March 5, 2012

The PixiGlow Collection sold only at Target

Photos: Target, Victoria’s Secret

At what age do girls begin wearing make up? Perhaps because adult women are spending less on beauty products cosmetics makers are increasingly targeting tween girls between nine and twelve as well as older teens aged 13 to 17. Nearly half of young girls and many of their parents, however, don’t think the girls are old enough to wear make up, according to Teens’ and Tweens’ Beauty Market US December 2011, a report resulting from a Mintel survey.

From 2007 to 2009, girls aged 8 to 12 who said they regularly use mascara and eyeliner increased to 18 percent from 10 percent for mascara, to 15 percent from 9 percent for eyeliner and to 15 percent from 10 percent for lipstick, according to a new report from the NPD Group, a consumer research company. Women, on the other hand, are wearing less make up. Perhaps because of the downturn in the economy women appear to be cutting back on beauty products to save money and unemployed women may be less inclined to apply make up every morning, according to the NPD report.

Researchers at Mintel believe marketers who want to win over young shoppers should offer products that are subtle in appearance while at the same time safe for young skin; they believe that body lotion and nail polish are the most likely to gain acceptance among have tweens and their parents.

A Victoria’s Secret runway model with “wings”

Responses to the survey indicate teens like CoverGirl, Maybelline, Wet n Wild, Victoria’s Secret and Avon products while tweens favor Bath & Body Works for body lotion. A spokesperson for Victoria’s Secret replied to an email question about the company’s percentage of beauty products sales to girls aged nine to seventeen and best selling products for this market segment as follows: “Unfortunately I’m unable to provide this information.”

Two relative newcomers targeting young girls with affordable products were mentioned in the Mintel report, Geogirl, a line sold at WalMart and promoted as environmentally responsible; and PixiGlow, inspired by Tinker Bell and sold at Target stores.

Petra Strand, creator of the Pixi cosmetics line, teamed with The Walt Disney Co. to design the PixiGlow collection. To develop the vintage look of the line Strand worked closely with character artist John Quinn. Products priced between $8 and $34 are available online are are expected to become available at Target stores beginning March 2012. According to the retailer’s website, the PixiGlow extension line offers six color cosmetics exclusively at Target: Catching Shadows Crayon ($18), Fairy Dust ($14), Fairy Face Palette ($34), Magic Tink Tint ($16), Straight On ‘til Morning Liner ($15), and Pirouette Pink Nail Colour ($8).

Willa lip gloss trio

“While I can’t say exactly what our best selling tween/teen beauty product is, I can tell you that Target offers a range of affordable cosmetics that appeal to tweens who are developing their individual style and beginning to experiment with makeup. Brands that appeal to the tween guest include Target’s exclusive Hello Kitty beauty collection, Caboodles, Wet & Wild and e.l.f. We also anticipate that the forthcoming tween natural skincare line Willa will be popular, said Evan Miller, spokesperson for Target. “PixiGlow, while created with a more mature beauty guest in mind, does appeal to our younger guest as well because of the link to Tinkerbell and Disney.”

According to the Mintel report, the least frequent users of makeup were tween girls between 9 and 12 and the most frequent daily users of cosmetics were those aged 15 to 17.

Posted by Elena del Valle on March 2, 2012

Getting More book cover

Photos: Sullivan and Partners

Stuart Diamond, a Pulitzer Prize Winner and Wharton School of Business professor who taught negotiation to 30,000 people in 45 countries, believes obtaining the most out of a negotiation varies with the situation. Although it may sometimes seem counter intuitive, good negotiations are about more than the familiar win-win or win-loose approaches, according to Diamond. In Getting More: How to Negotiate to Achieve Your Goals in the Real World (Crown Business, $26), a 400-page hardcover book published in 2010, Diamond outlines his situation specific approach to negotiation in 16 chapters.

Based on years of personal experience and the experience of his students, including 400 anecdotes in the book, he believes that: focusing on your goals, being knowledgeable about the other party and making human contact is key to success; emotion destroys negotiation; preparing, even briefly, is essential; dealing with the decision maker is necessary; acknowledging the other party’s power and position may be helpful; an incremental strategy can be most productive; being yourself and transparent is conducive to good negotiations; constant communication is powerful; identifying the source of the problem and converting it into an opportunity can lead to getting more in the negotiation; celebrating differences can be conducive to better negotiations; using power in a negotiation may harm a relationship, and result in retaliation and loss of credibility.

Stuart Diamond, author, Getting More

To get more when negotiating he relies on emotional sensitivity, clear goals, relationships, being incremental and viewing each situation independently; trusting while insisting on commitments in return. According to his biography, Diamond has advised executives from Google, Microsoft, JP Morgan, and Prudential as well as managers from more than 200 of the Fortune 500 countries.

Click to buy Getting More

Comments:

Filed Under: Books

Posted by Elena del Valle on February 29, 2012

By Debra L. Ness

President, National Partnership for Women & Families

Debra L. Ness, president, National Partnership for Women & Families

Photo: National Partnership for Women & Families

In last month’s State of the Union address, President Obama gave a powerful and resonant speech, issuing a ringing call for fairness, fair play and equal opportunity in our workplaces and our health care system.

President Obama was right. At this time when millions of people in this country are struggling, Congress must stop the political battles and instead advance the fair pay, job creation and other critical initiatives President Obama discussed — because they are the initiatives America needs.

As we work to create more jobs, we must ensure that new jobs pay fair wages and provide basic family friendly supports like paid sick days and paid family and medical leave. Right now, too many workers can lose pay or be fired just for taking time off to recover from illness or care for a sick child. Latino workers confront this reality at disproportionate rates: nearly 12 million Latino workers – almost 60 percent of the Latino workforce — don’t have a single paid sick day to use to recover from common illnesses. Many more lack paid sick days to care for a sick child, forcing them to make the terrible choice between leaving a sick child alone or sending him or her to school, or losing a paycheck or possibly even a job. A paid sick days standard would help to alleviate these choices for millions of families.

Read the entire In 2012, We Can and Must Do Better

Posted by Elena del Valle on February 27, 2012

Orly Wahba, CEO, Life Vest Inside

Photo: Vicki Ades

A podcast interview with Orly Wahba, founder and chief executive officer of Life Vest Inside, is available in the Podcast Section of Hispanic Marketing & Public Relations, HispanicMPR.com. During the podcast, she discusses her organization with Elena del Valle, host of the HispanicMPR.com podcast.

After completing her graduate studies in Jewish History from Touro College Orly dedicated ten years to work with tweens and teens and at charities in her community. Since 2004, she has been an educator for Middle School at the Yeshivah of Flatbush. Orly strives to incorporate ideas of kindness, love and respect in the hearts and minds of her students. She is fond of saying, “Kindness, don’t just do it live it!”

To listen to the interview, scroll down until you see “Podcast” on the right hand side, then select “HMPR Orly Wahba” click on the play button below or download the MP3 file to your iPod or MP3 player to listen on the go, in your car or at home. To download it, click on the arrow of the recording you wish to copy and save it to disk. The podcast will remain listed in the February 2012 section of the podcast archive.

To watch the video click on the play button in the video player below.

Posted by Elena del Valle on February 24, 2012

Why Has America Stopped Inventing book cover

Photo: Planned Television Arts

Contrary to what many of us think it seems the United States is not the most innovative nation on the planet any more. Darin Gibby, a Colorado patent attorney, has dedicated two decades of his life to representing clients filing patent registrations and claims. Over time his frustrations bubbled over and he realized it had become increasingly difficult and expensive to file a new patent registration, especially for individuals and small business owners. He researched the history of patents in the United States to discover how it was that our nation was rich in patents 150 years earlier and poor in patents today relative to the overall population. In Why Has America Stopped Inventing (Morgan James Publishing, $19.95), a 241-page softcover book published this year, he shares his findings.

An ineffectual patent registration system has made it nearly impossible for a lone inventor to register a new patent, according to Gibby. At its low point the United States patent overseers were only approving 12 percent of applications. Due to a series of actions by the government over the past century which continues to the present day patents have become the domain of large corporations with the resources to register and protect them yet little time for new inventions.

The book is divided into an Introduction and 22 chapters. In the last two chapters, the author addresses the high costs of registering an invention which start at $25,000 and can escalate steeply from there, and ways to fix the broken patent system.

“When I discovered that America invents half of what it used to, I wanted to know the reason. So, I began studying the lives of America’s famous early inventors for clues. In the process, I discovered that inventing in nineteenth century America was much more central to America’s culture than today,” said Gibby in response to a question about the most interesting part of the book project. “From Abraham Lincoln selecting the country’s three leading patent attorneys to be on his cabinet (Seward, Chase, and Stanton) to Daniel Webster arguing Goodyear’s case before the Supreme Court while still Secretary of State, all of America prized innovation. Patent cases were front page news, with transcripts of the Colt revolver cases being published daily in the N.Y. Times. Most important, I found that what made America successful more than a century ago could be brought back today. Why Has America Stopped Inventing? tells that story.”

Gibby spent two years researching and writing the book which includes much historical data and case studies. Over his legal career Gibby has procured patent registrations for hundreds of inventions and built IP portfolios for Fortune 500 companies.

Click to buy Why Has America Stopped Inventing

Comments:

Filed Under: Books

Posted by Elena del Valle on February 22, 2012

By Tony Malaghan

Chief Executive Officer

Arial International

Tony Malaghan, CEO, Arial International

The “Great Recession” has had an impact on us all in one way or another and with businesses across all industries struggling in the face of an economic climate not seen since the Great Depression, what better way to grow your business than tap into a market of 50.5 million people, with a purchasing power of more than one trillion dollars right at your own back door! A great majority of businesses however, appear to be overlooking the US Hispanic market with few companies proactively targeting this segment of the market in a strategic and culturally appropriate manner.

According to the US Census Bureau 2010 Census data, 308.7 million people reside in the US, of which 50.5 million (or 16%) are of Hispanic origin. This is an increase from 35.3 million in 2000 when this group made up 13% of the total population. That’s an increase of 15.2 million between 2000 and 2010, and accounts for over half of the 27.3 million increase in the total population of the United States. Put another way, the Hispanic population grew by 43%, which is four times the growth in the total population at 10%.

I can hear you saying, there is no denying the population growth of this segment of the market, but hasn’t the US Hispanic market been impacted just as much, if not more, than the general market by recessionary forces? It’s true that Hispanics were proportionally significant employees in those industries hardest hit by the recession, and that the Hispanic unemployment rate has been running higher than the nation’s overall rate, (Table 1).

Click to read the entire The US Hispanic Market, A Viable Acquisition Strategy in a Recovering Economy

Posted by Elena del Valle on February 20, 2012

Thomas Cooper, Ph.D., professor, Visual and Media Arts, Emerson College

Photo: Thomas Cooper, Ph.D.

A podcast interview with Thomas Cooper, Ph.D., professor, Visual and Media Arts, Emerson College, is available in the Podcast Section of Hispanic Marketing & Public Relations, HispanicMPR.com. During the podcast, Tom discusses leading media ethics issues with Elena del Valle, host of the HispanicMPR.com podcast.

Tom previously taught at Harvard University and the University of Hawaii. A former assistant to Marshall McLuhan, he is the co-Founder and co-Publisher of Media Ethics magazine. He serves as speechwriter for Jochen Zeitz who is CEO of Puma. He is also author of Fast Media Media Fast (see Massachusetts professor addresses media overload).

To listen to the interview, scroll down until you see “Podcast” on the right hand side, then select “HMPR Thomas Cooper, Ph.D.” click on the play button below or download the MP3 file to your iPod or MP3 player to listen on the go, in your car or at home. To download it, click on the arrow of the recording you wish to copy and save it to disk. The podcast will remain listed in the February 2012 section of the podcast archive.

Posted by Elena del Valle on February 17, 2012

Who We Are: Hispanics book cover

Marketers and planners across the nation continue to examine the findings of the 2010 United States Census. One of the notable findings, from a big picture ethnicity and race perspective, is that there were three million more people of minority background and one percentage point higher than the experts anticipated.

The Second Edition of Who We Are: Hispanics (New Strategist, $89.95), published last year, outlines the main findings of the 2010 Census about the Hispanic population of the United States, including counts by state and major urban areas.

The book, provides black and white tables and illustrations and data on spending, household wealth, impact of the Great Recession, time use and attitudes about some issues. Who We Are: Hispanics is part of the Who We Are Series of three books sold together and individually. The other two titles are Who We Are: Asians and Who We Are: Blacks.

The 312-page book is divided into an Introduction, an Executive Summary and 11 chapters titled: Attitudes, Education, Health, Housing, Income, Labor Force, Living Arrangements, Population, Spending, Time Use and Wealth.

For the Who We Are Series the publisher’s staff dedicated, according to promotional materials, hundreds of hours reviewing, compiling and analyzing information and data from the federal government about the size and characteristics of the Asian, black, and Hispanic populations, described as “the most rapidly growing segments of the consumer marketplace.”

New to the second edition of the Who We Are Series is a chapter on the attitudes of Asians, blacks, and Hispanics on issues such as political identification, happiness and trust in others, religious beliefs, and support for gay marriage.

Click to buy Who We Are: Hispanics

Comments:

Filed Under: Books

Posted by Elena del Valle on February 15, 2012

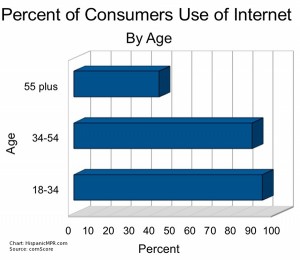

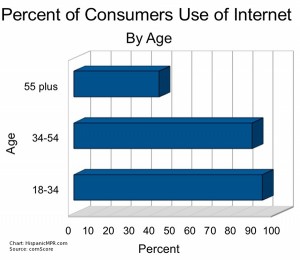

Percent of consumers use of the internet by age – click to enlarge

Marketers targeting Millennial women (those born between 1981 and 2000), should be aware that the members of this generation of 79 million tend to have short attention spans and are more likely to engage with digital media than television, according to Next-Generation Strategies for Advertising to Millennials, a 17-page report by comScore released January 2012. Overall, 93 percent of consumers aged 18 to 34; 88 percent of consumers 35 to 54 and 42 percent of consumers 55 and older said they used the internet, according to the comScore researchers.

It seems the engagement of this generation of women is stronger for digital media than that of older generations who engage more with television, according to the findings of the study. Given the right reasons and a strong incentive from an ad they, like other generations, respond with high ad effectiveness scores.

The results outlined in Next-Generation Strategies for Advertising to Millennials were gleaned from an analysis of nearly 1,000 comScore tests of the effectiveness of television ads and 35 tests of digital creative that aired in the United States. Ad recall and engagement were included in the study.

Overall, researchers examined the views of 500,000 women from four generational groups: Millennials (aged 16 to 29); Generation X (aged 30 to 44); Baby Boomers (aged 45 to 59); and Seniors (60 and older). Only women, considered the primary purchasers for most products, were studied.