Posted by Elena del Valle on August 22, 2007

Click on image to enlarge

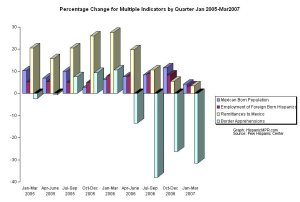

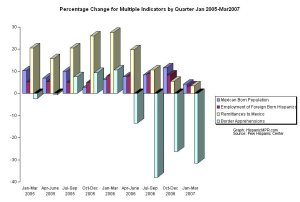

Although the Mexican born population in the United States has increased over the last three years and continues to increase, the rate of growth seems to have slowed in the last few months. According to a May 2007 report by the Pew Hispanic Center, it is difficult to determine exact changes in immigration from Mexico to the United States. It appears the percentage growth of south to north migration has been decreasing since mid 2006.

The researchers took into account four indicators in reaching their conclusion: the size of the Mexico born population of the United States; the number of Hispanic immigrants employed in the United States; Bank of Mexico remittance receipts; the number of apprehensions of individuals crossing the border illegally.

Target Latinos effectively by anticipating changes in the market with

“Hispanic Projections with 2007-08 updates” audio recording

Presenter Roger Selbert, Ph.D.

Find out

- About Latino buying power growth in the future

- How Latino market growth compares with other markets in the U.S.

- What drives the rise of Latino economic clout

- Who should target the Latino market

- What is the size of the Hispanic affluent market

- If the luxury Latino market is growing

- About Hispanics who earn more than $100,000 annually

Click here to purchase “Hispanic Projections with 2007-08 updates”

They concluded that the rate of growth of immigration from Mexico to the United States may have slowed in the second half of 2006 and first half of 2007. Due to inexact data sources, the researchers are unable to identify the reasons behind the possible changes or predict future trends. At the same time, they can’t tell if the slower immigration growth is the result of political, economic and border control policies or other factors.

In mid 2000 there were 4 million Mexican born residents in the United States. By early 2007 that number had reached 7 million. While many focus on the large number of Mexican immigrants entering the country, close inspection reveals a gentler slope in the growth over the last months.

Does the slowest rate of growth in remmitances to Mexico since 2003; half the increase in employment of Hispanics in the first quarter of 2007 than in the first quarter of 2004; and a 24 percent drop in apprehensions in the U.S. Mexico southwestern border compared to last year, in spite of increased patrols, reveal a lasting trend?

Posted by Elena del Valle on August 21, 2007

Ursula Mejia-Melgar, editor and Hispanic marketing manager, General Mills

Photo: General Mills, Inc.

Minneapolis, Minnesota – General Mills Inc. re-launched its free Spanish-language lifestyle advertorial magazine, Qué Rica Vida, as a quarterly publication. Last year it was published three times. This year, the publication, distributed via direct mail, at stores and community-based venues, is expected to have an average of 64 pages and a circulation of 350,000. The newly launched issues will have enhanced content and new layout and design. Qué Rica Vida was most recently published last spring.

The magazine will have four sections to be paired with General Mills brands: Ser Madre for moms, Ser Amiga with a friends slant, Ser Mujer, about being a woman and Ser Mejor, about self improvement. According to promotional materials, the magazine’s image and content were revised in response to consumer feedback. Company representatives declined to share information about the General Mills Hispanic market campaign budget or identify what percent of their overall budget they dedicate to Latino markets.

“Latino Family Dynamics” audio recording

Brenda Hurley and Liria Barbosa

Discuss

- Latino purchasing habits and products they favor

- Latino family characteristics

- Latinos and extended families

- Division of duties, responsibilities within the family

- Who is the decision maker in the Latino family

- Who is the information provider in the Latino family

Click here to purchase “Latino Family Dynamics”

Qué Rica Vida exceeded its first-year goal of enlisting 100,000 subscribers, and in its second year, we have decided to focus on further improving the magazine’s appeal and readability,” said Ursula Mejia-Melgar, editor and Hispanic marketing manager, General Mills. “For that reason we listened to our consumers and worked with our design team, the Betty Crocker Kitchens, in-house food stylists and photographers to create a beautiful publication and an integrated platform that will truly connect with our readers, emotionally as well as practically.”

Que Rica Vida July 2007

Qué Rica Vida, Spanish for “What a Rich and Wonderful Life,” the magazine and its matching website quericavida.com is the cornerstone of General Mills’ year-old, multi-brand, Hispanic marketing initiative of the same name.

This year, General Mills plans community and public relations programs created in conjunction with Hispania Public Relations of Miami and Latino Family Media of Los Angeles. General Mills, with annual net sales of $13.4 billion, is a leading global manufacturer and marketer of consumer foods products. Its global brand portfolio includes Betty Crocker, Pillsbury, Green Giant, Häagen-Dazs, and Old El Paso.

Posted by Elena del Valle on August 20, 2007

Carlos Santiago and Derene Allen of Santiago Solutions Group

Photos:Santiago Solutions Group

A podcast interview with Carlos Santiago, president, Santiago Solutions Group and Santiago ROI and Derene Allen, managing partner, Santiago Solutions Group, is available in the Podcast Section of Hispanic Marketing & Public Relations, HispanicMPR.com. During the podcast, they discuss best practices to reach Hispanics with Elena del Valle, host of the HispanicMPR.com podcast.

Carlos is a marketing strategy expert whose new paradigms in resource allocation, target marketing and quantitative prediction of multicultural purchasing behavior have been highlighted by national media including CNBC and The Wall Street Journal. Carlos has consulted and created profit and loss business units, branding and retail strategies across many industries.

Beginning his career at Anheuser-Busch’s strategic planning group, he internally consulted for beer, bread, snacks, bottled water and parks subsidiaries. Later, he was director of Ethnic Markets for Pacific Bell, where he launched Latino and Asian direct response initiatives targeting record growth. As NYNEX vice president of Premium Markets & Sales, he led the company’s first centralized unit dedicated to Latinos, African Americans and Asians, rolling-out programs for growth, loyalty and reengineering processes.

“Best in Class Hispanic Strategies” audio recording

Presenters Carlos Santiago and Derene Allen

Click here to buy “Best in Class Hispanic Strategies” audio recording

Derene heads Santiago Solution Group’s San Francisco practice bringing with her direct response, loyalty and Latin American marketing experience. Prior to joining the Santiago Solution Group, Derene was general manager for Fiera, a Latino e-commerce site. Derene was an adjunct professor at the Instituto Tecnológico de Monterrey. While in Mexico, she served as consultant for CCM-FEMSA (a leading beer-soda conglomerate), UNICEF and AeroMexico.

Previously, Derene co-founded The Innova Group, an international marketing firm where she consulted for Johnson & Johnson, Cigna, Philips, Kodak, Dannon, Nestlé and Proctor & Gamble. She is an adjunct professor at the University of San Francisco and an entrepreneurship instructor for The Women’s Initiative’s Alas program for Latinas, a non-profit. She is a contributing co-author of the Hispanic Marketing and Public Relations book. A native of Aruba, she is fluent in Spanish and Portuguese and served on the Board of MANA, a national Latina leadership organization.

To listen to the interview, scroll down until you see the “Podcast” on the right hand side, then select “HMPR Carlos Santiago, Derene Allen” click on the play button below or download it to your iPod or MP3 player to listen on the go, in your car or at home. To download it, click on the arrow of the recording you wish to copy and save to disk. The podcast will remain listed in the August 2007 section of the podcast archive.

Read Derene’s chapter about “A Deeper Look into the U.S. Hispanic Market ” in

Hispanic Marketing and Public Relations Understanding and Targeting America’s Largest Minority book

Click here to buy Hispanic Marketing & Public Relations today!

Click the button to hear the podcast:

Posted by Elena del Valle on August 19, 2007

Customer Loyalty Summit

Create a Great Customer Experience that Drives Profitability

November 12-15, 2007

The Westin Colonnade, Coral Gables, FL

IQPC is pleased to introduce our Customer Loyalty Summit, designed to explore best strategies for developing and maintaining customer loyalty. Find out how to prevent your brand from becoming a commodity and how to keep your customers. We will take a big picture, strategic look at the topic by demonstrating how it is the key to competitive advantage and impacts the bottom line. A small increase in customer loyalty can have a huge impact on bottom line revenue. Attendees will find out what’s new, what’s proven, and what works in:

• Marketing communications

• Measurement and analysis

• Customer education and response

• Technology, self service and service enabling

• Human Resources and motivation

• Fostering a customer focused culture.

For more information on our conference content, please visit www.iqpc.com/us/customerloyalty or call 1-800-882-8684

Posted by Elena del Valle on August 17, 2007

2007 Annie E. Casey Foundation Kids Count Data Book

Photo: Annie E. Casey Foundation

According to the recently released 2007 Annie E. Casey Foundation annual national Kids Count Data Book, Hispanic teens are the most likely to become pregnant and drop out of school. In 2005, Latino teenagers were more than twice as likely as non Hispanic whites to drop out. While 6 percent of non Hispanic whites between 16 and 19 dropped out, 14 percent of Latinos in the same age group left school.

In 2004, Latino girls 15 to 19 were more than three times as likely to become pregnant than non Hispanic white girls of the same age. The teen birth rate among Latinas was 83 for every 1,000 girls compared to 26 births for every 1,000 non Hispanic white girls.

The good news is that these indicators have been moving in the right direction for Hispanic teens. The Hispanic teen birth rate dropped 5 percent since 2000 and the Hispanic high school drop out rate dropped 31 percent since 2000.

“Unfortunately, the percent of Hispanic teens who are high school dropouts and the teen birth rate for Hispanic teens has consistently been the highest among the racial and ethnic groups we look at in our report over the last several years,” said Laura Beavers, research associate, Kids Count. “One exception was that in 2000, the high school dropout rate for American Indian teens was slightly higher than for Hispanic teens.”

This year, for the first time since 1990, the Annie E. Casey Foundation (AECF) annual national Kids Count Data Book includes data on children living in Puerto Rico in a separate section of the book. According to Foundation findings, children in Puerto Rico face higher levels of risk on nine of ten key indicators of child well-being.

Hear from market researchers about the Latino family in

“Latino Family Dynamics” audio recording

Brenda Hurley and Liria Barbosa

Click here to purchase “Latino Family Dynamics”

“The Kids Count Data Book is the gold standard for all those interested in data on the status of children in this country. The inclusion of Puerto Rico not only is a welcome and much-needed addition, but also will ensure that the urgent needs of Puerto Rico’s children are taken more fully into account,” stated Janet Murguía, president and chief executive officer, National Council of La Raza.

The National Council of La Raza has housed the Kids Count Puerto Rico Project for the last five years. The organization published several reports and provided free information through an online database.

According to the 192-page report, in 2005, there were one million children in Puerto Rico. This represents a larger child population than that of about half the states in the United States. Puerto Rico’s child poverty rate, 55 percent, was nearly three times that of the U.S.

The Annie E. Casey Foundation is a private charitable organization, dedicated to fostering public policies, human services reforms, and community supports to meet the needs of vulnerable children and families. The 2007 Kids Count Data Book is available online and can be ordered free of charge.

Comments:

Filed Under: Books

Posted by Elena del Valle on August 16, 2007

Jaime Kalfus, chief insights officer, The Bravo Group

Photo: The Bravo Group

New York, New York — The Bravo Group appointed Jaime Kalfus chief insights officer. In her new role Kalfus will be responsible for overall development of strategic and account planning functions at The Bravo Group.

“Jaime brings fresh thinking to the way that we understand and connect with our consumers,” said Linda De Jesús-Cutler, chief operating officer and president, The Bravo Group. “She will inspire those around her toward the development of powerful ideas and breakthrough creative.”

Most recently, Kalfus was associate director of Brand Planning at Deutsch where she served as the interim leader of the department. In that role, she was responsible for the strategic planning on the agency’s largest client of J&J/McNeil and directed the brand vision on the Olympus new business win. Kalfus also provided mentorship to the eight brand planners in the department, assisting with growth plans for their development.

Prior to Deutsch, Kalfus spent most of her career at Young & Rubicam Brands.

“I believe there is a real opportunity for Bravo, as a pioneer in multicultural marketing, to continue to push thought leadership about the power and uniqueness of different segments of our society,” said Kalfus. “My team and I hope to infuse the entire agency with a spirit of curiosity that will result in innovative solutions to drive our clients’ businesses forward.”

The Bravo Group, a Young & Rubicam Brands company, is an agency with over 27 years serving multi-national companies trying to reach consumers within the U.S. Hispanic marketplace. Established in 1980, The Bravo Group creates marketing programs that include research and strategic planning, advertising, interactive and digital, direct, promotional and event marketing, media planning/buying, branded entertainment and public relations. The company is headquartered in New York.

Hispanic Marketing and Public Relations Understanding and Targeting America’s Largest Minority book

“A must resource for practitioners/professionals expecting to reach US Hispanics; also valuable for college programs in marketing, public relations and communications. Highly recommended.”

Choice magazine

Click here to buy Hispanic Marketing & Public Relations today!

Posted by Elena del Valle on August 15, 2007

Gabriela Neves, Pat Pulido, Yvonne “Bonnie” Garcia, Coco Corona, Zully Gonzalez, founding members of Latina Agency Alliance

Photo: Latina Agency Alliance

San Antonio, Texas ––Five Latina marketing agency principals recently formed a marketing alliance, the Latina Agency Alliance (LAA), a coast-to-coast network of advertising, marketing and communications services targeting United States Latinos. The alliance members have offices in San Antonio, Los Angeles, San Francisco, Chicago and New York City; an employee base of 75; and access to a pool of 3,000 brand ambassadors.

The concept was spearheaded by Yvonne “Bonnie” Garcia, owner of San Antonio-based Market Vision. The other members of the network of independently owned Latina companies are Coco Corona, president, By Design Multimedia, a Hispanic marketing, special events and production company located in Vallejo, California; Zully Gonzalez, president, LatinSolutions, Inc., Long Beach, California, an event marketing and promotions agency; Gabriela Neves, owner, LatinFactory, Inc., a New York City-based events and experiential marketing company; and Pat Pulido-Sanchez, president and chief executive officer, Pulido Sanchez Communications, LLC in Chicago, a strategic marketing communications agency.

Target Latinos effectively by anticipating changes in the market with

“Hispanic Projections with 2007-08 update” audio recording

Presenter Roger Selbert, Ph.D.

Find out

- About Latino buying power growth in the future

- How Latino market growth compares with other markets in the U.S.

- What drives the rise of Latino economic clout

- Who should target the Latino market

- What is the size of the Hispanic affluent market

- If the luxury Latino market is growing

- About Hispanics who earn more than $100,000 annually

Click here to purchase “Hispanic Projections”

“It’s almost like a comadres network,” said Garcia, who plans to keep the alliance small with only eight members. Part of the alliance is to support each other through joint ventures,” said Gonzalez, when asked about the advantages and challenges of the alliance. “I think first and foremost is respecting the concept of alliance as opposed to partner. The alliance is more of a support group.”The Latina agency owners hope the alliance will expand their business opportunities; provide a forum where they can share capabilities and resources with likeminded agency owners, refer clients, mentor young Latina entrepreneurs; and facilitate collaboration on solutions to business issues the Latina-owned firms faces daily.

“Part of the alliance is to support each other through joint ventures,” said Gonzalez, when asked about the advantages and challenges of the alliance. “I think first and foremost is respecting the concept of alliance as opposed to partner. The alliance is more of a support group.”

The first entrepreneur in her family, Gonzalez, like the other alliance members, has worked closely with Garcia for the last few years. The decision to form the alliance was sudden. It was a “kind of premonition,” Garcia explained during a phone conversation. She contacted her colleagues on a Friday afternoon and by the following Monday they had made the decision.

Find out which Latino markets are booming with

“The Next Step: Secondary Latino Markets” audio recording

Presenter Dora O. Tovar, MPA

Click here to purchase “The Next Step: Secondary Latino Markets

Posted by Elena del Valle on August 14, 2007

14th Annual Ethnic & Multicultural Marketing Omnibus

September – November 2007

November 1 -2, 2007

Chicago, IL

Join a star team of Fortune 1000 clients and trail-blazers in multicultural marketing on the most successful ways of engaging the still growing and booming Multicultural Economy in the United States. One fifth of the nearly $10 Trillion in total U.S. buying power will come from the diverse multicultural segments. Learn how your brands can get a lion’s share of this robust market opportunity at a time when the general market’s buying power has considerably slowed down.

www.almevents.com/m1007

Posted by Elena del Valle on August 14, 2007

A Miami dealer page in Spanish

Click on image to enlarge

Photo: Dealerskins

Nashville, Tennessee – Dealerskins, an automobile web site developer based in Nashville, is introducing Spanish-language websites for dealers wishing to reach to target the fast-growing Spanish dominant Latino market. Although only 1 percent of the websites have content in Spanish, the company plans Spanish content for as much as 7 percent of websites.

The company relied on studies indicating that Hispanics’ online usage exceeds that of the general population including the AOL Latino 2006 Hispanic Cyberstudy. They point to the study’s findings that one third of Latinos visit automotive websites; Hispanic are expected to purchase 25 percent of cars in the next 20 years; and 60 percent of the participants in the study believed the Internet is the best source for auto information.

Discover how to reach Latinos in language today with

“Hispanic Market Translation Issues” audio recording

Presenter Martha E. Galindo

Translation company owner Martha E. Galindo explains

-

Why it’s important to reach your clients in language

-

Ins and outs of translations issues

-

How to select a translator

-

What to expect

-

How to save on translation costs

-

Much more

Click here to buy ”Hispanic Market Translation Issues”

“The U.S. Hispanic population is the fastest growing segment of Internet users, according to Jupiter Research. This group is currently underserved. Dealerskins wants to help ensure that Spanish language dealership sites are available for car buyers who prefer to visit sites in Spanish,” said Amanda Tossberg, marketing director, Dealerskins.

The Latino oriented Dealerskins websites are expected to allow Spanish speakers to shop for new or used vehicles, obtain financing, make a service appointment, and buy parts or accessories in their native language. Dealerskins hired a company specializing in automotive marketing to Hispanics to assist with the development of Spanish language websites.

Founded in July of 2000, Dealerskins is a division of Dominion Enterprises that provides automotive dealers web solutions. Dominion Enterprises, headquartered in Norfolk, Virginia is a media and information services company serving employment, real estate, automotive, recreation and industrial markets in the United States. The company has 6,600 employees nationwide and 2006 annual revenue of over $850 million.

Posted by Elena del Valle on August 13, 2007

Geoscape Multicultural Market Intelligence Summit 2007

October 26-27, 2007

Miami, Florida

Geoscape Multicultural Market Intelligence Summit 2007