Posted by Elena del Valle on January 13, 2006

Rudy Valenzuela, MSN, RN, FNP-C, president NAHN

Photo: NAHN

Ft. Lauderdale, Florida – In an effort to support bilingual and bicultural nurses nationwide, the National Association of Hispanic Nurses (NAHN) and LatPro.com formed a strategic partnership. Coinciding with the re-launch of NAHN’s Web site, the heart of the partnership is an integrated Job Center powered by LatPro.com, a leading employment Web site for professional Hispanic and bilingual talent in the Americas. In addition to assisting current nursing professionals with their career goals, the NAHN-LatPro partnership prompted the creation of a new LatPro-sponsored scholarship program that will provide financial assistance to Hispanic students pursuing nursing degrees.

By leveraging LatPro’s extensive database, NAHN’s new Job Center plans to enable candidates to access job listings and create personalized email “job agents.” At the same time, the program invites human resources professionals to use the Job Center and perform advanced database searches to find in-demand bilingual and bicultural nursing professionals.

In the United States , there is a significant shortage of multicultural, Spanish-speaking personnel in nursing and other health professions. This disparity is particularly evident in nursing, where Hispanics are vastly underrepresented at a only 2 percent of the nursing workforce, a stark contrast to the 14 percent represented by Hispanics in the total U.S. population. Looking ahead, healthcare for Hispanics will be further impacted by population increases. Accounting for half of the 2.9 million U.S. population growth from 2003 to 2004 (U.S. Census Bureau), the Hispanic growth trend is expected to accelerate. This and a shortage of Spanish-speaking students choosing healthcare careers, translates into an ever-increasing number of Hispanics facing a lack of healthcare professionals who speak their language.

"We are very pleased to have developed this relationship with a company like LatPro that understands the needs of our unique membership,” says Rudy Valenzuela, MSN, RN, FNP-C, president of NAHN. “ Our combined efforts will bring employers and bilingual nurses together, helping to address the need for qualified Hispanic healthcare professionals.”

Eric Shannon, president and founder LatPro

Photo: LatPro

“As the nation’s population becomes more diverse, the need for a healthcare workforce reflecting that diversity becomes increasingly essential ,” says Eric Shannon, president and founder of LatPro. “We are pleased to support NAHN in its efforts to address the acute shortage of Spanish-speaking nursing professionals in our communities, and we are proud to play even a small part in the solution by funding a scholarship program.”

Since its inception in 1975, the National Association of Hispanic Nurses has grown to 37 chapters across the United States . NAHN strives to improve the nursing and health-care delivery system in the Hispanic community, in addition to promoting equal access to opportunities for Hispanic nurses. Educating students on the growing demand for opportunities in healthcare, providing mentoring and scholarships are of special focus. NAHN’s bilingual journal, Hispanic Health Care International, is published three times a year. More information on this organization is available at NAHN

Since 1997, LatPro has become a leader providing online employment resources for Hispanic and bilingual professionals. With more than 275,000 members and 90 of the Fortune 100 companies using its service, LatPro is one of the largest diversity employment sites in the U.S. Further information is available at LatPro

Posted by Elena del Valle on December 20, 2005

|

Lupita Colmenero, NAHP president

A change in the bylaws by the National Association of Hispanic Publications, Inc. (NAHP), with respect to Spanish and bilingual publications who are not Hispanic-owned, creates an opportunity for these publications to join as active General Members. This organizational change will allow all publications serving the Hispanic community and meeting other good business standards to be admited as General Members on a par with Hispanic-owned publications.

"In a country where there is a free market economy, we cannot stop the creation of media companies who intend to enter the burgeoning Hispanic market, especially when they represent a source of employment for Hispanics, for those who have great editorial talent and for those with specialized drive in advertising or graphic design," said Lupita Colmenero, president of the NAHP.

According to NAHP, the admission of these publications as members is subject to Hispanic community sensitivities and industry good practices, such as having a majority of Hispanic employees and a Hispanic editor. The publication also must be audited. Publications that do not meet these requirements can become Associate members.

"The unanimous decision was taken in Dallas, Texas during an NAHP board of directors meeting. The NAHP is the leading media advocacy group of its kind in the United States with a mission to promote the excellence, recognition and use of Hispanic publications and provide access to professional development opportunities to better serve and empower Hispanic communities," said Colmenero.

"The core of the amendment will allow non-Hispanic owned publications to become active members. It was an on-going request and desire of these associate publications. Independent of the decision of the board of directors, the very act of putting this topic on the table for discussion was a major step forward for the organization. It was our historical responsibility," said Jose Luis B. Garza, vice president for membership of NAHP.

The National Association of Hispanic Publications is the largest organization representing Hispanic publications at the national level. NAHP Inc. works with more than 200 member and affiliated publications that share a combined circulation of more than 10 million. Its member publications reach more than 50 percent of Hispanic households in 55 U.S. markets every week. NAHP provides professional tools to assist Hispanic publications to more effectively reach their readership. More information at NAHP

|

|

Posted by Elena del Valle on December 15, 2005

TV, TV-related Technology Preferred by Hispanics

— Entertainment Devices Preferred To PCs, DCs —

According to a recent GfK NOP Hispanic OmniTel™ Technology survey Hispanic Americans are "living large," as in large screen TV. When asked about which consumer electronics they currently own, Hispanic Americans were more likely than the population in general to claim ownership of big ticket items such as large screen (32 inches or larger) TVs. In contrast, Hispanic Americans are less likely to own PCs and DCs (digital cameras) than the general population.

Hispanics Prefer TV, Entertainment-Related Technology

Among those surveyed, almost half (42%) say they own a large screen TV, compared to only a third (33%) of the general population. Ownership levels of other TV-related items are also higher among Hispanic Americans than the general population, including HD or high definition TV sets (19% vs. 14%), Plasma TVs (12% vs. 4%) and digital video recorder (DVR) systems, such as TIVO (22% vs. 16%).

"These survey results are consistent with our earlier research which shows Hispanic Americans tend to rely more heavily on television as an information source than other Americans," notes Bruce Barr, vice president, Omnibus Services for GfK NOP. "Given the importance of television as a resource for information among Hispanics, it’s not surprising that ownership rates for items like big screen and high definition TVs are higher than for the population at large."

The survey also found that Hispanic Americans tend to adopt entertainment-related technology more quickly than consumers in the general population. Specifically, Hispanics are more likely than other Americans to own other entertainment-related hi-tech devices such as video gaming systems (48% vs. 43%), MP3 players such as iPods (18% vs. 16%) and even, to a lesser extent, satellite radios (9% vs. 6%).

Hispanic Americans Less Likely To Own PCs, DCs

In contrast, Hispanic Americans are slower to embrace computer-based technologies than their general market counterparts. For example, only two-fifths (43%) of Hispanic Americans claim to own a personal computer or laptop, as compared to three-fifths of the general population (59%). Consequently, Hispanics are "online" less than other Americans (41% vs. 58%) and tend to choose a dial up connection to access the Internet over a high-speed modem or DSL.

Among Americans in general, however, the Internet access tool of choice is split evenly between dial-up and high speed. Hispanic Americans are also less likely than the general population to own Digital Cameras (39% vs. 46%), DVD players (62% vs. 71%), Cell phones (59% vs. 63%) and even VCRs (64% vs. 74%).

"Potential growth markets can be measured by what items are cited for future purchase intent," notes Barr. "Key products in this segment among Hispanic Americans are those found to be below those levels reportedly owned by the general population. Specifically, digital cameras, cell phones and camcorders all show a trend towards higher purchase plans in the next 12 months relative to the general population. TV and TV-related products, such as large screen TVs, Plasma and HD TVs, DVRs, video game systems and Home Theatre Systems also show future purchase intent levels among Hispanics that outstrip the population as a whole. Marketers representing these product lines would be keen to leverage their Hispanic marketing efforts to gain a competitive edge."

GfK NOP World’s Hispanic OmniTel is a monthly survey of the Hispanic American market that represents Hispanic American adults nationwide. The survey offers a way to understand trends and issues relating to this rapidly-growing market. The Technology Study was conducted in October 2005 among 500 Hispanic Americans aged 18 and older nationwide via telephone. Respondents were given the choice of completing the survey in English and Spanish.

Headquartered in New York, with Omnibus Services managed out of the Princeton, New Jersey office, GfK NOP includes GfK Custom Research, North America, part of the GfK Group. With home offices in Nuremberg, Germany, the GfK Group is among the top market research organizations in the world. Its activities cover five business divisions: Custom Research, Retail and Technology, Consumer Tracking, Media and Healthcare. In addition to 13 subsidiaries in Germany, the GfK Group has more than 130 subsidiaries and affiliates in 61 countries.

Posted by Elena del Valle on December 8, 2005

Today’s Hispanic Marketing & Public Relations news is available in an audio format. To listen to it, visit www.HispanicMPR.com and scroll down until you see "Podcasts." Select the file with today’s date (120805) and click on the play button to listen to it online.

Posted by Elena del Valle on December 7, 2005

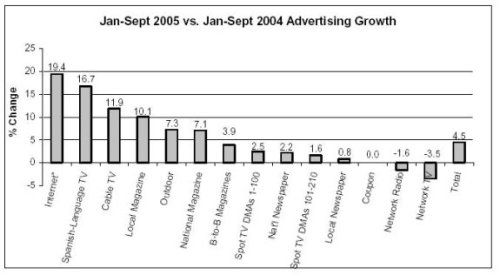

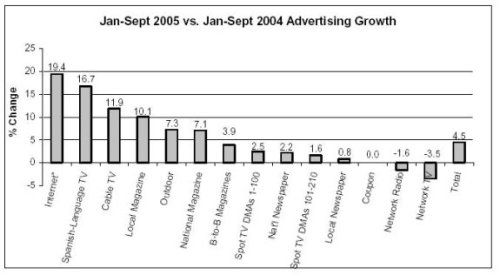

Nielsen Monitor-Plus Report

Source: Nielsen Monitor-Plus.

*Internet data provided by Nielsen//NetRatings

Notes:

-Estimated online spending reflects CPM-based advertising only, and excludes search-based advertising, paid fee services, performance-based campaigns, sponsorships, barters, partnership advertising, advertorials, promotions, email and direct response

-Spot Radio and Syndicated TV were omitted due to changes in tracking.

-Newspaper reflects display ads only.

-Coupon reflects CPG products only.

According to Nielsen Monitor-Plus, although network TV and network radio ad revenues are not growing, most media advertising spending increased in the first nine months of 2005. Advertising across the 14 media tracked by Monitor-Plus increased 4.5 percent. The Internet showed the highest percet growth with an increase of 19.4 percent. Spanish-language TV showed the second highest growth,16.7 percent.

Other media growth: cable TV (11.9 percent), local magazines (10.1 percent), outdoor (7.3 percent), national magazines (7.1 percent), business-to-business magazines (3.9 percent), national newspapers (2.2 percent), and local newspapers (0.8 percent).

Nielsen Monitor-Plus is provided by Nielsen Media Research, a leader of innovative advertising information services in the United States, providing advertising activity for 16 media including television tracking in all 210 Designated Market Areas (DMAs). Nielsen Media Research is a leading provider of television audience measurement and advertising information services. In the United States, Nielsen’s National People Meter service provides audience estimates for all national program sources, including broadcast networks, cable networks, Spanish language networks, and national syndicators. Local ratings estimates are produced for television stations, regional cable networks, MSOs, cable interconnects, and Spanish language stations in each of the 210 television markets in the U.S., including electronic metered service in 56 markets. Nielsen Media Research is part of VNU Media Measurement & Information, a global leader in information services for the media and entertainment industries. VNU is active in more than 100 countries, with headquarters in Haarlem, the Netherlands and New York, USA. VNU is listed on the Euronext Amsterdam (ASE: VNU) stock exchange. For more information, please visit the VNU website at www.vnu.com.

Posted by Elena del Valle on November 29, 2005

Shayne Walters, President/Founder

Carmen’s Cupones y Consejos™

Carmen’s, which reaches millions of Hispanic households with each mailing in the top 11 U.S. Hispanic states and 17 markets, is entering its fifth year as a leading co-op direct mail program to U.S. Hispanics. Carmen’s provides mailings for client products and services in consumer package goods, telecommunication and Internet service providers, financial services, retailers, and insurance companies. Clients include GEICO Insurance, Kern’s Beverages, STAPLES and and QWEST Communications.

“We’ve worked very hard to create a successful program. One that would allow advertisers to reach over 2.5 million households nationwide with each mailing, for as little as 3.5 cents per household, but one that would also benefit the Hispanic community through a medium that had overlooked this consumer far too long. We are happy to hear the success stories that our clients bring to us everyday," said Shayne Walters, Carmen’s president.

Carmen’s mailings arrive in a 6” x 9” flat oversized envelope with advertisements in English and Spanish although Carmen’s recommends bilingual ads. Carmen’s distributes ready-made materials and can create inserts through their production partners at PlanetWoot, LLC.

Mailbox “clutter” to Hispanic households is minimal since the typical Hispanic household receives an average of 50 direct mail pieces per year, compared to 500 or so received by the general U.S. population. In addition, 72 percent of Hispanics say they always read their advertising mail, 66 percent respond to their advertising mail, and 39 percent say they want to receive more, according to two surveys by Dimension/Draft and Data Research Group. Hispanic consumers also tend to be price conscious and 46 percent say they “always” or “sometimes” use coupons, particularly those with high acculturation, 75 percent of which reported using coupons compared to 56 percent of overall consumers in the U.S. (NCH Marketing Services’ Hispanic Coupon Survey, 2002).

Posted by Elena del Valle on November 18, 2005

– News Magazines, Sitcoms Favorite Primetime TV Format –

New York, November 15, 2005 — According to GFK NOP’s Hispanic OmniTel™ Media and Entertainment Study Hispanic Americans are two to three times more likely than the general population to turn to television as their primary source for entertainment-related information. The survey also found that Hispanics prefer to watch news magazines and sitcoms over other primetime television formats.

Asked what they considered to be the best source of information on a variety of leisure activities, the majority of Hispanic Americans surveyed cited television as their preferred media source. Nearly two-thirds (64%) said they rely on television to learn about new movies coming to theaters, and nearly half (48%) said they turn to TV to learn about upcoming concerts and sporting events. The study also found that Hispanic Americans are much more likely than the general population to rely on television for information about travel and entertainment.

For example, Hispanics are three times more likely than other Americans to use television as an information source when making travel plans (30% versus 10%) or deciding to go to a concert or sporting event (48% versus 16%).

Following is a breakdown showing the percentage of Hispanics that turn to television when planning these activities as compared to other Americans:

-New Movies Coming to the Theater

Hispanic Americans: 64%; General Population: 34%

-Planning a Trip or Vacation

Hispanic Americans: 30%; General Population: 10%

-Attending Concerts or Sporting Events

Hispanic Americans: 48%; General Population: 16%

Based on an August 2005 GfK NOP Hispanic OmniTel survey of 500 Hispanic Americans 18 and up

"Marketers, particularly those in the media and entertainment industry, must be mindful of the critical role that TV plays in the marketing mix when looking to target Hispanic Americans," said Bruce Barr, vice president, Omnibus Services for GfK NOP. "While some Hispanic Americans do turn to other media for information, there is a far less established "word-of-mouth" network for gathering information on mainstream American leisure activities, especially among the less acculturated Hispanics. Television fills this void when it comes to making entertainment-related decisions."

News Magazines, Sitcoms Favorite Primetime TV Format

The GfK NOP survey also found that the viewing patterns of Hispanics are generally similar to the general population. Findings indicate that while viewership of primetime sitcoms and reality shows are consistent, there are differences evident for news magazine and primetime drama viewership.

Specifically, comedies/sitcoms were consistently high between both groups (64% among Hispanics and 67% for the general population), and reality shows were consistently low (with only 37% of either group saying they routinely watch shows of this nature). Where the similarities erode, however, is among the other two main genres. The study reports that almost two thirds (65%) of Hispanic Americans regularly or occasionally watch primetime TV news magazine shows, compared to only 57% of the general population. In contrast, a little more than half (54%) Hispanic Americans regularly tune in to view primetime TV dramas, compared to 64% of the general population.

Below is a recap of the percentage of Hispanic Americans who regularly or occasionally watch a particular program format versus the general population:

-News Magazines

Hispanic Americans: 65%; General Population: 57%

-Sitcoms or Comedies

Hispanic Americans: 64%; General Population: 67%

-Dramas

Hispanic Americans: 54%; General Population: 64%

-Reality Shows

Hispanic Americans: 37%; General Population: 37%

Based on an August 2005 GfK NOP Hispanic OmniTel survey of 500 Hispanic Americans 18 and up

"Advertisers looking to use television to reach Hispanic Americans should give special consideration to news magazines and sitcoms over other primetime program formats," says Barr. "Marketers who recognize and understand the nuances of the Hispanic market are uniquely positioned to tailor their approach for a competitive advantage."

NOP World’s Hispanic OmniTel is a bi-monthly survey of the Hispanic-American market that represents all Hispanic-American adults nationwide. The survey offers a way to understand trends and issues relating to this rapidly-growing market. The Media and Entertainment Study was conducted in August 2005 among 500 Hispanic Americans aged 18 and older nationwide via telephone. Respondents were given the choice of completing the survey in English and Spanish. Headquartered in New York, GfK NOP is a company of GfK Custom Research, North America, part of the GfK Group. With home offices in Nuremberg, Germany, the GfK Group is among the top market research organizations in the world. Its activities cover five business divisions: Custom Research, Retail and Technology, Consumer Tracking, Media and Healthcare. In addition to 13 subsidiaries in Germany, the GfK Group has more than 130 subsidiaries and affiliates in 61 countries.

Posted by Elena del Valle on October 31, 2005

Manny Ruiz, president Hispanic PR Wire

Miami, FL–(Hispanic PR Wire)–October 5, 2005–In celebration of its fifth anniversary, Hispanic PR Wire relaunched its bilingual news Website with a new look and powerful features for journalists, marketers and consumers. Highlights of the new website include: Three new news channels including HPRW’s 15th news category Human Interest, a dedicated channel for Multimedia-related press releases and a link for broadcast TV and radio advisories; an improved internal search engine in Spanish and English that archives stories published on Hispanic PR Wire; in-depth, dedicated job listings for Hispanic journalists, Hispanic advertising and public relations professionals; an updated listing of Hispanic and multicultural related conferences and conventions; a feature that allows visitors to email Hispanic PR Wire stories to their colleagues and friends; a listing of Hispanic market facts and another link with statistics about Hispanic media; a list of Latino culture links; a listing of Hispanic PR Wire’s online guaranteed placements; a link to the latest issues of The Hispanic PR Monitor, a Hispanic PR Wire national monthly trade newsletter.

“Our new Website features a host of useful changes that journalists and marketers told us they wanted but also retains the popular, intuitive navigation style that makes it one of the most visited Hispanic news Websites in the nation,” said Hispanic PR Wire President Manny Ruiz.

Website headlines are linked to Hispanic news partner websites throughout the country including Yahoo! en Español, HispanicBusiness.com and El Latino de San Diego. A dynamically generated newsfeed of Hispanic PR Wire wire news releases and photos is available to media and non-profit organizations.

Miami-based and Latino-owned Hispanic PR Wire (HPRW) is a leading press release newswire service for Hispanic and Puerto Rico journalists and marketers. Through scores of news partnerships with many Hispanic newspapers, magazines and Internet portals, HPRW offers clients more than 70 online media placements with any geographic press release distribution.

Hispanic PR Wire sends corporate, government and non-profit press releases and media advisories daily to thousands of journalists subscribed to receive its free email and fax newsfeeds. Media subscribers can register for HPRW’s news by accessing HPRW’s media registration form online. The online form enables journalists to select which news they want to subscribe to from among HPRW’s 15 news categories varying from Entertainment and Business/Finance to Government and Immigration.

Hispanic PR Wire is a sister company of editorial features service ConTexto Latino, Hispanic monitoring service LatinClips, Hispanic Web marketing firm Hispanic Digital Network and African American wire service Black PR Wire. HPRW is also the exclusive Hispanic wire partner of leading corporate wire distributor Business Wire and public affairs news distribution leader US Newswire.

Posted by Elena del Valle on September 22, 2005

Gloria Ruiz, Ph.D., Chair Department of Communication Arts, St. Thomas University

The first program of its kind, it was developed in response to the growing Hispanic media market and offers the only comprehensive, bi-lingual education in communications subjects which vary from Hispanic Events Management to Creative Processes in Visual Imaging. The latest experts to join the St. Thomas team are former editor of Buenos Aires Daily and film actor, Raul Urtizberea, Ph.D. who teaches Periodismo Escrito and Pascual Otazu, Ph.D., a recognized authority on contemporary values, who teaches Management Ethics.

The program is designed for working professionals with classes conveniently scheduled during evenings and weekends. The masters may be completed in as little as 15 months while a certificate can be completed in 36 weeks and classes can be applied toward the masters degree. Courses can also be taken individually as special certificate courses. For more information, contact Gloria Ruiz, Ph.D. at (305) 628- 6508 or gruiz@stu.edu or Andrea Campbell, Ph.D. at (305) 628-6526 or acampbell@stu.edu

Posted by Elena del Valle on September 21, 2005

Frida Kahlo Tequila Bottles

New York, NY — (Market Wire) — 09/19/2005 — Pizzorni & Sons, LLC Importers, in cooperation with the Frida Kahlo family estate, is launching a new tequila named for famous Mexican artist and style icon Frida Kahlo, the Frida Kahlo Tequila. Frida Kahlo Tequila, made in Jesus Maria, in the highlands of Jalisco, Mexico from 100 percent pure blue agave, will initially be launched in three U.S. markets, New York, Los Angeles, and Miami, and Mexico. The producers plan to expand marketing nationally in 2006. Frida Kaho Tequila, which will be sold at leading spirits shops and restaurants, will be available in three varieties: Blanco, Reposado, and Añejo.

Frida Kahlo Tequila Blanco, which will retail for $50, is fermented naturally for up to four days; the agave juices are then double-distilled in antique copper stills and bottled un-aged. Frida Kahlo Tequila Reposado, which will retail for $65, is aged after fermentation in American Oak casks for six to nine months before bottling. Frida Kahlo Tequila Añejo, which will retail for $90, is aged after fermentation in American Oak casks for at least three years before bottling. Southern Wines & Spirits will handle the U.S. distribution.

"This tequila is superior to others because it is elaborated in small batches through a 100% natural, handcrafted and traditional process. We only use the finest quality blue agaves and natural ingredients," said Jorge Gutierrez, president of Dorado, Pizzorni & Sons, LLC.

"It has been an exciting adventure to develop and launch a product that would characterize my Aunt Frida: her love for Mexico, her strength and her passion for life. Tequila, her favorite drink, accompanied her in the greatest moments of her life," said Kahlo’s niece, Isolda P. Kahlo. "While searching in the region of Jalisco it was a unique opportunity and a great challenge to obtain the right quality, taste and pureness that would match Frida’s expectations. Always taking care of the finest details, Frida Kahlo Tequila is a Super Premium Tequila that my family and I proudly present to the world, at the level and quality of the tequilas that Frida would definitely expect from her favorite drink."