Posted by Elena del Valle on August 14, 2007

A Miami dealer page in Spanish

Click on image to enlarge

Photo: Dealerskins

Nashville, Tennessee – Dealerskins, an automobile web site developer based in Nashville, is introducing Spanish-language websites for dealers wishing to reach to target the fast-growing Spanish dominant Latino market. Although only 1 percent of the websites have content in Spanish, the company plans Spanish content for as much as 7 percent of websites.

The company relied on studies indicating that Hispanics’ online usage exceeds that of the general population including the AOL Latino 2006 Hispanic Cyberstudy. They point to the study’s findings that one third of Latinos visit automotive websites; Hispanic are expected to purchase 25 percent of cars in the next 20 years; and 60 percent of the participants in the study believed the Internet is the best source for auto information.

Discover how to reach Latinos in language today with

“Hispanic Market Translation Issues” audio recording

Presenter Martha E. Galindo

Translation company owner Martha E. Galindo explains

-

Why it’s important to reach your clients in language

-

Ins and outs of translations issues

-

How to select a translator

-

What to expect

-

How to save on translation costs

-

Much more

Click here to buy ”Hispanic Market Translation Issues”

“The U.S. Hispanic population is the fastest growing segment of Internet users, according to Jupiter Research. This group is currently underserved. Dealerskins wants to help ensure that Spanish language dealership sites are available for car buyers who prefer to visit sites in Spanish,” said Amanda Tossberg, marketing director, Dealerskins.

The Latino oriented Dealerskins websites are expected to allow Spanish speakers to shop for new or used vehicles, obtain financing, make a service appointment, and buy parts or accessories in their native language. Dealerskins hired a company specializing in automotive marketing to Hispanics to assist with the development of Spanish language websites.

Founded in July of 2000, Dealerskins is a division of Dominion Enterprises that provides automotive dealers web solutions. Dominion Enterprises, headquartered in Norfolk, Virginia is a media and information services company serving employment, real estate, automotive, recreation and industrial markets in the United States. The company has 6,600 employees nationwide and 2006 annual revenue of over $850 million.

Posted by Elena del Valle on August 9, 2007

Marc Mauer, executive director, The Sentencing Project

Photo: The Sentencing Project

According to a new report by The Sentencing Project, Hispanics are incarcerated twice as often as non Hispanic whites. The report, Uneven Justice: State Rates of Incarceration by Race and Ethnicity, examines the racial and ethnic dynamics of incarceration in the U.S., and identifies widespread variations in racial disparity in the 50 states. It indicates African Americans are incarcerated at almost six times the rate of whites and Hispanics at nearly double the rate of whites.

“What we’ve seen over the last decade is significant increase in the Hispanic population that’s incarcerated,” said Marc Mauer, executive director of The Sentencing Project. “This could reflect changes in crime rates by state or could reflect the way the government processes people.”

While men represent 97 percent of the general inmate population, among Latinos men represent 95 percent. At the same time, while Latinos correspond to 13 percent of the United States population, 20 percent of individuals incarcerated in state prisons, excluding non criminal immigration detainees, are Hispanic. The Latino population is generally young, especially when compared with America’s aging mainstream population. This may cause Hispanics to be represented in higher numbers among inmates.

“My guess is that is part of the explanation but it doesn’t account for all the increase,” said Mauer. “Racial disparities in incarceration reflect a failure of social and economic interventions to address crime effectively and also indicate racial bias in the justice system. The broad variation in the use of incarceration nationally suggests that policy decisions can play a key role in determining the size and composition of the prison population.”

Target Latinos effectively by anticipating changes in the market with

“Hispanic Projections – with 2007- 08 update” audio recording

Presenter Roger Selbert, Ph.D.

Find out

- About Latino buying power growth in the future

- How Latino market growth compares with other markets in the U.S.

- What drives the rise of Latino economic clout

- Who should target the Latino market

- What is the size of the Hispanic affluent market

- If the luxury Latino market is growing

- About Hispanics who earn more than $100,000 annually

Click here to purchase “Hispanic Projections”

African Americans (24 percent) and Hispanics (23 percent) are well represented among inmates charged with drug crimes while non Hispanic whites only make up 14 percent of those inmates. Mauer explained these inmates are usually minor players who use and sell drugs but are seldom the decision making kingpins. As part of the analysis, researchers integrated the findings of previous studies. They included jail populations in the general incarceration rate and assessed the impact of incarceration on the Hispanic community, a group that represents an increasing portion of prisoners.

The state figures for Hispanic incarceration also reveal broad variation nationally. Three states, Connecticut, Massachusetts, and Pennsylvania, have a Hispanic-to-white ratio of incarceration more than three times the national average. Research from the Department of Justice projects that if current trends continue; one in three black males and one in six Hispanic males born today will go to prison.

Incarceration rates for women, though lower, display similar racial and ethnic disparities. Following the report The Sentencing Project recommended that: legislators revise domestic drug control strategies which penalize a disproportionate number of low level offenders; revisit mandatory minimum sentencing requirements; establish standards for indigent defense to allow individuals with limited resources to receive quality representation; and require that future prison legislation include a Racial Impact Statement to anticipate projected consequences for persons of color.

Founded in 1986, The Sentencing Project is a national non profit organization working for a fair and effective criminal justice system by promoting reforms in sentencing law and practice, and alternatives to incarceration.

Posted by Elena del Valle on August 7, 2007

Click on image to enlarge

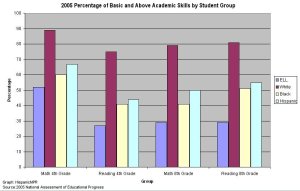

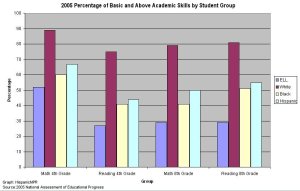

Under the No Child Left Behind act English Language Learners (ELL) public school students must be proficient in reading and math by 2014. English Language Learners are students whose first language is not English. According to a report by the Pew Hispanic Center English Language Learners students lag far behind in reading and math. How many Hispanics are ELL students?

Although there doesn’t seem to be an exact number, an administrative count with little demographic information indicates in the 2003-04 school year there were 3.8 million ELL students. A more recent report, the 2005 American Community Survey, estimated that 9.4 million Hispanic students attended public school and 2.7 million public school students spoke English less than very well. Seventy percent of the limited English students were Hispanic; one in five Hispanic students spoke a language other than English at home and spoke English less than very well.

Hispanic Marketing and Public Relations Understanding and Targeting America’s Largest Minority book

“A must resource for practitioners/professionals expecting to reach US Hispanics; also valuable for college programs in marketing, public relations and communications. Highly recommended.”

Choice magazine

Click here to buy Hispanic Marketing & Public Relations today!

National testing conducted in 2005 indicates that 46 percent of fourth grade ELL students scored in the lowest category possible in math; by eighth grade the scores had plummeted to 71 percent of ELL students in the lowest category possible. By eighth grade 71 percent of ELL students also scored in the lowest category possible in reading.

The Pew Hispanic Center report is based on an analysis of standardized testing around the country. It indicates eighth grade ELL students are 50 percentage points behind whites in reading and math. In fourth grade, they are 35 percentage points behind in math and 47 percentage points behind in reading.

The report also identifies significant gaps between the scores of ELL students and their black and Hispanic counterparts. An analysis of demographic data also explains why there is a decline in achievement among English Language Learners from elementary to middle school.

The Pew Hispanic Center, an initiative of the Pew Research Center, is a non-partisan, non-advocacy research organization based in Washington, D.C. The Pew Hispanic Center is funded by The Pew Charitable Trusts.

Posted by Elena del Valle on August 1, 2007

By Chelsea Starr Ph.D.

Qualitative Research Manager, Phoenix Multicultural

Chelsea Starr Ph.D., qualitative research manager, Phoenix Multicultural

Photo: Phoenix Multicultural

Some medical recruiting projects are more challenging for multicultural markets than for the general market. For diseases that are fairly common in the Latino community, like diabetes, your recruit may not be particularly challenging. But with a less common disease, for example a particular type of cancer, there are both cultural and practical aspects to be considered in the Hispanic market.

Click here to read the complete article

“A Snapshot of the U.S. Hispanic Market” audio recording

Presenter Michele Valdovinos, Phoenix Cultural Access Group

Click here to purchase “A Snapshot of the U.S. Hispanic Market”

Posted by Elena del Valle on July 26, 2007

Click on image to enlarge

Graphic: Hudson Employment Index

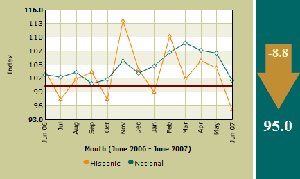

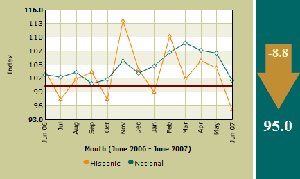

Worker confidence among Hispanics zigzagged dramatically over the last year with the most significant drop in a year in June 2007. Although the national average for June 2007 also fell, the 8.8 points drop for Hispanics was more severe reaching 95 compared to 103 in June 2006, according to the monthly Hudson Employment Index SM.

Worker confidence for African-Americans slumped, 5.8 points to register 88.2. The composite index, based on responses from 9,000 workers across races and ethnicities, also plunged in June, dropping 5.7 points to 101.2.

Other noteworthy findings from the June The Hudson Employment Index for Hispanic workers include: There was a substantial 12 point increase in the number of workers worried about losing their job in June (30 percent); fewer workers rated their finances as “excellent” or “good” in June (35 percent) than in May (45 percent); and more workers reported being happy with their job in June (78 percent) than in May (72 percent).

The Hudson Employment IndexSM measures the worker confidence in the United States. Based on monthly telephone surveys with 9,000 U.S. workers, the Index tracks aggregate employment trends on career opportunities, hiring intentions, personal finances, and job satisfaction. The Index is designed to reflect the opinions of a diverse cross-section of employees, across career levels within many industries. Researchers focus mainly on employees views.

Target Latinos effectively by anticipating changes in the market with

“Hispanic Projections” audio recording

Presenter Roger Selbert, Ph.D.

Find out

- About Latino buying power growth in the future

- How Latino market growth compares with other markets in the U.S.

- What drives the rise of Latino economic clout

- Who should target the Latino market

- What is the size of the Hispanic affluent market

- If the luxury Latino market is growing

- About Hispanics who earn more than $100,000 annually

Click here for details on “Hispanic Projections”

Posted by Elena del Valle on July 20, 2007

2007 Search Engine Strategies San Jose

August 20-23, 2006

San Jose, CA

http://www.searchenginestrategies.com/sew/sj07/index.html?utm_source=his

panicmpr&utm_medium=bannerad&utm_campaign=sessanjose

Posted by Elena del Valle on July 19, 2007

David J. Perez, chief executive officer, Latin Force

Photo: Latin Force Group

New York, New York, – Latin Force LLC, a Hispanic marketing strategy firm, and Geoscape International Inc., a multicultural consumer intelligence and data analytics company, merged recently to form Latin Force Group. Existing staff will remain in place. The company plans to hire sales, finance and consulting staff.

The merger was made possible with the financial support of the Goldman Sachs Urban Investment Group (UIG). UIG is planning additional strategic investments in Hispanic marketing and related companies. Company representatives would not disclose the terms of the investment.

“The merged company will provide its existing and future customers with a clear competitive advantage in reaching America’s fastest growing demographic,” said Kevin Jordan, managing director, Goldman Sachs.

According to promotional materials, the new company provides integrated marketing services for over a quarter of the Fortune 100. Latin Force Group, with a staff of 30, will offer services and information to assist customers who want to identify and service ethnic consumers in financial, telecommunications, retail, insurance, health care, pharmaceuticals and consumer packaged goods. Latin Force Group clients include Allstate, Bank of America, Best Buy, Cranium, Direct TV, Epic Records, Humana, H&R Block, HSBC, ING, Kraft Foods, MTV, the NFL, Nickelodeon Networks, Toyota, Univision and Wells Fargo.

“This is an exciting first step in building out a full-service, integrated marketing company. The combination of Latin Force’s strategy consulting and Geoscape’s market intelligence data and systems form a unique and solid foundation for accelerated growth and future acquisitions,” said David J. Perez, chief executive officer of Latin Force.

Cesar Melgoza, managing director, Latin Force Group

The Latin Force Group will continue supporting Geoscape’s proprietary web-based platform, which draws upon database engines to reveal cultural attributes with dynamic segmentation, demographics and consumer spending data. Latin Force Group will operate from offices in Los Angeles, Miami and New York.

“Our industry leading products identify and segment customer data by ethnicity, acculturation, media preferences as well as consumer spending patterns,” said Cesar Melgoza, founder of Geoscape and now managing director of Latin Force Group.

The Goldman Sachs Urban Investment Group is part of the Merchant Banking Division of The Goldman Sachs Group, Inc. that invests capital in ethnic minority-owned or targeted businesses and urban real estate. Founded in 1869, Goldman Sachs is a leading global investment banking, securities and investment management firm. UIG makes corporate and real estate investments of $5 million to $50 million in various industries, project types, and financial structures.

Discover how to reach Latinos in language today with

“Hispanic Market Translation Issues” audio recording

Presenter Martha E. Galindo

Translation company owner Martha E. Galindo explains

-

Why it’s important to reach your clients in language

-

Ins and outs of translations issues

-

How to select a translator

-

What to expect

-

How to save on translation costs

-

Much more

Click here to purchase “Hispanic Market Translation Issues”

Posted by Elena del Valle on July 18, 2007

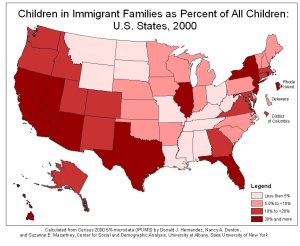

Click on image to enlarge

Images: Donald Hernandez, Ph.D

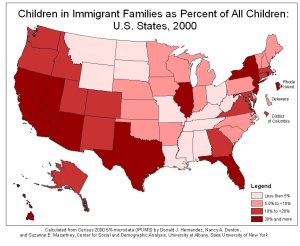

Washington, DC – Children in Immigrant Families: The U.S. and 50 States National Origins, Language and Early Education, a new research brief by Child Trends and the Center for Social and Demographic Analysis of the University at Albany, State University of New York, indicates that four of every 10 children in immigrant families have Mexican origins. Children with Mexican roots constitute the largest group of newcomers in 26 states.

The brief, authored by Donald J. Hernandez, Ph.D., Nancy A. Denton, Ph.D., and Nancy MacCartney, M.A., also indicates that 20 percent of children in the United States live with one foreign born parent. Four in five children are American citizens, three out of four speak English and nearly one-half speak English fluently and another language at home.

These findings led the researchers to conclude that children in immigrant families are deeply rooted in the United States. At the same time the researchers concluded that many young children in immigrant families would benefit from quality early education programs to further their integration into American society.

Donald Hernandez, Ph.D., professor and chair, Department of Sociology, University at Albany, SUNY

“These children represent a unique human resource for America. Investing now in early education and family literacy programs can help these children flourish,” said Hernandez, Ph.D., lead author of the brief. “Such investments will help to maximize the economic productivity of the next generation of workers who will support the soon-to-retire baby-boom generation. By developing strong language skills, these children can enhance the global economic and geopolitical positions of the U.S.”

While a state-by-state analysis on children in immigrant families revealed children whose families come from more than 125 countries and live in 50 states, 40 percent of children with immigrant parents have origins in Mexico. These children account for 50 percent to 81 percent of children in newcomer families in 12 states including Arizona, Arkansas, California, Colorado, Idaho, Illinois, Kansas, Nebraska, Nevada, and New Mexico, Oklahoma, and Texas. Children with other national origins are more likely to be found in the remaining states.

Child Trends is a nonprofit, nonpartisan research organization providing social science research to those who serve children and youth. Established in 1981, the Center for Social and Demographic Analysis (CSDA) at the University at Albany is dedicated to provide a strong research infrastructure for scholarship in the social sciences. It emphasizes support for interdisciplinary population research, especially the analysis of spatial inequalities and concerns for vulnerable.

“Latino Family Dynamics” audio recording

Brenda Hurley and Liria Barbosa

Discuss

Latino purchasing habits and products they favor

Latino family characteristics

Latinos and extended families

Division of duties, responsibilities within the family

Who is the decision maker in the Latino family

Who is the information provider in the Latino family

Click here to purchase “Latino Family Dynamics”

Posted by Elena del Valle on July 17, 2007

5th Annual Marketing Foods & Beverages to Hispanic Consumers conference

July 17-18, 2007

Chicago, IL

World Research Group is proud to present The 5th Annual Marketing Foods & Beverages to Hispanic Consumers Conference, taking place on July 17-18, 2007 at Chicago, IL. Don’t Miss this Ground-Breaking Conference with In-Depth Case Studies and Proven Marketing Strategies from Leading Food & Beverage Companies and Product Retailers including:

- Yolanda Angulo – Director of Multicultural Marketing from Kraft Foods North America

- Sunil Pande – Category Manager from Tyson Foods and

- Jose Serafin – Senior Brand Manager from The Coca –Cola Company

Join us and our expert speaking faculty and gain valuable insight into effective strategies for successfully connecting with Hispanic consumer audiences. Please register early as space is limited.

For more information and to register, please visit our website, http://www.worldrg.com/ or call 800-647-7600. Mention promo code: EBS778 to receive a $400 registration fee discount!

For details, visit http://worldrg.com/showConference.cfm?confcode=FW07052

Posted by Elena del Valle on July 10, 2007

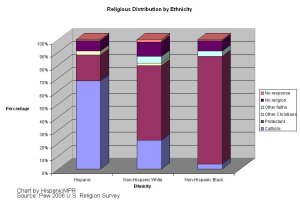

Click on image to enlarge

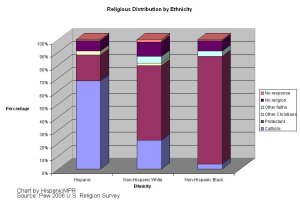

According to a series of public opinion telephone surveys conducted by the Pew Hispanic Center and the Pew Forum on Religion & Public Life, between August 10 and October 4, 2006, Hispanics are transforming the nation’s religious landscape. The researchers came to this conclusion based on their findings; and believe the changes are the result of the fast growing Hispanic population numbers and because Latinos are practicing a distinctive form of Christianity.

As part of the survey the two organizations conducted more than 4,600 interviews, resulting in one of the largest data collection efforts on this subject. The study examined faith and behaviors and their association with political beliefs among Latinos. Researchers placed particular focus on Catholics, including those who remain with the church and those belonging to evangelical churches.

The study suggests that religion influences Latino political views. The researchers concluded that most Latinos believe religion provides a moral compass that includes political thought. At the same time, most Latinos feel the pulpit is an acceptable forum for social and political issues.

According to the study, evangelical Latinos are twice as likely as Catholic Latinos to identify with the Republican Party; and Catholic Latinos are much more likely than evangelical Latinos to identify with the Democratic Party.

The study centered on a telephone survey of a nationally representative sample of 4,016 Hispanic adults. The survey included an oversample of 2,000 non-Catholics to examine the growth of evangelical and Pentecostal Christianity among Latinos, including a detailed examination of the process of conversion. The sampling methodology included significant numbers of respondents in the major country-of-origin Hispanic segments.

The Pew Hispanic Center and the Pew Forum on Religion & Public Life are projects of the Pew Research Center, a Washington-based, nonpartisan research organization that seeks to provide timely information free of any advocacy on issues, attitudes and trends that are shaping America and the world. This study is the result of a yearlong collaboration involving more that a dozen researchers drawn from the staffs of both projects with expertise in a variety of subjects and research methodologies.

Hispanic Marketing and Public Relations Understanding and Targeting America’s Largest Minority book

“A must resource for practitioners/professionals expecting to reach US Hispanics; also valuable for college programs in marketing, public relations and communications. Highly recommended.”

Choice magazine

Click here to buy Hispanic Marketing & Public Relations today!