Posted by Elena del Valle on July 7, 2009

Information provided by our Event Partner

Delivering Value

November 7–10, San Diego

Discover bottom-line boosting strategies, best practices and real-world advice to improve your bottom line.

· Attend sessions on the hottest topics — social media, crisis communications, branding and sustainability — taught by more than 175 experts.

· Network with thousands at our events and luncheons.

· Join free-flowing conversations with industry gurus and career counselors.

· Gain insights from our keynoters — Arianna Huffington,The Huffington Post; and Todd Buchholz, former White House director of economic policy and commentator on “Marketplace.”

Save by registering by September 25! www.prsa.org/conf2009

Posted by Elena del Valle on July 6, 2009

Carlos Aguirre, CEO, Grupo Radio Centro

Photo: Grupo Radio Centro

A podcast interview with Carlos Aguirre, chief executive officer, Grupo Radio Centro is available in the Podcast Section of Hispanic Marketing & Public Relations, HispanicMPR.com. During the podcast, Carlos discusses entering a new market during a recession with Elena del Valle, host of the HispanicMPR.com podcast.

A graduate of the Universidad Iberoamericanao Mexico City, Carlos also studied Alta Dirección de Empresas at the Instituto Panamericano de Alta Dirección de Empresa. He joined Grupo Radio Centro in 1974 as an assistant to the president and has served in several positions, including: general director in Lahina, S. A., Pharmaceutical and Perfumery Manufacturer for 10 years; general sales manager of Pronosticos Deportivos, the Sports Lottery in Mexico for one year; and corporate development director between 1979 to 1983.

He was also general manager of KSSA/Founders Communications in Dallas, Texas; president, Cadena Radio Centro, one of the first Spanish langauge radio networks in the United States; chief operating officer, Grupo Radio Centro from 1989 to June 1998. In 1998, he became chief operating officer as well as member of Executive Committee and member of the Board.

To listen to the interview, scroll down until you see “Podcast” on the right hand side, then select “HMPR Carlos Aguirre” click on the play button below or download the MP3 file to your iPod or MP3 player to listen on the go, in your car or at home. To download it, click on the arrow of the recording you wish to copy and save it to disk. The podcast will remain listed in the July 2009 section of the podcast archive.

“Latino Family Dynamics” audio recording

Brenda Hurley and Liria Barbosa

Discuss

- Latino purchasing habits and products they favor

- Latino family characteristics

- Latinos and extended families

- Division of duties, responsibilities within the family

- Who is the decision maker in the Latino family

- Who is the information provider in the Latino family

Click here to find out about Latino purchasing habits and “Latino Family Dynamics”

Posted by Elena del Valle on July 1, 2009

By Vanessa Bravo

Intern, HispanicMPR.com

Vanessa Bravo

The three sections users prefer are guest articles, articles authored by Elena del Valle and podcasts

Happy birthday! Hispanic Marketing and Public Relations (HispanicMPR.com) is reaching its fourth anniversary and is growing fast. What started four years ago as a small forum to share ideas about the book Hispanic Marketing & Public Relations (Poyeen Publishing, $49.95) has grown into a fully developed website with a wealth of information about business topics in general and the Hispanic market in particular.

Today, HispanicMPR.com offers visitors dozens of guest articles, podcasts, articles authored by Elena del Valle (host and editor of the website), presentations, videos, and job ads. The website has become a useful tool for business people and entrepreneurs interested in topics like marketing, public relations and business development. It has grown a loyal pool of users: just the e-mail newsletter is received by more than 3,500 subscribers.

Click here to read the complete article

Posted by Elena del Valle on June 29, 2009

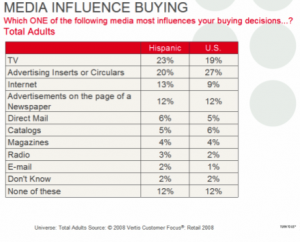

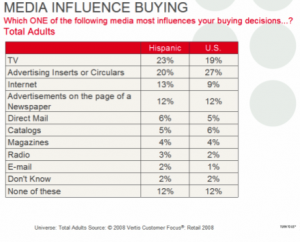

Graphics: HispanicMPR, Vertis

For several years the media industry has been changing before our eyes. Slowly we witness a media revolution and evolution driven by outdated business models, the increasing availability of technology to an ever growing populace and consumers’ mistrust of conventional media as well as the desire of some consumers to be part of the machinery that informs and opines.

As one of the latest large waves of immigrants Latinos are a significant consumer market for media because the Hispanic market is young, comparatively speaking, and growing. The most recent arrivals often have their own cultural preferences for media consumption and may even prefer Spanish language or bilingual options. Many among the millions of Latino immigrants or children of immigrants, usually the most affluent and best educated, have acculturated and mimic mainstream consumers in their media consumption habits.

Some data, including a Vertis Communications 2007 telephone survey of 500 Hispanic adults, indicates Latinos may spend more time watching television and surfing the web than their counterparts among established and emerging markets. Respondents to that survey also were 44 percent more likely to be influenced by information they found online than the total United States population.

Although they may make many of their purchases offline they are likely to research choices, reviews and prices online before placing an order by phone or shopping in person. Vertis researchers concluded that Hispanic adult respondents were more likely than the overall population to buy consumer electronics, even when the economy was down. For example, 28 percent of Hispanics said they would buy a big screen or HDTV within 12 months while only 23 percent of non-Hispanics anticipated such purchases.

The survey also found that Hispanics with online access conducted the most internet research on electronics and clothing. At that time, 62 percent of Hispanics with internet access said they researched home electronics online prior to purchase compared to 59 percent of all United States respondents with internet access. Also, 38 of online Hispanics who participated in the survey said that they research clothes online before buying them compared to 30 percent of all online respondents.

The Vertis Customer Focus Opiniones survey is designed to track consumer behavior in retail, grocery, home improvement, fashion, home electronics, sporting goods, furniture, technology, auto aftermarket, financial and media such as direct mail marketing. The 2007 Opiniones survey conducted by Vertis was the most recent survey of that type conducted by the company, according to a company spokesperson.

Posted by Elena del Valle on June 26, 2009

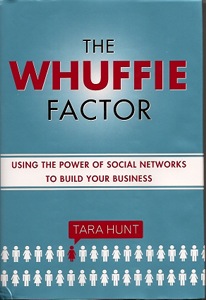

The Whuffie Factor book cover

While millions of people have online profiles and are active in well known social networking sites like Facebook and Twitter, reaping measurable advantages from the profiles does not necessarily follow. Some companies and individuals are convinced these networks are the future and that for those who know what to do and how to do it all the coveted goals will become a reality. As the social networking craze continues a wave of new experts is stepping up to the plate to share their insights with amateurs who want to build a business, develop their presence online or generate business benefits.

In The Whuffie Factor Using the Power of Social Networks to Build Your Business (Crown Business, $25), a 312-page hardcover book published in 2009, Tara Hunt, who has spent the past 15 years participating in or building online communities addresses how-to and best practices issues. She titled the book for the word “whuffie” which refers to the social capital of a person based on his or her actions and contributions to a community and what other people think of him or her.

The book is divided into 10 chapters: How to Be a Social Capitalist, The Power of Community Marketing, Turn the Bullhorn Around and Create Continuous Conversations with Customers, Building Whuffie by Listening to and Integrating Feedback, Become Part of the Community You Serve, Depositing into and Withdrawing from Your Whuffie Account, Be Notable: Eleven Ways to Create Amazing Customer Experiences, Embrace the Chaos, Find Your Higher Purpose, and Whuffie IRL.

Hunt, also known as Miss Rogue, co-founded Citizen Agency, a San Francisco community marketing consulting firm. She now leads the marketing efforts of Intuit’s partner platform.

Click here to buy The Whuffie Factor

Comments:

Filed Under: Books

Posted by Elena del Valle on June 24, 2009

Hispanics

For companies targeting online audiences Latinos represent a booming market with continued potential for growth. As of February 2009 there were 20.3 million Hispanics or 11 percent of the total United States online population and a record number, according to comScore, Inc., a company that measures the digital world. As a greater number of Hispanics went online in the past year, the U.S Hispanic Internet audience grew faster than the total U.S. online population in terms of number of visitors, time spent and pages consumed.

At the same time, some believe effective targeting of the Latino online market requires knowledge and finesse to push the hot buttons that will prompt loyalty and purchasing responses from the highly diverse and demographically young audience. The days of viewing ethnic markets through a uni dimensional single scope are past. Just as translating materials as the sole method of addressing the highly desirable Hispanic market, online and offline, is no longer considered sufficient or in some cases even appropriate (when targeting English dominant Latinos for example).

“It’s well known that the Hispanic market is a growing and increasingly important segment to advertisers and marketers,” said Jack Flanagan, executive vice president of comScore Media Metrix. “However, any business attempting to effectively reach this segment needs to understand the behavior of the U.S. Hispanic online consumer as a fundamental component of their marketing and media strategies.”

Some are convinced the Hispanic market is diverse and distinct from the general market. Given the increasing number of new Latin consumers and their desirable purchasing habits even if that market segment requires extra attention, dedicated or customized campaigns it may prove a worthwhile investment for savvy businesses in the long term.

“As most people know, US-H (US Hispanics) currently represents 15 percent of the total US population and it is estimated to grow up to 20 percent within the next 10 years, half of them are online and this number will only grow. The fact is that even thought we are still a minority, we are definitely a minority that can not be underestimated, not only because of the massive number of potential costumers that we represent, but because our habits significantly differ from those of the US General market users, and more importantly, because our purchase behavior is way more apealing than the US General market users,” said Joel Bary, chief executive officer, Latin Medios.

“We, the online Latinos, have a higher household income than any other online users group in the US, and simply put, we buy more than any other group, so we make a very interesting and potential costumer base that can not be ignored. The marketplace is no longer a single group one, it is now composed of several major groups that will need to be addressed in a special and direct way, other ways, a segment of this marketplace will not respond to the message and will be left araw to be picked up by the competition.”

In 2009, Hispanics’ time online increased 6.9 percent (3.9 times faster than the total U.S. online population), while total pages consumed grew 6 percent (3.6 times faster than the total U.S. Population).

“The Hispanic online market is growing faster than the general market, not just in terms of gross number of users but also in other measures that are important to marketers like time spent online. Advertisers are taking notice too: While categories like Automotive, Wireless, and Credit Cards have been on board since the early days of Hispanic internet, more recently we’ve noticed growth coming from other important categories like Food, Retail, Insurance, and Personal Care Products. That’s especially important now that the automotive and credit card categories are down,” said Carlos Pelay, president, Media Economics Group.

“Just in the Food category, for example, we’ve seen some major companies making their first forays into the Hispanic online market in 2009. Companies like Birds Eye Foods (BirdsEyeenEspanol.com), General Mills (“Nature Valley”), Hershey (“Hershey’s Kisses” sweepstakes on Univision.com) have advertised on Hispanic sites for the first time this year. Significantly, these three companies are running Spanish-language campaigns on Spanish-language Hispanic websites.”

Researchers looked at the site categories where Hispanics spent an above average share of their online time. The most popular categories were Community – Teens, where U.S. Hispanics accounted for 18 percent of total time spent in the category; Gaming Information at 13 percent; entertainment and leisure including Radio (13 percent), Multimedia (12 percent), Discussion/Chat, Instant Messengers (11 percent) and Music (11 percent).

Reach Hispanics online today with

“Marketing to Hispanics Online” audio recording

Identifying and characterizing the booming Hispanic online market

Joel Bary, Alex Carvallo and Matias Perel

Find out about

• The 16 million Latino online users

• Latino online users by gender

• What they do online

• Their language preferences

• How to reach Hispanic urban youth online

• What affects their online behavior

• What influences their purchases

Click here for information about “Marketing to Hispanics Online”

Posted by Elena del Valle on June 22, 2009

Craig Handley, CEO, Listen Up Espanol

A podcast interview with Craig Handley, founder and chief executive officer of Listen Up Español, is available in the Podcast Section of Hispanic Marketing & Public Relations, HispanicMPR.com. During the podcast, Craig discusses how to pick a U.S. Hispanic call center with Elena del Valle, host of the HispanicMPR.com podcast.

Craig leads Listen Up Español, a near-shore Spanish language call center, and its sister enterprise, Revenue Enhancement Consultants (REC), which supports the work of service providers and affiliates.

He started his career in door-to-door sales and rose through the ranks in several call centers. A consultant for hundreds of products and services he has contributed articles to Response Magazine, eRetailer and DM News on how to effectively increase revenue and profitability.

Craig served in the U.S. Army, and studied music as a vocal major in college. These days, his passion for music is often displayed as one-half of the hip-pop duo CR Gruve.

To listen to the interview, scroll down until you see “Podcast” on the right hand side, then select “HMPR Craig Handley” click on the play button below or download the MP3 file to your iPod or MP3 player to listen on the go, in your car or at home. To download it, click on the arrow of the recording you wish to copy and save it to disk. The podcast will remain listed in the June 2009 section of the podcast archive.

Posted by Elena del Valle on June 19, 2009

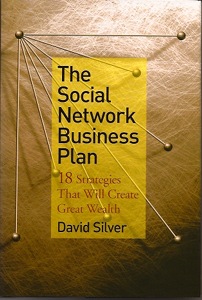

The Social Network Business Plan book cover

In spite of the popularity of social networks in the last years, from a business perspective the question many investors are asking is whether they make business sense. Since social networks are free to users in order to become financially viable they must generate revenue from another source. Many believe the traditional media model that offers advertising space to support editorial content is the key. Others question the effectiveness of ads in the social network pages. In The Social Network Business Plan 18 Strategies That Will Create Great Wealth (Wiley, $24.95), a 191-page hardcover book published this year, David Silver says there is another way.

According to him social networks are the biggest thing since the development of bread 6,000 years ago; and the social networks that prompt consumers to try out, rank and recommend products and services are a revolutionary marketing tool that will create a huge disruption in the way we do business today. He promises readers that through his book they will discover how to create an online recommender community, a new way to launch products and services; how to show their value to vendors; operate several online recommender communities; create a loyal following and make money.

He talks about oligopsony, a shift in power from the producer to the consumer that will benefit consumers by allowing them to receive services that are provided truthfully and efficiently; provide them products that do what they are said to do; and drive prices down noticeably by reducing the need for advertising.

The book is divided into eight chapters: Eighteen Sustainable Revenue Channels, Your Recommender Community as a Theater, Mimic the Bakers and Copy Starbucks, Why Not Start Five Simultaneously? Loyalty and Passion Builders, Disruption: The Sumptuous Impertinence, Should You Sell, or Are You Having Too Much Fun? and Wrap Up.

Silver is the founder of a dozen social networks including onesite.com, iboats.com, and collarfree.com. He provided the seed capital for ActMedia, Cognition Technologies, Frontier Telecommunications, and Intelepeer.

The Social Network Business Plan

Click here to buy The Social Network Business Plan

Comments:

Filed Under: Books

Posted by Elena del Valle on June 17, 2009

Sticky buns prepared at home

Photo: Simon and Baker

In the last two years sugar consumption has increased 20 percent. This is important because sugar is the most popular product in the $4.3 billion sweetener industry in the United States. The industry is divided into three main segments: sugar, sugar substitutes, and liquid sweeteners for tabletop use and as ingredients in baking. There are also presweetened products competing for space in supermarket shopping carts. Ultimately it’s the buyer who decides whether to opt for sugar-based, presweetened or sugar-free products.

While most American households, 89 percent, use sugar, 48 percent of households rely on sugar substitutes. At the same time, while sugar is equally popular across most demographic groups older adults favor sugar substitutes

It is interesting to note that in spite of the popularity of sugar, those consumers have the lowest brand loyalty. Some 47 percent of homes that bought granulated sugar picked the store brand; 39 percent of homes bought Domino, and 26 percent chose C & H, according to a recent study conducted by Mintel, a supplier of consumer, media and market research. A Mintel spokesperson responded by email that demographic breakdown by gender, age, ethnic group or geographic location was available.

In 2008, consumers used an average of 2.4 pounds of sugar each month compared to 2 pounds in 2006. Households using sugar substitutes consumed an average of three packets per day, and 60 percent of them selected Splenda.

On the other hand, users of sugar substitutes are brand loyal and prefer substitutes to sugar because of the calorie savings. One third of sugar substitute consumers like the products because of the way they dissolve and 27 percent believe they are better for dental health. Consumers of liquid sweeteners like honey, molasses, and pancake syrup are also brand loyal.

Economic climate changes have driven consumers to dine at home more often, resulting in an increase in consumption of sugar and sugar like products. Changes in sugar markets such as the use of sugar for biofuel, man made and natural disasters that impact the industry may affect availability and prices. At the same time, the sugar substitute market has seen promising developments thanks to the availability of natural sugar free sweeteners like stevia and agave.

Health related issues affecting America’s aging population, especially obesity and diabetes, also impact the consumption and selection of sugar industry products. Obesity and diabetes are exacerbated by excessive sugar consumption, driving sufferers to purchase sugar substitutes instead of sugar. Older consumers are most likely to have these conditions which is why they are more inclined than younger consumers to purchase sugar substitutes.