Posted by Elena del Valle on September 7, 2007

Lantigua Designs Feliz Navidad and Reyes Magos cards

Photos: Lantigua Designs

The Occasions Group, a consortium of companies that design, produce and distribute stationery and décor products for weddings, holidays, parties and special, recently added Spanish and bilingual Christmas greeting cards from Lantigua Designs to its retail catalog, Libre-Creación.

“There was a lack of original Latin-flavored product in the Holiday market and a need for bilingual cards. We saw Lantigua Designs’ ideas and knew they were what our market would want to send to their friends and family: Latino Holiday designs made especially for the Hispanic market,” said Claudia Goffan, director of Hispanic Market Business Development at The Occasions Group.

Lantigua Designs’ colorful Spanish language Christmas cards are meant to be attractive to the diverse Latino groups and a reflection of the varied traditions they share in common. The cards are sold in boxed sets or personalized through The Occasions Group 30-page catalog which is distributed to 3,000 retailers nationwide.

The Occasions Group has two Hispanic market retail collections, Festividades and Celebracion. The Libre-Creacion catalog features print-at-home invitations and holiday cards. Do-it-yourself kits for Latinas are in the works. There is also a catalog of accessories and decorations for quinceañeras, Uniquely Quince.

To reach Latino consumers The Occasions Group representatives attend exhibits; the company also places print and online advertising, produces brochures, and relies on public relations and grassroots efforts. The percent of sales Latino products represent for the company was not made available nor was the percent of marketing dollars the company dedicates to the Spanish speaking Latino market.

“We are honored to have been chosen by the leading company in the greeting card and invitation industry,” said Liz Lantigua, creative director and founder of Lantigua Designs, Inc. “They have a great vision and commitment to serving the Hispanic market with quality products.”

The Occasions Group, headquartered in North Mankato, Minnesota, employs over 3,500 people in 25 locations across the United States, Canada, Sweden, Mexico and the United Kingdom.

Lantigua Designs, a Florida-based greeting card company since 2004, produces greeting cards, stationery and invitations for the Hispanic market. Lantigua products are can also be found in South Florida and New York stores.

“Latino Family Dynamics” audio recording

Brenda Hurley and Liria Barbosa

Discuss

Latino purchasing habits and products they favor

Latino family characteristics

Latinos and extended families

Division of duties, responsibilities within the family

Who is the decision maker in the Latino family

Who is the information provider in the Latino family

Click here to find out about Latino purchasing habits and “Latino Family Dynamics”

Posted by Elena del Valle on September 4, 2007

Richard Swerdlow, chief executive officer, Condo.com

Photos: Condo.com, Terra Networks

Condo.com and Terra Networks signed a partnership agreement to launch a bilingual real estate website. Bienesraices.terra.com, the co-branded website, features a Spanish language condo marketplace designed for real estate buyers and developers from Latin America, Spain and Hispanics in the United States. The companies hope 10 percent of the website visitors will be from Spain, 50 percent from Latin America and 40 percent from the United States.

English dominant visitors to the website will also find a small news section and blog at the bottom of the page. Visitors to Condo.com have the option of searching in English or Spanish.

The co-branded site will be promoted on Terra.com’s network of sites. Project marketers plan to promote the site on the web and in print. Eleven of the top 16 markets listed on the website are in the Caribbean and Latin America: Argentina, Barbados, Belize, Brazil, California, Costa Rica, Dominican Republic, Las Vegas, Mexico, Miami, New York, Panama, Puerto Rico, Uruguay, Texas, and Venezuela.

Find out which Latino markets are booming with

“The Next Step: Secondary Latino Markets” audio recording

Presenter Dora O. Tovar, MPA

Click here to find out about Secondary Latino Markets

Fernando Rodriguez, chief executive officer for Terra Networks

“This strategic partnership will set a precedent for how U.S. and Latin American developers, real estate agents and individual sellers communicate with each other,” said Richard Swerdlow, chief executive officer, Condo.com. “Serving the Hispanic and Latin American communities has become increasingly important to the real estate industry and Condo.com is proud to be leading the way. Our relationship with Terra will transcend the language barrier and impact the real estate community in an extremely positive way, facilitating condo transactions across all borders.”

“Terra leads the U.S. Hispanic and Latin American online market, so it makes sense for us to partner with the leading online condo marketplace,” said Fernando Rodriguez, chief executive officer for Terra Networks. “We anticipate our relationship with Condo.com will have a significant impact on the Spanish speaking real estate community and look forward to building an online real estate portal, unrivaled around the world.”

Condo.com is a privately held company headquartered in Miami, Florida. According to the Condo.com website, the Company lists 300,000 condos from the U.S. and 70 countries valued in excess of $100 billion and the site is visited by over 15 million viewers per month. Terra Networks is a global Internet group with a presence in the U.S. and Latin America. The group operates websites in the United States, Spain and Latin America.

Posted by Elena del Valle on August 28, 2007

Andres Montalvo, general director of Construmex

Photo: Construmex

In spite of a slump in bank remittances to Mexico in the last few months, two companies are confident in continued growth. Construmex, a United States housing project supported by Cemex, and DolEx Dollar Express, Inc., an electronic money-transfer agency, recently announced a strategic alliance to facilitate their marketing efforts to reach Mexican immigrants in the United States. They believe many immigrants want to invest in a family home or small business in their country of origin.

Under the new alliance, DolEx promises to promote Construmex at is branches and ensure funds sent for Construmex building materials and monthly payments for a new home are used by beneficiaries and family members specifically for those purposes. Additionally, regular monthly housing credit payments can be made at all DolEx locations. Construmex and Dolex plan to install toll free hotlines at DolEx locations in the U.S. to respond to DolEx client interests in the Construmex service.

“We are thrilled to join forces with a company as reputable as Cemex’ Construmex and are confident that Mexicans in the U.S. will take full advantage of the services of both companies from our combined networks throughout the U.S. and Mexico,” said Salvador Velazquez, general director of DolEx’s operations in Mexico. “Now our clients can both send money home and invest productively in their futures. No other similar program exists in the U.S.”

“Latino Family Dynamics” audio recording

Brenda Hurley and Liria Barbosa

Discuss

Latino purchasing habits and products they favor

Latino family characteristics

Latinos and extended families

Division of duties, responsibilities within the family

Who is the decision maker in the Latino family

Who is the information provider in the Latino family

Click here to discover essentials about “Latino Family Dynamics”

“We’re giving Mexican immigrants the opportunity to create wealth by making productive investments in their home country, contribute to the strengthening the economy of our dear country, and, of course, allowing them to build their dream. Most recently, we have witnessed an increased interest in building small businesses in Mexico,” said Andres Montalvo, general director of Construmex.

Since it was established in 2001, Construmex has provided Mexicans working in the U.S credit and financing services to facilitate investments in building materials, self-construction, remodeling and new home purchases in Mexico. The program allows Mexicans who may not be creditworthy the opportunity to own a “dream home” in their motherland. According to the Cemex and Construmex websites, Houston based Construmex has assisted more than 30,000 Mexicans and 8,000 Mexican families living in the United States to build or buy homes in Mexico.

The Construmex program is designed to be comprehensive and is meant for Mexican immigrants to the United States wishing to purchase or have work done in homes in their country of origin. According to promotional materials, Construmex offers interest rates and payment options commensurate with the financial needs of Mexican immigrants.

DolEx has a network of over 875 branches in the U.S. and 10,000 distribution points in Mexico. Cemex, a 100 year old company, is a building solutions company with operations in more than 50 countries.

Posted by Elena del Valle on August 24, 2007

Quince pedicure set

In May 2007, entrepreneur Jennifer Fallon launched Myquincefavors.com, a website targeting young Latinas getting ready to celebrate their 15 birthday with traditional quinceañera parties. Now there are 800 products, mainly quinceañera party favors, as well as accessories and gifts for the court, on the website. Company representatives indicate they pay special attention to personalization, offering tags for many of the party favors to be personalized as well as embroidered and engraved gifts.

“I have experience in the reception party favor market and I am always looking for the trend-setting colors and styles. I noticed that today’s 15-year old girl dreaming of her perfect Quincenera doesn’t have many options when it comes to party favors and accessories,” said Fallon, owner of Smart Marketing, Inc. and Myquincefavors.com.

Quince gown candles are among the website’s top selling items

“I saw an opportunity to market trend-setting and cool designer party favors and gifts that appeal to the modern 15-year old girl. I am always looking for unique and elegant products and carefully hand-pick each items we sell on My Quince Favors.com. Our goal is to help the new generation of Latinas who are comfortable blending old traditions with their own modern sense of style,” said Fallon.

Candles are very popular. Best selling favorites include happily-ever-after, orchid, ball of roses and quince gown candles, forever photo coasters, and a tiara place card holder.

The company has a staff of 15 including several Spanish speakers. Fallon markets the website via the main search engines and on sites reaching 14-15 year old girls such as quincegirl.com. She has also experimented with print advertising and trade shows.

“Latino Family Dynamics” audio recording

Brenda Hurley and Liria Barbosa

Discuss

Latino purchasing habits and products they favor

Latino family characteristics

Latinos and extended families

Division of duties, responsibilities within the family

Who is the decision maker in the Latino family

Who is the information provider in the Latino family

Click here to find out about Latino purchasing habits and “Latino Family Dynamics”

Posted by Elena del Valle on August 23, 2007

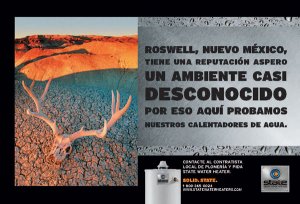

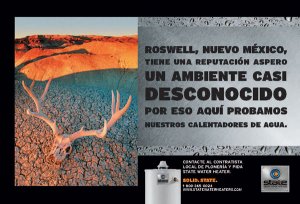

State Water Heaters Spanish language ad

Photo: State Water Heaters

State Water Heaters is targeting Spanish speaking contractors in some United States Latino markets with Spanish language and Hispanic-themed print advertisements, web enhancements, and a Spanish language television show sponsorship.

“There are a growing number of plumbing and HVAC contractors in the U.S. who are Spanish speaking,” said Jeff Storie, brand manager, State Water Heaters. “We are increasing our Hispanic marketing in order to partner with these professionals and to have a larger presence in the southwestern United States.”

According to promotional materials, there are plans for a sponsorship and link to the website of “De Casa a Hogar,” a new home improvement show on Spanish language television scheduled to air this fall. The company also plans to publish English versions of the new print advertisements to attract English dominant Hispanics. The exact extent of State’s Latino market efforts was unavailable. A State spokesperson indicated the company was “unable to disclose what percent of the overall marketing budget is dedicated to Latino efforts.”

Find out which Latino markets are booming with

“The Next Step: Secondary Latino Markets” audio recording

Presenter Dora O. Tovar, MPA

Click here to discover today’s booming Latino markets

“De Casa a Hogar” is expected to feature home improvement segments, technology tips, and a peak into Hispanic celebrity homes. State’s sponsorship includes product demonstrations as well as website, print, and broadcast sponsor recognition.

“The show will have tremendous impact among Latino communities, as there is currently no programming specifically speaking to Latinos about home improvement brands and services,” said Juan Escano, executive producer of “De Casa a Hogar.”

State Water Heaters is a manufacturer of water heaters for commercial and residential use. Based in Ashland City, Tennessee, State has seven water heater manufacturing plants and hundreds of distribution centers across the United States.

Discover how to reach Latinos in language today with

“Hispanic Market Translation Issues” audio recording

Presenter Martha E. Galindo

Translation company owner Martha E. Galindo explains

-

Why it’s important to reach your clients in language

-

Ins and outs of translations issues

-

How to select a translator

-

What to expect

-

How to save on translation costs

-

Much more

Find out why its important to reach clients in language ”Hispanic Market Translation Issues”

Posted by Elena del Valle on August 22, 2007

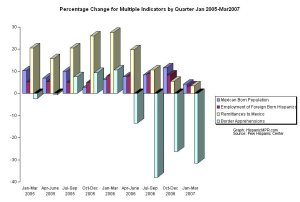

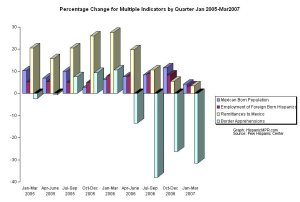

Click on image to enlarge

Although the Mexican born population in the United States has increased over the last three years and continues to increase, the rate of growth seems to have slowed in the last few months. According to a May 2007 report by the Pew Hispanic Center, it is difficult to determine exact changes in immigration from Mexico to the United States. It appears the percentage growth of south to north migration has been decreasing since mid 2006.

The researchers took into account four indicators in reaching their conclusion: the size of the Mexico born population of the United States; the number of Hispanic immigrants employed in the United States; Bank of Mexico remittance receipts; the number of apprehensions of individuals crossing the border illegally.

Target Latinos effectively by anticipating changes in the market with

“Hispanic Projections with 2007-08 updates” audio recording

Presenter Roger Selbert, Ph.D.

Find out

- About Latino buying power growth in the future

- How Latino market growth compares with other markets in the U.S.

- What drives the rise of Latino economic clout

- Who should target the Latino market

- What is the size of the Hispanic affluent market

- If the luxury Latino market is growing

- About Hispanics who earn more than $100,000 annually

Click here to purchase “Hispanic Projections with 2007-08 updates”

They concluded that the rate of growth of immigration from Mexico to the United States may have slowed in the second half of 2006 and first half of 2007. Due to inexact data sources, the researchers are unable to identify the reasons behind the possible changes or predict future trends. At the same time, they can’t tell if the slower immigration growth is the result of political, economic and border control policies or other factors.

In mid 2000 there were 4 million Mexican born residents in the United States. By early 2007 that number had reached 7 million. While many focus on the large number of Mexican immigrants entering the country, close inspection reveals a gentler slope in the growth over the last months.

Does the slowest rate of growth in remmitances to Mexico since 2003; half the increase in employment of Hispanics in the first quarter of 2007 than in the first quarter of 2004; and a 24 percent drop in apprehensions in the U.S. Mexico southwestern border compared to last year, in spite of increased patrols, reveal a lasting trend?

Posted by Elena del Valle on August 21, 2007

Ursula Mejia-Melgar, editor and Hispanic marketing manager, General Mills

Photo: General Mills, Inc.

Minneapolis, Minnesota – General Mills Inc. re-launched its free Spanish-language lifestyle advertorial magazine, Qué Rica Vida, as a quarterly publication. Last year it was published three times. This year, the publication, distributed via direct mail, at stores and community-based venues, is expected to have an average of 64 pages and a circulation of 350,000. The newly launched issues will have enhanced content and new layout and design. Qué Rica Vida was most recently published last spring.

The magazine will have four sections to be paired with General Mills brands: Ser Madre for moms, Ser Amiga with a friends slant, Ser Mujer, about being a woman and Ser Mejor, about self improvement. According to promotional materials, the magazine’s image and content were revised in response to consumer feedback. Company representatives declined to share information about the General Mills Hispanic market campaign budget or identify what percent of their overall budget they dedicate to Latino markets.

“Latino Family Dynamics” audio recording

Brenda Hurley and Liria Barbosa

Discuss

- Latino purchasing habits and products they favor

- Latino family characteristics

- Latinos and extended families

- Division of duties, responsibilities within the family

- Who is the decision maker in the Latino family

- Who is the information provider in the Latino family

Click here to purchase “Latino Family Dynamics”

Qué Rica Vida exceeded its first-year goal of enlisting 100,000 subscribers, and in its second year, we have decided to focus on further improving the magazine’s appeal and readability,” said Ursula Mejia-Melgar, editor and Hispanic marketing manager, General Mills. “For that reason we listened to our consumers and worked with our design team, the Betty Crocker Kitchens, in-house food stylists and photographers to create a beautiful publication and an integrated platform that will truly connect with our readers, emotionally as well as practically.”

Que Rica Vida July 2007

Qué Rica Vida, Spanish for “What a Rich and Wonderful Life,” the magazine and its matching website quericavida.com is the cornerstone of General Mills’ year-old, multi-brand, Hispanic marketing initiative of the same name.

This year, General Mills plans community and public relations programs created in conjunction with Hispania Public Relations of Miami and Latino Family Media of Los Angeles. General Mills, with annual net sales of $13.4 billion, is a leading global manufacturer and marketer of consumer foods products. Its global brand portfolio includes Betty Crocker, Pillsbury, Green Giant, Häagen-Dazs, and Old El Paso.

Posted by Elena del Valle on August 19, 2007

Customer Loyalty Summit

Create a Great Customer Experience that Drives Profitability

November 12-15, 2007

The Westin Colonnade, Coral Gables, FL

IQPC is pleased to introduce our Customer Loyalty Summit, designed to explore best strategies for developing and maintaining customer loyalty. Find out how to prevent your brand from becoming a commodity and how to keep your customers. We will take a big picture, strategic look at the topic by demonstrating how it is the key to competitive advantage and impacts the bottom line. A small increase in customer loyalty can have a huge impact on bottom line revenue. Attendees will find out what’s new, what’s proven, and what works in:

• Marketing communications

• Measurement and analysis

• Customer education and response

• Technology, self service and service enabling

• Human Resources and motivation

• Fostering a customer focused culture.

For more information on our conference content, please visit www.iqpc.com/us/customerloyalty or call 1-800-882-8684

Posted by Elena del Valle on August 15, 2007

Gabriela Neves, Pat Pulido, Yvonne “Bonnie” Garcia, Coco Corona, Zully Gonzalez, founding members of Latina Agency Alliance

Photo: Latina Agency Alliance

San Antonio, Texas ––Five Latina marketing agency principals recently formed a marketing alliance, the Latina Agency Alliance (LAA), a coast-to-coast network of advertising, marketing and communications services targeting United States Latinos. The alliance members have offices in San Antonio, Los Angeles, San Francisco, Chicago and New York City; an employee base of 75; and access to a pool of 3,000 brand ambassadors.

The concept was spearheaded by Yvonne “Bonnie” Garcia, owner of San Antonio-based Market Vision. The other members of the network of independently owned Latina companies are Coco Corona, president, By Design Multimedia, a Hispanic marketing, special events and production company located in Vallejo, California; Zully Gonzalez, president, LatinSolutions, Inc., Long Beach, California, an event marketing and promotions agency; Gabriela Neves, owner, LatinFactory, Inc., a New York City-based events and experiential marketing company; and Pat Pulido-Sanchez, president and chief executive officer, Pulido Sanchez Communications, LLC in Chicago, a strategic marketing communications agency.

Target Latinos effectively by anticipating changes in the market with

“Hispanic Projections with 2007-08 update” audio recording

Presenter Roger Selbert, Ph.D.

Find out

- About Latino buying power growth in the future

- How Latino market growth compares with other markets in the U.S.

- What drives the rise of Latino economic clout

- Who should target the Latino market

- What is the size of the Hispanic affluent market

- If the luxury Latino market is growing

- About Hispanics who earn more than $100,000 annually

Click here to purchase “Hispanic Projections”

“It’s almost like a comadres network,” said Garcia, who plans to keep the alliance small with only eight members. Part of the alliance is to support each other through joint ventures,” said Gonzalez, when asked about the advantages and challenges of the alliance. “I think first and foremost is respecting the concept of alliance as opposed to partner. The alliance is more of a support group.”The Latina agency owners hope the alliance will expand their business opportunities; provide a forum where they can share capabilities and resources with likeminded agency owners, refer clients, mentor young Latina entrepreneurs; and facilitate collaboration on solutions to business issues the Latina-owned firms faces daily.

“Part of the alliance is to support each other through joint ventures,” said Gonzalez, when asked about the advantages and challenges of the alliance. “I think first and foremost is respecting the concept of alliance as opposed to partner. The alliance is more of a support group.”

The first entrepreneur in her family, Gonzalez, like the other alliance members, has worked closely with Garcia for the last few years. The decision to form the alliance was sudden. It was a “kind of premonition,” Garcia explained during a phone conversation. She contacted her colleagues on a Friday afternoon and by the following Monday they had made the decision.

Find out which Latino markets are booming with

“The Next Step: Secondary Latino Markets” audio recording

Presenter Dora O. Tovar, MPA

Click here to purchase “The Next Step: Secondary Latino Markets

Posted by Elena del Valle on August 14, 2007

14th Annual Ethnic & Multicultural Marketing Omnibus

September – November 2007

November 1 -2, 2007

Chicago, IL

Join a star team of Fortune 1000 clients and trail-blazers in multicultural marketing on the most successful ways of engaging the still growing and booming Multicultural Economy in the United States. One fifth of the nearly $10 Trillion in total U.S. buying power will come from the diverse multicultural segments. Learn how your brands can get a lion’s share of this robust market opportunity at a time when the general market’s buying power has considerably slowed down.

www.almevents.com/m1007