Posted by Elena del Valle on August 23, 2005

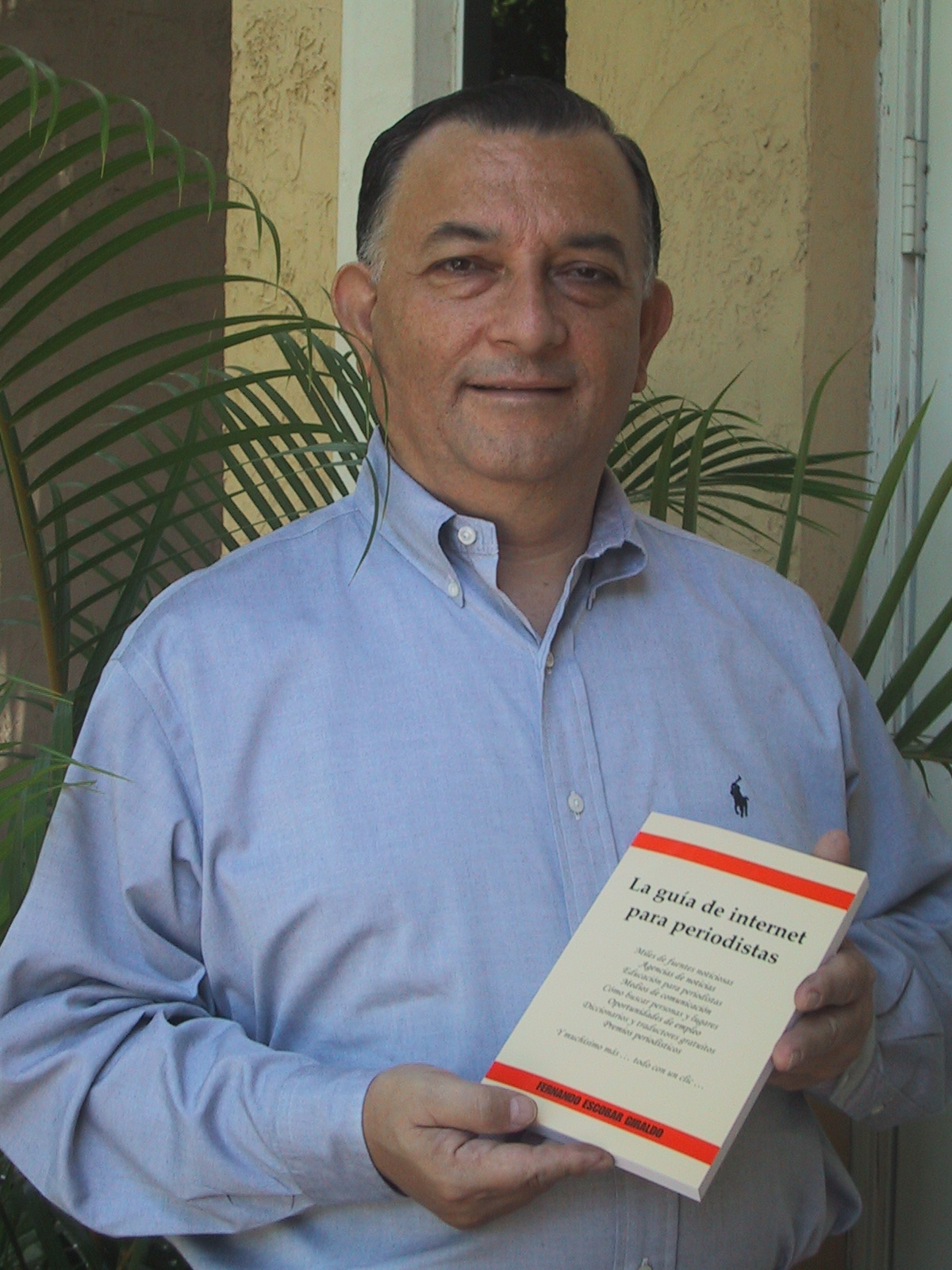

Fernando Escobar Giraldo

Miami, Florida August – 2005 Veteran Hispanic reporter Fernando Escobar Giraldo writes an Internet guide for Spanish speaking reporters in Spanish. Titled La Guia de Internet para Pariodistas (Spanish for The Internet Guide for Journalists) it is meant to facilitate the work of journalists in all fields and in all mass media as well as that of journalism professors and students.

The book and CD ROM contain practical information on Internet use and a comprehensive access guide to more than a million news sources, hundreds of job opportunities for journalists, scholarships, live television and radio from different parts of the world, United States and Latin America universities, front pages of renowned newspapers worldwide, dictionaries, public records, news agencies, mass media, instantaneous translations, and hundreds of organizations related to health and finances.

“It was a two-year investigation. There are wonderful things in this work that are unknown to the majority. And it will not only be useful to journalists but to writers, all types of organizations, investigators, scientists, public officials, economists, medicine professionals, educators, etc.,” said Escobar Giraldo.

Fernando Escobar, a Colombian lawyer and writer who has lived for more than 20 years in the

United States, is a journalist for the Univision network national news.

Founder of the weekly magazine

La Aurora and the bilingual magazine

Puntos Dallas, Texas, he is a former RCN and Caracol Miami news director and

author of several books.

Has worked with five Internet journalism companies and managed Univision’s

Tu Consejero online section for five years.

La Guia de Internet para Pariodistas is available by mail for $14.50.

Posted by Elena del Valle on August 22, 2005

Heidi Eusbeio

Hidekel (Heidi) Eusebio, vice president and founder of Edelman’s diversity department will be moving to Frankfurt, Germany where she will support Edelman’s U.S. Hispanic business. Eusebio was one of the founders of Edelman’s Hispanic marketing department in New York seven years ago. The company’s diversity practice includes 20 multicultural marketing specialists in seven markets. She is also a contributing author to the book Hispanic Marketing & Public Relations: Understanding and Targeting America’s Largest Minority, which will be released this fall.

Posted by Elena del Valle on August 19, 2005

Aterciopelados

Singled out by The New York Times for its support of the Latin Alternative Genre in a recent cover story entitled “Latinos Say Rock is More Than Just Reggaeton,” LATV will air artist interviews and performances from the Latin Alternative Music Conference (LAMC) throughout August. Artists profiled and featured during the special espisodes of “LATV Live” include Coheed & Cambria, Aterciopelados, Javier Garcia, Plastilina Mosh, Natalia y La Forquetina, Sara Valenzuela, Los Amigos Invisibles, and JD Natasha.

The Los Angeles-based bilingual youth network LATV will bring on the rock in August with interviews, behind-the-scenes footage, and live performances from the recent Latin Alternative Music Conference (LAMC) in

New York. Singled out by a recent New York Times cover story as one of the leading outlets for the exposure of Latin rock in the

United States, LATV has broadcast from the conference since 2001.

“LATV has been an integral part of the Alternative Latin Music genre and continues to be a great outlet for this music” says conference co-founder Tomas Cookman

With its groundbreaking mix of English and Spanish language music and lifestyle programming, LATV has solidified itself as the leading network among bicultural Latinos in

Los Angeles, America’s top Hispanic market. The Network’s content is predominantly in English, targeting bilingual Latino youth. Each week, LATV has a live in-studio audience. LATV is the only network airing on basic cable in

Los Angeles that reaches the highly sought-after bicultural demographic.

LATV Live recently won an Imagen Award for Best Television Variety Special, beating out programming from networks like SiTV and Fox Deportes en Espanol. The Awards, presented in 17 categories by the Imagen Foundation, were established in 1985 to encourage and recognize the positive portrayal of Latinos in all media, and to increase Latino representation at all levels of the entertainment industry. LATV had the greatest presence of any network in the category, with nominations for both LATV Live and also Mex 2 The Max.

Bebe in Central Park

Comments:

Filed Under: Media

Posted by Elena del Valle on August 18, 2005

Zulema Arroyo

New York, NY, August 12, 2005 – The Bravo Group established a West Coast division, BravoWest, created by the merger of its San Francisco and Irvine, California offices. BravoWest will continue to service its California accounts including Mazda, Chevron Products Company, Jaguar, Visa U.S.A., Land Rover, Foster Farms and Paramount Great America.

"The West Coast, in many senses, is the epicenter of the Hispanic market and the new American mainstream," said Gary Bassell, chairman and CEO of The Bravo Group. "Bravo has a longstanding presence and involvement with our communities there, and this is the first of many moves to build more assertively on that legacy."

Due to growth experienced with its California accounts, particularly the automotive brands, Bravo is moving towards building a comprehensive operation providing a full range of integrated marketing services. The new management team for BravoWest will be led by Zulema Arroyo and Christine Hahn. Ms. Arroyo, based in Irvine, has been appointed group managing director and will be responsible for operations and growth of the Irvine and San Francisco Bravo offices while continuing her day-to-day oversight of operations in Irvine. Christine Hahn was appointed BravoWest managing director. She will partner with Ms. Arroyo to aggressively build the consolidated resource and continue to manage the San Francisco operation on a day-to-day basis. The merger will not result in any downsizing or layoffs. Both offices of the new enterprise are in a growth mode.

"There’s a great opportunity for us to expand the competencies we bring to the table for clients locally in our West Coast markets, and explore opportunities for partnerships among those clients," said Linda De Jesús-Cutler, President and COO of The Bravo Group, noting that partnership ideation was already underway by the BravoWest staff.

"The formation of BravoWest will provide all of our clients with access to more resources and higher levels of support. Christine and I are excited about our association and confident about our ability together, along with the team, to develop BravoWest into the premier West Coast Hispanic agency. We’re taking steps to provide nothing less than world-class support to all of our current clients, and all those to come. It’s really a win-win, for all of our clients," said Arroyo.

_1.JPG)

Christine Hahn

"The consolidation of our teams is complementary in nature," said Hahn. "Today, the importance of bringing innovative strategic and creative ideas to our clients cannot be overstated. This merger facilitates greater cross-pollination of ideas across our offices, most immediately in the automotive and gasoline categories, and that will further elevate our strategic and creative acuity."

Arroyo joined Bravo in 2002 as the account supervisor managing a Mazda account. In February 2004, she was appointed account director over the multi-million dollar Mazda, Jaguar and Land Rover business and overall Bravo Irvine operations. Arroyo, a Puerto Rico native, began her automotive career in 1996 at Hyundai Motor Finance in a legal capacity. Thanks to her bicultural background, she was promoted in 1999 to head Hyundai Motor America’s multicultural advertising. On the client side, she managed the implementation of Hispanic advertising initiatives that built a successful integrated marketing plan. This plan’s goal was to place the Hyundai brand on Hispanic customers’ shopping lists and to achieve a turnaround in brand awareness and perception, that would increase sales. On the general market side she managed the Hyundai dealer ad association and related projects.

Christine Hahn, previously vice president General Manager for Bravo San Francisco, has worked in Hispanic advertising for 19 years. In 1996, Hahn joined The Bravo Group in San Francisco to manage the Clorox Company account. Later she managed the Chevron Products company. Other key accounts Christine Hahn has managed include Del Monte, Nestlé Ice Cream Company and Visa U.S.A. Previous positions include account supervisor, managing Blue Cross of California and Pizza Hut/Western Region accounts at BBDO/West in Los Angeles, where she helped establish the company’s first Hispanic advertising division, then known as "BBDO Hispanica."

The Bravo Group, a Young & Rubicam Brands company, is a pioneer agency of Hispanic marketing now in its 25th year and a leader among U.S. Hispanic integrated communications agency groups. Established in 1980, The Bravo Group creates programs that incorporate advertising, research and strategic planning, interactive, direct, promotional and event marketing, media planning/buying and public relations. Recognized in 2005 as one of the two largest Hispanic agencies in the U.S. by Advertising Age, the company is headquartered in New York and has offices in San Francisco, Chicago, Miami. and Irvine, California.

Posted by Elena del Valle on August 18, 2005

Time Inc. acquired Grupo Editorial Expansión (GEE), a Mexico City-based company which owns 15 magazines in Mexico. Time publishes People en Español and Sports Illustrated Latino. Grupo Editorial Expansión’s flagship publication is the business magazine Expansión. Other publications include Obras about architecture; Balance, about women’s health and fitness; and Quién, a magazine about celebrities. Grupo Editorial Expansión, founded in 1966, also publishes Vuelo, Mexicana Airlines’ in-flight magazine.

Time Inc. is one of the world’s leading magazine publishers, publishing 140 titles that are read more than 300 million times worldwide on a monthly basis and account for nearly a quarter of the total advertising revenues of U.S. consumer magazines. Time Inc. is a wholly-owned subsidiary of Time Warner Inc., a leading media and entertainment company, whose businesses include interactive services, cable systems, filmed entertainment, television networks and publishing.

Comments:

Filed Under: Media

Posted by Elena del Valle on August 17, 2005

New York, NY–(HISPANIC PR WIRE)–August 15, 2005–Through a series of television commercials, print, Internet ads and a unique Web experience, Verizon’s broadband experience promotes to Hispanic consumers the broadband option. The theme of the campaign is "A Todo Lo Que Da" (to the max). The campaign, developed by Verizon’s Hispanic corporate ad agency, La Agencia de Orci & Asociados, mirrors Verizon’s mass market advertising campaign that brings to life the company’s “Richer. Deeper. Broader.” Broadband experience.

The Spanish-language campaign was developed after Verizon asked Latinos in four major markets to share their broadband stories. From meeting people online to making purchases, from learning recipes to creating and sharing their own music, Latinos are spending time online “A Todo Lo Que Da.” Verizon is showcasing their experiences.

“The research we did was invaluable,” said Amy Rubenstein, Verizon vice president of Brand Management. “We found that Hispanics have real and unique online interests and lifestyles. And we developed advertising that would bring these insights to life.”

Four original TV spots created specifically for the Hispanic market provide a glimpse of what consumers do in their online lives, from starring in their own Lucha Libre web movie to competing in virtual DJ battles. The spots, “DJ,” “Window,” “Baseball,” and “Wrestler” create relevant stories that connect with Hispanic consumers, making broadband more tangible for them. Two additional TV spots adapted from the company’s general market campaign reflect "hyper-real" situations to convey the powerful experience.

Four original print executions center on broadband “must haves” for Hispanics: music, sports, entertainment, and online gaming. Through broadband, Verizon executives believe, Hispanics can be who they want to be 24×7. The online component features traditional, rich media and video banners. In addition, Verizon created a Spanish-language broadband Web experience – http://www.atodoloqueda.com – an interactive community of broadband enthusiasts from all walks of life.

The site enables users to create profiles and share their broadband stories by uploading images and videos. Visitors share stories of how broadband is changing their world. Members can also join personal interest groups, such as gaming and music, share favorite links and advice with other members, and learn new ways that broadband can help them explore their interests further.

Verizon’s broadband products and services are featured on the Web site, which was created by Verizon’s interactive marketing agency, R/GA. The Web site acts as a portal and link to various exclusive content promotions and events appealing to the online Hispanic consumer.

Posted by Elena del Valle on August 16, 2005

The Jaguares

Mexican rock supergroup Jaguares announced new dates as part of their extensive U.S. tour, which has already seen sold-out dates in San Francisco, Denver, New York, and Las Vegas. The band is touring in support of its recently-released studio album ‘Cronicas de un Laberinto’ (Sony/BMG). Jaguares recently returned to American television with a special performance on CBS “Late Late Show With Craig Ferguson.” The group has been in the midst of a 30 city U.S. tour in which they are hitting many new markets for Latin rock, including such unlikely destinations as Oklahoma City and Memphis.

The new disc was co-produced in Nashville by Jaguares friend and King Crimson member Adrian Belew, who has also worked with David Bowie and Frank Zappa. The follow-up to 2002’s platinum-selling ‘El Primer Instino’ live acoustic album, ‘Cronicas de un Laberinto’ features 14 new tracks, including "Hay Amores que Matan."

“I think that love created us, but it also can kill us,” says vocalist Saúl Hernandez.

“The song talks about the many loves – love of one’s country of one’s family, of the person you’re in a relationship with. But in the end, there is just one love that kills you – that is the love you don’t have.” According to Hernandez, the new album’s title ‘Cronicas de un Laberinto’ (“chronicles of a labyrinth”) is an analogy for the present state of Mexico, and on a larger scale, humanity. “In our country, we are kind of lost, whether it be economics, politics, or society. This idea of political change in Mexico is not working well. We are in a labyrinth, walking on a road,” he says.

“They are still killing the Indians here. The economic situation still primarily only benefits the wealthy. We are lost – that is the image is of a labyrinth. The first song on the album is about entering the labyrinth, while the end of the album is the hopeful exiting of the labyrinth – not depending on the government all the time, being responsible for ourselves, making a better country – be it Mexico, the United States, or any place.”

The new album has an increased emphasis on melody. “With our previous studio album, we worked on a harder, more vintage guitar sound,” says Hernandez. “On this record, we were working on a different sonic idea – melodic guitar lines. There were three guitar players – Adrian Belew, Cesar “Vampiro” Lopez, and myself. We realized the best way to work together was to make an ensemble instead of emphasizing solos. When you hear it, you never know who is playing the guitar lines. It’s one sound.”

Over the past three years, the Jaguares has appeared on Late Night With Conan O’Brien, Tonight Show w/Jay Leno & FOX Good Day NY, received a Grammy nomination, and landed its previous album Cuando La Sangre Galopa in the top position on the Billboard Top Latin Albums & Heatseekers Sales Charts. The Jaguares found poetry in darkness, strength in musical mystery, and modern innovation in Mexican tradition. The group can play for 120,000 fans in the Zócalo of Mexico City one week, and then light up 31,000 more people in the United States. Jaguares’ music when performed live is far more than a concert; "it’s a communal ritual between thousands of singing strangers". Candles are lit, priests take the stage, and in the space of a single evening, the concert becomes a holy rock-and-roll ceremony.

Jaguares U.S. Tour Dates

Sept. 15 Los Angeles, CA Pantages Theater

Sept. 19 Seattle, WA Moore Theatre

Sept. 20 Portland, OR Roseland Theatre

Sept. 28 Philadelphia Trocadero

Sept. 29 Atlanta, GA Earthlink Live

Sept. 30 Memphis, TN State Fair – Main Stage

Oct. 1 Charlotte, NC Tremont Music Hall

Oct. 2 Carrboro, NC Cat’s Cradle

Posted by Elena del Valle on August 15, 2005

Multicultural Market Intelligence Summit

October 5-7, 2005 – Ritz-Carlton Resort Key Biscayne, FL (Miami)

More than 200 senior level executives are expected to convene again this year in Miami to discuss American consumer marketing updates. Attendees will be able to hear presentations from and network with top corporations and research firms who pay to be presenters at the conference. The Summit is designed for busy executives who want access to readily available information in a single high end venue and are seeking to capture the rapidly growing multicultural consumer and business-to-business market opportunities, and receive research updates. The Summit serves as a showcase for Geoscape services. It also brings together current market data, workshops and case studies by the marketing, media and distribution executives who are selected on an advertorial basis.

Features include case studies from large companies such as AOL Latino, Citigroup, Bally Total Fitness, Blockbuster, Bally, Sigma Alimentos and Delta Dental; coaching on subjects like direct target segmentation, retail distribution planning and strategic media planning; data, including statistical figures of America’s diverse population as of 2006 and 2011; and the American Marketscape DataStream: 2006 Series Summary Report.

Organizers also anticipate the attendance of senior marketing executives from Fortune 1000 companies such as: AAA, ACE Hardware, Allstate, AOL, American Express, Amerigroup, Anheuser-Busch, AstraZeneca, AT&T, Avon Products, Bank of America, Bellsouth, Burger King, Blue Cross Blue Shield, Cendant, CAN, CVS, DirecTV, Fannie Mae, Firestone, FOX, Macy’s, NBA, New York Life, Nextel, Office Depot, Starbucks, State Farm Insurance, Telemundo NBC, Time Warner Cable, Toyota, Univision, USPS, Verizon, Walgreen, Wells Fargo, and Yahoo.Details at Geoscape

Posted by Elena del Valle on August 12, 2005

Editorial Televisa recently announced changes in their north region (U.S., Puerto Rico and Central America). David Taggart was named General Manager for the "Zona Norte" (north region) in addition to his current role as group publisher. In his new role he will oversee the commercial and operating divisions in the company’s north region.

At the same time, Ernesto Cervantes was appointed director of planning and strategy for Editorial Televisa. In this role he will assume the responsibilities of acquisitions and partner business management as well as his current position of chief pperating officer for the "Zona Norte."

Guillermo Plehn, currently regional sales manager for the East Coast, will be sales director for the U.S. overseeing all ad sales and marketing operations.

Posted by Elena del Valle on August 11, 2005

ORLANDO, Fla., Aug. 3 /PRNewswire-FirstCall/ — First American Title Insurance Company announced the launch of an enhanced Hispanic marketing program in Orlando, Florida., designed to help increase homeownership opportunities within Orange County’s Hispanic community. The program’s goal is to address the specific needs of Hispanic homebuyers by helping real estate practitioners better serve this growing homebuyer segment.

The Orlando kickoff marks the expansion of First American’s Emerging Markets Program, a comprehensive program helping increase home sales to Hispanic, African-American, Asian-American and other traditionally under, served consumer segments-into Florida. The program has been successful in California, Arizona and other key regions across the United States.

"First American has proven itself to be a true industry leader in helping explain, simplify and increase access to homeownership," said John Sepulveda,chief executive officer of the National Association of Hispanic Real Estate Professionals (NAHREP). "We are proud to support the expansion of their innovative program into the state of Florida and we look forward to the continued growth of our partnership with them."

Hispanics, African-Americans and Asian-Americans are the fastest growing segment of homebuyers in the nation. First American has set the goal of becoming the leading provider of title insurance and real estate information services to this growth segment.

The Florida Hispanic Marketing Program will help breakdown the cultural, language and financial education barriers that often arise when Hispanics begin the homebuying process. It is comprised of consumer-focused outreach and educational events, specialized programs for real estate professionals, and the hiring and training of key First American staff to better service ethnically diverse communities.

"By working in close coordination with our industry partners, we can potentially create tens of thousands of new homeowners in the state of Florida," said Matias Correa, regional director of Emerging Markets for First American Title Insurance Company. "Over time, this strengthens both our communities and First American’s role as a trusted advisor among Hispanic homebuyers."

_1.JPG)