Posted by Elena del Valle on June 11, 2010

The Business Tree book cover

Does your company have a business plan? Do you know what it is? If the answer is no. You are not alone. Only 2 percent of the businesses of the world have functioning strategic plans. At the same time most businesses (82 percent) and almost all (98 percent) of new businesses are small and emerging businesses. So far so good for entrepreneurs. The discouraging news is that 70 percent of new businesses go under in the first five years and 90 percent do so within 10 years. Many business owners may already be familiar with these statistics.

What they may not know is that 83 percent of businesses in the United States employ 20 people or less and only a mere 7 percent employ 100 or more. Although Hispanics own 7 percent of businesses in the United States 98 percent of Hispanic-owned businesses have 50 employees or less*.

What causes so many entrepreneurs to remain small or to lose their way and fail? Hank Moore, who makes a living advising companies on ways for them to remain healthy and profitable in the future, is convinced a plan for growth is essential for companies who want to be around past the initial years.

Also, to be competitive companies have to have a strategic plan that outlines their long term future and the tools that allow them to adapt to changing market conditions. Often he finds the companies that get into trouble are those that failed to plan properly from the start. He estimates that it costs six times as much to make adjustments to a company midway compared to one that set out with a strategic plan from the onset.

In his recently published book, The Business Tree Growth Strategies and Tactics for Surviving and Thriving (The Career Press, $15.99) Moore shares some of the wisdom he has acquired during a career as a corporate strategist.

The 224-page paperback book is divided into 10 chapters. The tree part of the title refers to the organization itself while each branch represents a component or aspect of the company. According to his biography, Moore, who specializes in big picture issues, has advised 5,000 clients including 100 of the Fortune 500.

*See Hispanic Business magazine May 2010

Click here to buy The Business Tree

Comments:

Filed Under: Books

Posted by Elena del Valle on June 10, 2010

The University of California, Riverside is a Carnegie Comprehensive Doctoral Institution located in Inland

Southern California. U.S. News & World Reports named UC Riverside the 5th most ethnically diverse research university in the nation, and identified the campus as one of the top 20 Up-and-Coming National Universities.

Click here for the full text of UC Riverside – Assistant Vice Chancellor for Strategic Communications

Posted by Elena del Valle on June 9, 2010

Click on image to enlarge

Photo: Aflac

Last month, Aflac launched a Spanish language website targeting Spanish dominant Latinos in the United States. The provider of guaranteed-renewable insurance seeks to offer “the same quality of interaction and experience, as we offer on our English site.” The development of the English site began in summer 2009 and was launched January 2010; the development of the Spanish language site began the last quarter of 2009. The interactive Spanish-language pages were designed “to inform Hispanic consumers in a culturally relevant way about how Aflac is different from other types of insurance.”

A team with members from New Media, IT, and Emerging Markets departments worked closely with staff from Conexión and FirstBorn, the company’s public relations and digital agencies respectively. The Spanish language website invites visitors to discover why they should purchase its insurance services, and link for visitors to find and communicate with an agent. A section titled Nuestras Historias (Our Stories) features videos of five women and three men agents in California, Florida, New York and Texas who discuss their work with the company.

In addition to press releases the company is planning to promote the new Spanish language website, aflacenespanol.com, to its primary audiences: consumers, business owners and bilingual recruits for the remainder of this year. According to a company representative, the online strategies they have in mind differ by target group and include SEM (search engine marketing), banner ads, and email marketing.

When asked by email how many visitors they anticipate on the Spanish language website a company representative responded: “We expect the site to be well received by Spanish speakers and are putting significant efforts to promote it. At this point, we are building traction and are looking at this as a long term investment in the Hispanic community. It is a bit early to speculate on specific traffic goals.”

According to Aflac.com, 70 percent of employees at the insurance company are women. Women account for more than half of the company’s management and 30 percent of senior executives. The site indicates minorities make up over 40 percent of the company workforce.

Aflac is short for American Family Life Assurance Company. Established by brothers John, Paul and Bill Amos in 1955, Aflac is a Fortune 500 company incorporated is an international holding company based in Columbus, Georgia. The company, the insurer of 50 million people worldwide according to its website, has a presence in all 50 United States and U.S. Territories as well as more than 75,300 licensed agents; it had assets at the end of 2009 of more than $84 billion and annual revenues of more than $18 billion.

Posted by Elena del Valle on June 7, 2010

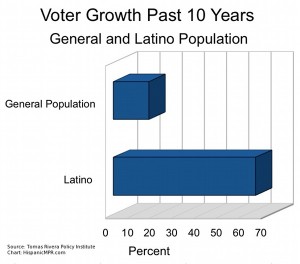

Click on image to enlarge

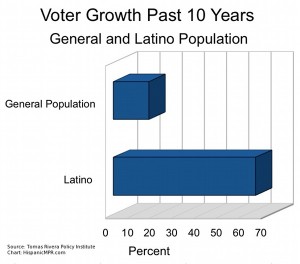

Photo: Tomas Rivera Policy Institute

In the past ten years the Hispanic vote has increased 64 percent from 5.9 million to 9.7 million voters. Compared to the overall population of over 300 million that may not seem like much. On the other hand, the vote of the general population has only increased 16 percent in that same time period. If that growth pattern continues in the decades to come Hispanic voters will have an increasingly loud voice in political matters.

What impact will Hispanic voters have on future elections? For years political candidates, seers, and pundits have speculated and tried to curry favor among Latinos. As the Latino population grows, especially United States born Hispanics and naturalized citizens and their children who are able to vote, this question will become more relevant. Lately, given the increasingly controversial immigration and immigration enforcement issues facing the nation and Latino’s strong stance on them Latino voter participation may be more noticeable than ever.

Last week, the Tomás Rivera Policy Institute at the University of Southern California (TRPI) released new data that addresses the potential importance of the Latino vote in some states. The Institute researchers examined data from the United States Census for the 2008 elections to estimate the percent of the Hispanic vote it would take to cause a 1 percent shift in the statewide election in the eight states with the largest Hispanic population. According to their analysis, a shift of 2.3 percent of Hispanic voters in California to another statewide party or candidate “results in that candidate increasing their percent of the overall vote and conversely decreasing the percentage of the vote for the opposing candidate.”

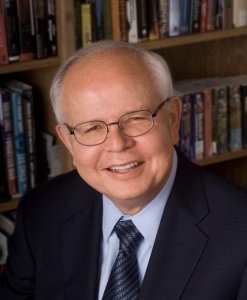

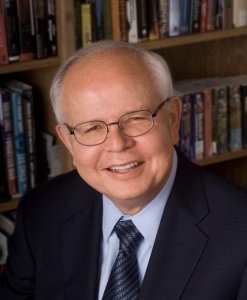

Harry Pachon, president, Tomas Rivera Policy Institute

“Various national surveys indicate that while sixty plus percent of the general electorate favor local immigration enforcement, close to three out of four Hispanics oppose such policies due to fear of discrimination,” said Harry Pachon, PhD, president, Tomás Rivera Policy Institute. “Will Hispanic voters remember this issue in the fall and associate it with parties or candidates when general elections are held in November?”

Founded in 1985, the Tomás Rivera Policy Institute (TRPI) mission is to advance informed policy on “key issues affecting Latino communities through objective and timely research contributing to the betterment of the nation.” TRPI is an affiliated research unit of the University of Southern California School of Policy, Planning, and Development, and is associated with the Institute for Social and Economic Research and Policy at Columbia University.

Posted by Elena del Valle on June 4, 2010

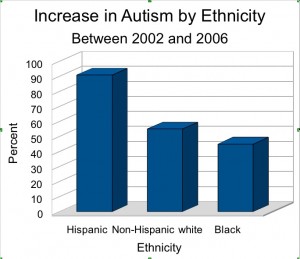

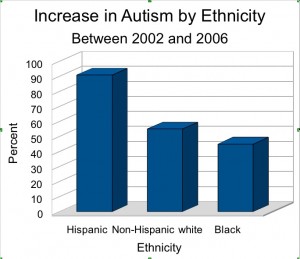

Click on image to enlarge (Source: CDC, Chart: HispanicMPR)

The incidence of autism is increasing. In a December 2009 report by the United States Centers for Disease Control and Prevention (CDC) about the condition, the government researchers confirmed that the prevalence of autism spectrum disorders in the United States is 1 percent of the population, or one in 110 of children 8 years of age in 2006.

This may alarm some people because autism has been a much misunderstood developmental condition. Autism sufferers are unable to interact normally within society. According to the National Institute of Neurological Disorders and Stroke, Autism Spectrum Disorder (ASD) “is a range of complex neurodevelopment disorders, characterized by social impairments, communication difficulties, and restricted, repetitive, and stereotyped patterns of behavior.”

Boys are four times more likely to suffer from autism than girls. The disorder occurs across ethnic, age and socioeconomic groups. Increases of autism among children including some minorities between 2002 and 2006, according to the CDC report, were significant: there was a 91 percent increase in Hispanic children (noteworthy was a 144 percent increase in Arizona); a 41 percent in black non-Hispanic; and a 55 percent increase in white non-Hispanic.

At the same time, it seems possible Hispanic children are diagnosed accurately with autism less frequently than other children. A Reuters Health article refers to a 2009 American Journal of Public Health article that in turn cites a study in Texas schoolchildren that may indicate Latino children in that state are under diagnosed because they are less likely to have health insurance or access to medical care. Is it possible this is the case in other states?

According to a recently published book, every 20 minutes a child is diagnosed with autism. Yet no one knows why cases of autism are increasing worldwide.

Author William Stillman

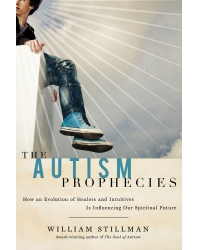

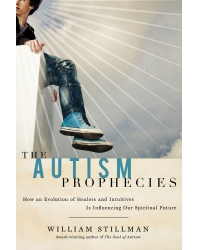

William Stillman, an adult sufferer of Aspeger’s Syndrome (a milder condition on the autism spectrum), has explored and written about the issue extensively. This year, he published The Autism Prophecies How and Evolution of Healers and Intuitives Is Influencing Our Spiritual Future (New Page Books, $14.99) with the goal of revealing what he believes to be the truth about autism and its purpose.

He is convinced mind control and speaking unknown languages could be among the abilities possessed by some people with autism; that it is possible for parents to distinguish between their child’s spiritual interactions and what some might consider hallucinations; and that autism sufferers posses wisdom that may help society prepare for future hardships, resulting in a rebirth of civility, respect, and compassion.

“Given the growing rates of autism worldwide, the face of business will be required to adapt in the coming decades so that individuals with autism can contribute as taxpaying citizens, not citizens that tax an already overburdened system,” said Stillman by email when asked about the impact of autism in the business community.

“In the same manner that industries presently serve our aging population, individuals with autism will be poised for success in partnership with businesses that will adjust to meet their needs as consumers, and will redefine business approaches that tap the unique skills and talents of those same consumers. Many people with autism will always require physical care and support but their cognitive ability to problem-solve, conceptualize, and apply a rare and alternative logic can be maximized to great advantage in the future.”

The Autism Prophecies book cover

The 205-page paperback book is divided into nine chapters within three parts: Healers, Mysterious Ways and Future Forecasts. In the book, he shares comments he has received from the parents of autistic children he has met through his work and as a result of prior books he has authored. He also shares examples of what he believes are autistic sufferer’s spiritual gifts and anecdotes about the possible sensitivities of people with autism.

Described in promotional materials as an autism spectrum self-advocate, consultant, and speaker Stillman authored The Soul of Autism and Autism and the God Connection prior to writing this book. The Pennsylvania resident also wrote The Autism Answer Book, Empowered Autism Parenting, and Demystifying the Autistic Experience. Stillman also writes columns for The Autism Perspective and Children of the New Earth magazines.

Click here to buy The Autism Prophecies

Comments:

Filed Under: Books

Posted by Elena del Valle on June 2, 2010

Opening the Door with Relevant Products and Services Part Two (click here to read Part One)

By Ricardo Quayat

Executive Creative Director, Rauxa Roja

Ricardo Quayat, executive creative director, Rauxa Roja

Photo: Rauxa Roja

In Part One of Unleashing the Financial Purchasing Power of the Growing U.S. Hispanic Population (click here to read Part One), Ricardo Quayat discussed recognizing the huge potential of the vast Hispanic market and how to use data, creative and brand strategies to market to this promising audience in a meaningful and actionable way. Part Two explores cultural differences that affect the Hispanic consumer and how banks and financial institutions can effectively tap into this rapidly growing and financially sound market with relevant messages, products and services.

Culture-Based Banking

In Mexico, and South and Central America, banks employ practices that are unique to their specific regions, capitalizing on how locals save money, buy products and pay bills. Evaluated against standard banking models in the U.S. however, Latinos are turned away in many instances because conventional credit platforms may not reflect the credit worthiness the bank requires, creating a missed opportunity.

For example, payment plans with routine installments are a common purchasing method in Latin American countries, where it is preferred to have a predictable monthly responsibility. These may be personal agreements and traditional credit programs – commonplace in Latin America, but ineffectual in establishing the stability and sound payment records typically verified using traditional credit scoring methods.

Click here to read the complete article