Housing policies influenced recession in developed countries including USA

Posted by Elena del Valle on January 26, 2011

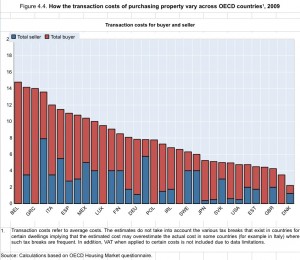

Click to enlarge

Graphic, photo: Organization for Economic Co-operation and Development (OECD)

As we look back at the housing market over the past few years and its impact on the economy it is still difficult to understand what exactly went wrong and what it may take to keep it from happening again. Seeing how other developed countries stand on the housing issue may give us some perspective and insights on how to move forward in the future.

According to Housing and the Economy: Policies for Renovation, a recently released chapter from the book Economic Policy Reforms 2011 Going for Growth from the Organization for Economic Co-operation and Development (OECD), which tracks changes in 29 developed countries including the United States, poor housing policies played an important role in triggering the recent economic and financial crisis.

The chapter looks at ways in which housing policies might be designed for better results. The Organization’s analysts believe “effectively supervised financial and mortgage market development combined with policies that enhance housing supply flexibility are key for macroeconomic stability.”

Here are some of the analysts conclusions and recommendations from the chapter: Appropriate housing policies, designed for efficiency and equitability, can help residential mobility, match workers with jobs and assist the job market recovery. Any changes in the mortgage markets should be accompanied by regulatory oversight and careful banking regulations; and housing supply responsiveness to demand has the potential for improvement in many of the markets examined as long as investment in residential real estate is dealt with to avoid volatility.

Angel Gurria, secretary-general, OECD

“OECD countries have seen the damage caused by badly designed policies through their effects on housing markets,” said Angel Gurria, secretary-general, OECD in a press release. “As we search for new sources of growth, as we seek to restore trust in our financial sectors, as we try to green our economies, policies related to housing can have a huge impact on our future”.

The United States is in good company when in comes to housing and economic problems. The OECD says that easy credit over the past two decades increased the volatility of prices resulting in housing price jumps of 90 percent or higher in Australia, Belgium, Finland, Ireland, Netherlands, New Zealand, Norway, Spain and the United Kingdom over the study period. Poor supervisory systems alongside deregulation and innovation in mortgage markets led in part to a “significant relaxation in lending standards, an increase in non-performing loans and the sub-prime crisis.”

The Organization recommends an increase in responsiveness of new housing supply to market demand, specifically the revisiting of licensing procedures that limit new housing projects and reconsidering land-use regulations that unduly prevent development. Its analysts believe a better supply may lead to less price volatility, fewer excessive price increases and encourage labor mobility.

It also supports the elimination of tax policies that favor housing over other types of investments. Such favoritism can lead to cheap lending fees which can lead to excessive investment, speculation and price volatility while at the same time limiting mobility. It encourages a system in which property taxes more accurately reflect the true market value of property.