What it takes to become the financial firm of choice for Hispanics

Posted by Elena del Valle on August 13, 2007

By Francisco J. Valle, president, Valle Consulting

Photo: Francisco J. Valle

“The Hispanic Gold Rush™”

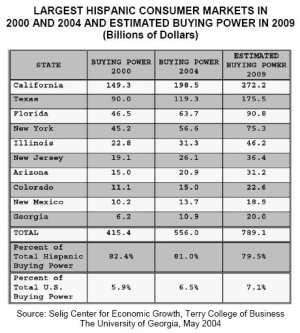

The overall buying power of consumers in the United States has continued to grow at significant at rates. Hispanics, in particular, have experienced some of the fastest increases ever in their buying power. In fact, Selig reported that the Hispanic consumer market in the U.S. represented about $798 billion in spending power by the end of 2006 and it is estimated to reach $1.2 trillion in 2011. The 2011 value will exceed the 1990 number by 457 percent or 2.6 times the non-Hispanic increase for the same time period (176 percent). The rising median income of Hispanics has also experienced an exponential growth, and is estimated to be 105% of the growth for non-Hispanics.

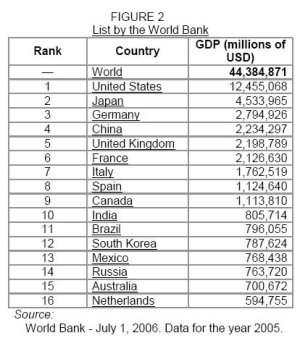

This ethnic group has become the fastest growing middle class in the United States and the main source of wealth for many countries in Latin America, due to the wiring of money back home from people in the U.S. Indeed, if the U.S. Hispanic buying power were a country by itself, it would be the tenth or eleventh largest economy in the world (as shown in Figures 1 and 2) when compared to the 2005 Gross Domestic Product (GDP) listed by the International Monetary Fund and the World Bank. In addition, the phenomenal increase in the number of Hispanics in the U.S. between 2000 and 2005 proved to be even more stunning than the previous decade. Revised population figures released in 2006 indicated that Hispanics accounted for one-half of the nation’s population increase, and now total close to 43 million out of the 296 million for the country.

The combination of the escalating number of Hispanics and the unlimited market potential they represent for U.S. businesses and companies from around the world U.S. is what led the author of this article to refer to this phenomenon as “The Hispanic Gold Rush™” of the 21st century. Indeed, these organizations have recognized that this ethnic market is one of the main driving engines of the U.S. economy for years to come. For this reason, all types of organizations have made the penetration of the Hispanic market a key component of their strategic growth plans. In particular, the financial services, banking and insurance industries have recognized that Hispanic households are a key underserved market.

This fact has prompted firms in these industries to try to penetrate this ethnic market. They are certainly trying to do all the “right things” to leverage the potential that the Hispanic market offers. However, in spite of their massive investments of effort and resources, many organizations in these industries, not only U.S. based but from around the world, have experienced only limited success and low returns on their investments. Therefore, there is a great need for Financial Advisors, Bankers and Insurance Agents to acquire objective, practical and experienced knowledge and expertise as to how to pursue the Hispanic market.

As America’s “new demographic engine,” Hispanics will drive growth in the U.S. economy, population, and workforce as far out as statisticians can project. Those companies better equipped to leverage this opportunity will be the big winners of the “Hispanic Gold Rush™.”

This article focuses on four practical items Financial Advisors, Bankers and Insurance Agents must have and demonstrate to benefit from the opportunities offered by the Hispanic market.

Knowledge of Hispanic Culture

It is well known that, in most cases, direct translations of successful general market campaigns are not appealing to Hispanics. While effective advertising for the general market can be focused in promoting the economic value and benefits of the products it serves, successful Hispanic advertising should highlight the benefits brought to the client or costumers and his family.

For instance, the copy for general market may say: “By starting to save and invest early in your life, you will be able to convert your dreams into realities when you retire, such as traveling all over the world, owning a boat or, even, an airplane”. The Hispanic advertisement could say, “By starting to save and invest early, you will be able to take care not only of your needs when you retire, but those of your family members and relatives, such as providing support to them in case they get sick and can not provide for themselves, sending money to relatives in other countries, etc.”

Therefore, it is imperative that marketing campaigns for predominantly Hispanic populated service areas be produced by personnel with a true Hispanic cultural knowledge and understanding. These campaigns can be in either English, when directed to highly educated Hispanics, and/or Spanish, for low-level of education Hispanics, depending on the service area, or bilingual to play it safe. But these campaigns must have one element in common regardless of the language: Hispanic family and community values must be emphasized.

High Customer Service in Spanish From End to End

It is a given that organizations pay a lot of attention to be effective in attracting Hispanic clients or customers. The question is: “How much attention and efforts are being spent in retaining these clients, or customers, after they have selected the organization?” Here is a suggested checklist to determine the level of Hispanic customer service offered by a company:

- Do customer service personnel at branches, offices, in the field, or at call centers serving Hispanic clients, or customers, receive Hispanic sensitivity training on a regular basis? Hispanic clients, or customers, tend to demand more time from customer service representatives than non-Hispanics specially when they are face to face.

- Does the financial services firm, bank, agency, company, or call center offer dedicated phone numbers for use by Spanish speakers to contact Customer Service Representatives who answer in Spanish because they know there is a Spanish-speaking customer on the line?

- Are customer satisfaction surveys conducted with Hispanics particularly Spanish-speaking clients, or customers, on a regular basis?

- Do new Spanish-speaking clients, or customers, receive a Spanish-language welcome kit at time of signing for products or services

- Do current or new Hispanic clients, or customers, receive on a regular basis something unexpected that would exceed their expectations, such as a call to let them know the status of their account, an invitation to attend an exclusive event which would provide the client, or customers, “bragging rights” among their friends or a sense of “being an important” as a reward for a long-term patronage (e.g. My bank gave me tickets to this exclusive concert for being its customer. What has your bank given you?).

Implementation of an Integrated, Year-Round Marketing Campaign

Most Financial services firms, banks, and insurance companies tend to implement monthly campaigns for the general market segment in their service areas. Indeed, the development of a yearly marketing calendar is a must for organizations; but what about for the Hispanic market? Is there a similar yearly calendar dedicated to this ethnic group or is the organization more focused on developing Holiday-centered marketing programs (e.g. Cinco de Mayo, Independence Day, or Hispanic Heritage Month)? Since Hispanics do not take a long siesta between holidays, it is highly recommended to follow the same type of effective monthly advertising cycles used with the general market if it is not being done.

Valuable Corporate Citizen in the Community

Financial services firms, banks, and insurance companies know how valuable it is to be part of the community. There are certainly many good examples of community involvement in these industries. Here is another checklist to assist these types of organizations in determining their Hispanic corporate citizenship level:

- Are 100% of all branches, offices, or agencies in all service areas providing some type of a financial literacy program in the communities they serve?

- Is there at least one technology-divide abatement program being sponsored in each Hispanic service area?

- Is there a scholarship or grant offered to students by the local branch, office or agency in Hispanic service areas?

- Are local branches, offices, or agencies regularly supporting community events in Hispanic service areas?

- Are there examples of on-going national and local grass roots efforts supporting the communities?

- Are there examples of lasting partnerships with Hispanic organizations and community leaders at the national and local levels in all service areas?

Where Do We Go From Here?

Given the current high level of competition for Hispanic market share, the success experienced by a company will be determined by its:

- Ability to customize and brand products and services for the Hispanic market

- Aggressiveness in positioning and pricing its products with this ethnic group

- Effectiveness in developing culturally-relevant marketing strategies

- Capacity to provide a high level of customer service in Spanish

Hispanics are very loyal customers and, therefore, it pays to be first in meeting their needs. Like in the “Gold Rush” days, the early risk takers were the ones who, in most cases, were the big winners!

Any information presented about tax considerations affecting client financial transactions or arrangements is not intended as tax advice and should not be relied upon for the purpose of avoiding any tax penalties. Francisco Valle and Valle Consulting do not provide tax, accounting or legal advice. Clients should review any planned financial transactions or arrangements that may have tax, accounting or legal implications with their personal professional advisors.

Francisco J. Valle is the president of Valle Consulting. He helps his clients solve their most pressing Hispanic-related issues. Valle is the author of How To Win The Hispanic Gold Rush™, a book on Hispanic marketing and cultural values. This article was published with his permission.