Kagan Research: Hispanic TV to capture 4 percent of TV ad spending

Posted by Elena del Valle on March 14, 2006

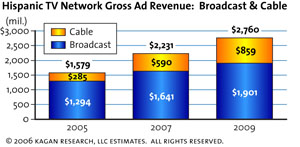

Kagan estimates 3.4 percent of TV ad dollars in 2005 went to Hispanics, who accounted for 10.2 percent of TV households; those shares should rise to 4.2 percent of TV ad spend and 11.1 percent of TV households by 2009. According to Kagan Research, Hispanic TV will capture 4.2 percent of TV ad spending by 2009.

Graphic: Business Wire

Monterey, California — With more than 75 Spanish-language cable networks available to multichannel subs, Kagan Research, LLC expects those outlets to be the leaders in television ad revenue growth rates over the next decade. Kagan’s “Economics of Hispanic Television in the U.S.” reports that, compared with total U.S. media spending, Hispanic ad dollars are up significantly, about 12.1 percent in 2005 compared with a 6.6 percent boost for all U.S. advertising markets. The numbers for 2004 were similar, with Hispanic media up 12.1 percent versus a 5.7 percent rise for all U.S. media markets.

Kagan forecasts total Hispanic ad spend will achieve a hefty 10.3 percent compound annual growth rate (CAGR) from 2004-’09, bettering 6.2 percent growth for all U.S. media. The beneficiaries of the boom include four over-the-air Spanish-language TV broadcasters, Univision, Telemundo, Telefutura and TV Azteca.There still exists a significant gap between Hispanic ad spending and Hispanic population share.

“Despite accounting for approximately 14 percent of the U.S. population, the Hispanic audience has been the ‘forgotten demo’,” said Deana Myers, senior analyst at Kagan Research. “That has changed as advertisers look to target this group’s rapidly growing buying power.”

Filling the ad spend gap of this increasingly valuable demographic will be a major focus of Hispanic media over the next ten years. Kagan estimates 3.4 percent of TV ad dollars in 2005 went to Hispanics, who accounted for 10.2 percent of TV households; those shares should rise to 4.2 percent of TV ad spend and 11.1 percent of TV households by 2009.

“Economics of Hispanic Television in the U.S.” provides an analysis of population trends, buying power and the Hispanic media market in the U.S., with market projections for broadcast networks and cable networks through 2009. The detailed profiles of 14 broadcast and cable networks include ownership information, subscriber data, and projections of gross and net ad revenues, programming expenses and cash flow, as well as programming descriptions and contact information for 32 other Hispanic-targeted networks. The report also compares affordability of Hispanic packages from multichannel distributors and dissects advertising revenues in the top ten Hispanic markets.

Kagan Research consulting and publishing services offer financial data and analysis, relevant market advisories and 5- to 10-year projections on cable and DBS, broadcast television and radio, movies, entertainment and sports, digital, wireless and Internet technologies and media finance and law.

Kagan’s “Economics of Hispanic Television in the U.S.”Electronic Edition with license for five users sells for $2,695; the Print Edition sells for $895 and both editions sell for $3,095. For table of contents and more information on the Report, visit Kagan.com.